/Akamai%20Technologies%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Valued at a market cap of $10.9 billion, Akamai Technologies, Inc. (AKAM) is a leading American provider of cloud computing, cybersecurity, and content delivery network (CDN) services. Headquartered in Cambridge, Massachusetts, the company operates a global edge platform designed to optimize and secure digital experiences for enterprises and consumers worldwide.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and AKAM fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the software infrastructure industry. Akamai Technologies remains a pivotal player in the digital infrastructure space, providing scalable and secure solutions to meet the evolving needs of the internet economy.

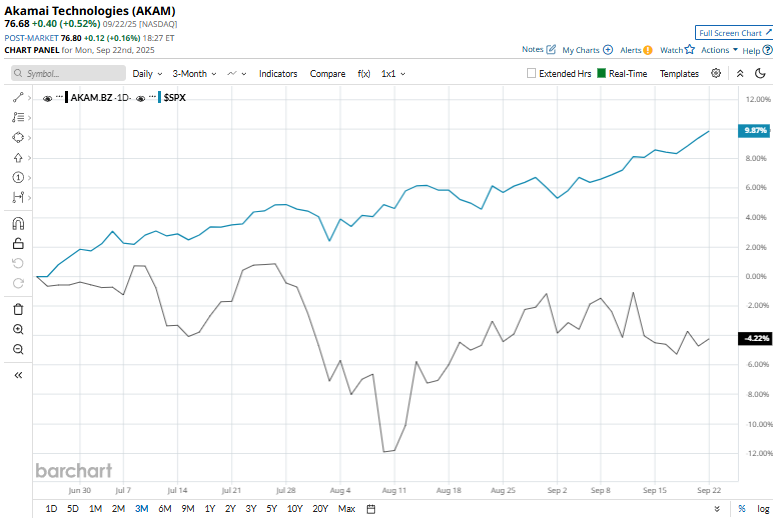

This tech company has dipped 28.2% from its 52-week high of $106.80, reached on Oct. 18, 2024. Shares of AKAM have declined 2.2% over the past three months, trailing the S&P 500 Index ($SPX), which has returned 12.2% over the same time frame.

In the longer term, AKAM has declined 23% over the past 52 weeks, significantly lagging behind $SPX’s 17.4% return over the same period. Moreover, on a YTD basis, shares of AKAM are down 19.8%, compared to $SPX’s 17.4% uptick.

To confirm its bearish trend, AKAM has been trading below its 200-day moving average since the end of February, and it has been below ined under its 50-day moving average since late July.

On Aug. 7, the company released its fiscal 2025 second-quarter results, and its shares dipped 5.7% in the next trading session. Its revenue rose 7% year-over-year to $1.04 billion and non-GAAP EPS stood at $1.73, surpassing analyst expectations. Segment-wise, security and cloud infrastructure services led growth, increasing by 11% and 30%, respectively, while delivery revenue declined by 3%. Geographically, U.S. revenue increased 4% and international revenue improved 10%. With Q3 revenue guidance of $1.035–$1.050 billion and full-year non-GAAP EPS projected at $6.60–$6.80, Akamai is well-positioned for continued expansion, driven by strong demand in security and cloud services.

Akamai Technologies has also significantly underperformed its rival, Cloudflare, Inc. (NET), which surged 176.9% over the past 52 weeks and 112% on a YTD basis.

The stock has a consensus rating of "Hold” from the 21 analysts covering it, and the mean price target of $93.31 suggests a 21.7% premium to its current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)