/Lowe's%20Cos_%2C%20Inc_%20storefrony%20by-%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $123.8 billion, Lowe's Companies, Inc. (LOW) is a leading U.S. home improvement retailer serving homeowners, renters, and professional customers. It offers a wide range of national and private brand-name products across categories like building materials, appliances, lawn and garden, and more, both in-store and through digital platforms, while also providing installation and repair services via independent contractors.

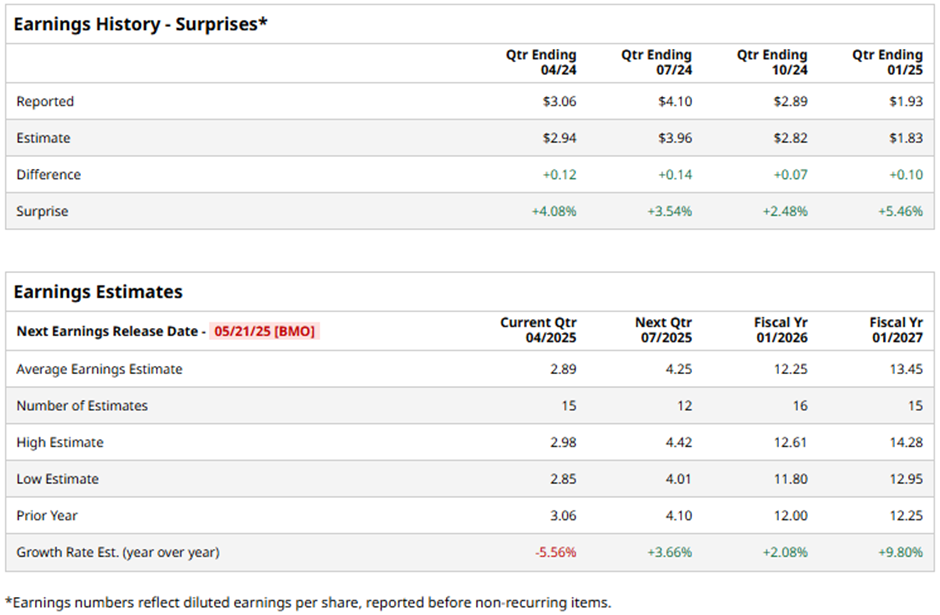

The Mooresville, North Carolina-based company is expected to announce its fiscal Q1 2025 earnings results before the market opens on Wednesday, May 21. Ahead of this event, analysts expect LOW to report an adjusted EPS of $2.89, down 5.6% from $3.06 in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect Lowe's Companies to report an adjusted EPS of $12.25, up 2.1% from $12 in fiscal 2024. In addition, adjusted EPS is anticipated to grow 9.8% year-over-year to $13.45 in fiscal 2026.

Shares of LOW have declined 3.9% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 8.4% rise and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 9.9% return over the period.

Shares of LOW rose 1.9% on Feb. 26 after the company reported stronger-than-expected Q4 2024 results, including an adjusted EPS of $1.93. Despite flat revenue at $18.6 billion, it still topped forecasts. Investors were also encouraged by solid performance in the Pro customer segment and growth in online sales, both driven by strategic investments under the Total Home and omnichannel strategies.

Additionally, Lowe's reaffirmed its commitment to shareholder returns, with $1.4 billion in share repurchases and $650 million in dividends, further boosting investor confidence.

Analysts' consensus view on Lowe's Companies’ stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 32 analysts covering the stock, 21 recommend "Strong Buy," one suggests "Moderate Buy," nine indicate “Hold,” and one gives "Strong Sell." As of writing, LOW is trading below the average analyst price target of $275.94.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)