(NGZ25) (TGZ25) (NFZ25) (UNG) (KOLD) (BOIL)

“Stratospheric Warming: The Kingpin that Spurred Panic Buying in Natural Gas”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- Weekend Report - November 14-16, 2025

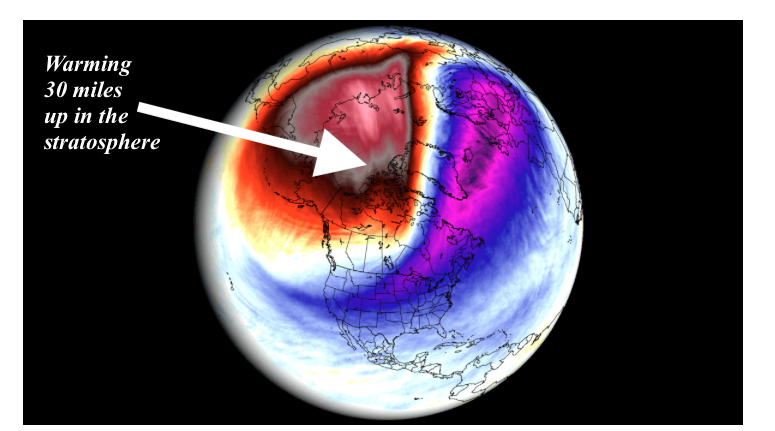

The surge of over 15% in natural gas prices (NGZ25) (UNG) (BOIL) in the last couple of weeks was as impressive as the biggest November stratospheric warming event since 1958.

Yes… you did hear me correctly!!! >>> 1958

Record strong LNG exports have also given this market a huge boost.

Stratospheric warming is simply a rapid and significant rise in the temperature of the stratosphere, which is the atmospheric layer above where we live.

Image Source: Severe-weather.eu

Here is a simple breakdown:

- Normally: The stratosphere is a very cold layer that sits above the troposphere (where all our weather happens).

- The event: Strong, high-altitude winds that normally circle the North Pole (called the "polar vortex") can weaken, slow down, or even reverse direction .

- The effect: When these winds break down, the air in the stratosphere is forced downwards. This compression and descent of air causes it to heat up very quickly—sometimes by as much as 100°F (35°C) in just a few days .

- The outcome: This warming can eventually affect the lower atmosphere, often leading to a shift in weather patterns further south, resulting in prolonged periods of very cold weather and potentially heavy snow events across North America, Europe, and Asia

This video discussion explains more about stratospheric warming and La Niña, along with how it has influenced natural gas prices, and may continue to do so.

W a t c h T h i s V i d e o

Sources: CNBC & WeatherWealth newsletter

To receive frequent FREE weather and commodity updates sign up for our reports on Substack here:

Visit Us At Substack >>>>> https://weatherwealth.substack.com/p/whats-making-gas-traders-all-excited

Remember when trading commodities, always use risk management, such as stop-loss orders and position sizing, and consider using spreads to isolate the seasonal component of a particular market move.

Thanks for your interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.