/Resmed%20Inc_%20logo%20and%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

San Diego, California-based ResMed Inc. (RMD) develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders. Valued at a market cap of $41.1 billion, the company is scheduled to announce its fiscal Q1 earnings for 2026 in the near future.

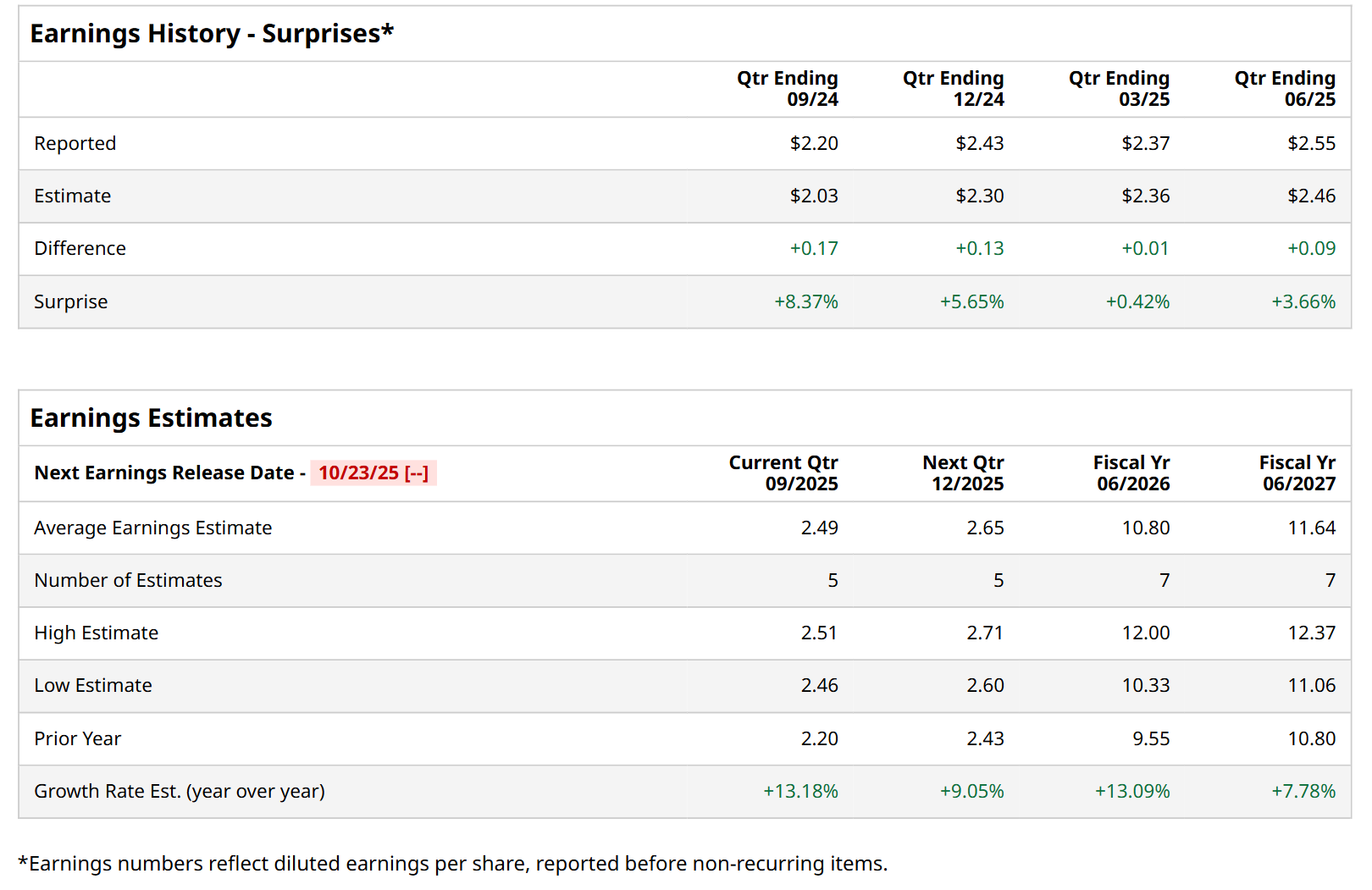

Before this event, analysts expect this healthcare company to report a profit of $2.49 per share, up 13.2% from $2.20 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.55 per share in the previous quarter topped the consensus estimates by 3.7%.

For fiscal 2026, analysts expect RMD to report a profit of $10.80 per share, representing a 13.1% increase from $9.55 per share in fiscal 2025. Furthermore, its EPS is expected to grow 7.8% year-over-year to $11.64 in fiscal 2027.

Shares of RMD have rallied 20.3% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 17.2% uptick and the Health Care Select Sector SPDR Fund’s (XLV) 5% drop over the same time frame.

ResMed released better-than-expected Q4 results on Jul. 31, prompting its shares to surge 2.7% in the following trading session. The company’s revenue grew 10.2% year-over-year to $1.3 billion, surpassing consensus expectations by 2.3%. Moreover, its adjusted EPS soared 22.6% from the year-ago quarter to $2.55, and came in 3.7% ahead of analyst estimates.

Wall Street analysts are moderately optimistic about RMD’s stock, with a "Moderate Buy" rating overall. Among 17 analysts covering the stock, eight recommend "Strong Buy," two indicate "Moderate Buy," six suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for RMD is $290.92, implying a 3.4% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)