Orrville, Ohio-based The J. M. Smucker Company (SJM) manufactures and markets branded food and beverage products worldwide. With a market cap of $12 billion, the company operates through U.S. Retail Coffee, U.S. Retail Frozen Handheld and Spreads, U.S. Retail Pet Foods, and Sweet Baked Snacks segments.

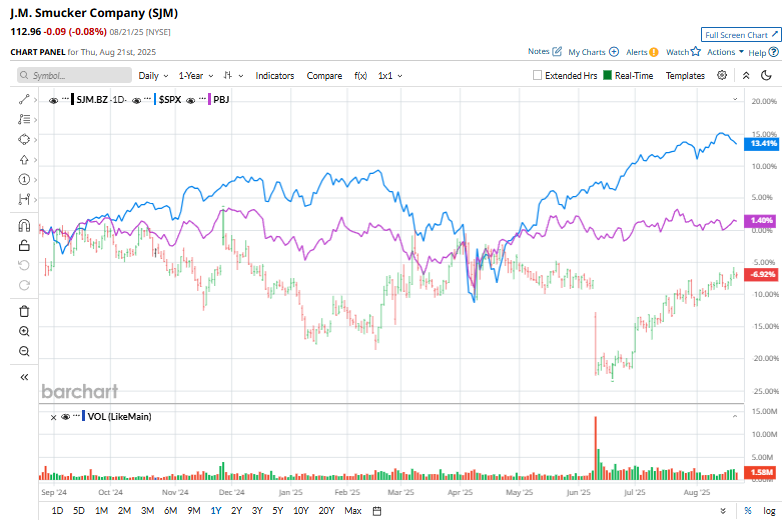

SJM’s shares have dropped 6.6% over the past 52 weeks and surged 2.6% on a YTD basis, trailing the S&P 500 Index’s ($SPX) 13.3% gains over the past year and an 8.3% uptick in 2025.

Narrowing the focus, SJM has also underperformed the industry-focused Invesco Food & Beverage ETF’s (PBJ) 3.1% rise over the past 52 weeks and 3.5% return on a YTD basis.

On Jun. 10, shares of SJM plunged 15.6% following its Q4 earnings release, as revenue fell 2.8% year-over-year to $2.1 billion, missing expectations and weighing on investor sentiment. The decline in gross profit, pressured by higher costs, unfavorable volume/mix, and divestiture impacts, further dampened the outlook. However, adjusted EPS came in at $2.31, down 13.2% from last year but still topping analyst estimates by 2.7%.

For FY2026, which ends in April, analysts expect SJM’s EPS to fall 99.1% year-over-year to $9.25. However, the company has an impressive earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

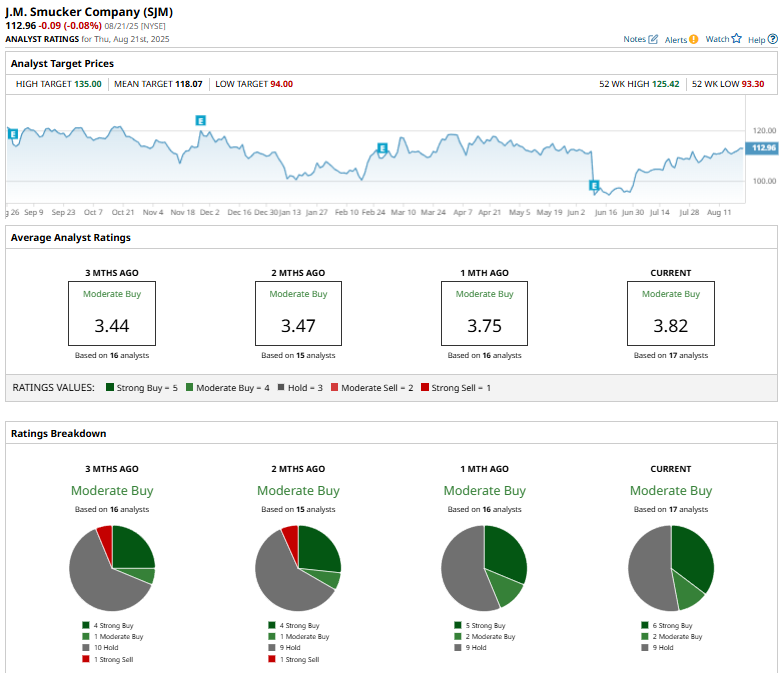

SJM has a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, opinions include six “Strong Buys,” two “Moderate Buy,” and nine “Holds.”

The configuration is slightly more bullish than it was a month ago, when five analysts issued “Strong Buy” recommendations.

On Aug. 20, UBS raised its price target for J.M. Smucker from $115 to $130 while maintaining a “Buy” rating, citing stronger earnings estimates and improved demand trends.

SJM’s mean price target of $118.07 indicates a premium of 4.6% from the current market prices. While the Street-high target of $135 suggests a robust 19.5% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)