/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)

Shares of tech titan Apple (AAPL) climbed more than 3% on Feb. 17 after reports surfaced that the company is stepping up its push into artificial intelligence (AI) with a new slate of AI-centric products. While AI has been front and center across the tech landscape in recent years, with nearly every major player aggressively weaving it into their ecosystem, Apple’s advances in this space have often been viewed as underwhelming. That narrative, however, could be shifting.

The iPhone maker, which has faced a lot of criticism over the past year for not fully capitalizing on the AI wave, is reportedly working on AI-powered smart glasses, a wearable pendant, and camera-equipped AirPods, according to Bloomberg. Of course, Wall Street didn’t waste time responding. Investors appeared to welcome the idea that Apple is choosing to strengthen its AI story through high-margin devices, a strategy that contrasts sharply with the massive cloud data center spending spree underway at the hyperscalers.

Rather than chasing infrastructure-heavy AI investments, Apple seems focused on embedding intelligence directly into consumer hardware, where it already dominates. So, with momentum building around this renewed AI push, is this the turning point that makes AAPL shares a compelling buy right now?

About Apple Stock

Tech giant Apple is, without a doubt, one of the most established companies in the technology sector, with a product lineup that includes the iPhone, Mac computers, Apple Watch, and AirPods. Over time, the Cupertino-based company has developed an ecosystem designed to connect its devices, software, and services, creating a unified user experience across its platforms.

The company operates across several areas of the tech landscape, including smartphones, personal computing, digital entertainment, and cloud services. More recently, Apple has been allocating resources toward emerging segments such as AI, wearables, and mixed reality, signaling its intent to remain relevant as industry trends evolve.

After facing headwinds in early 2025, from U.S. tariff uncertainty and intensifying competition from Chinese smartphone makers to slower AI traction relative to its Big Tech peers, Apple’s stock staged a powerful rebound. Last October, it crossed the $4 trillion market capitalization mark for the very first time, fueled by reports that the iPhone 17 lineup, launched in September, was selling better than its predecessors.

Although the shares have lost momentum again this year, pressured by a wider tech pullback, regulatory scrutiny, and setbacks tied to an AI-enhanced Siri update, Apple’s sheer size continues to set it apart. Even amid these challenges, the company commands a market value of roughly $3.9 trillion, making it the second-most valuable company globally, behind only Nvidia (NVDA). The stock has risen 6.48% over the past 52 weeks but has slipped 4.09% year-to-date (YTD) in 2026, trailing the broader S&P 500 Index ($SPX) across both time frames.

Apple Delivers Record Quarter on Surging iPhone Demand

Apple kicked off fiscal 2026 on a strong note, delivering first-quarter results on Jan. 29 that comfortably topped Wall Street’s expectations on both revenue and earnings. The performance was once again anchored by the iPhone, still the company’s most critical revenue driver. For the quarter, revenue jumped 15.6% year-over-year (YOY) to $143.76 billion, comfortably ahead of the Street’s $137.81 billion forecast.

iPhone sales alone soared 23.3% annually to $85.3 billion, fueled by strong demand for the iPhone 17 models launched in September. CEO Tim Cook called it a record-setting period, stating, “iPhone had its best-ever quarter driven by unprecedented demand, with all-time records across every geographic segment.” In fact, Apple saw especially strong momentum in China, including Taiwan and Hong Kong, where sales surged 38% to $25.5 billion during the quarter.

However, performance outside the iPhone was more uneven. iPad revenue rose 6.3% YOY, but Mac sales declined 7%. Meanwhile, the Wearables, Home, and Accessories segment, which includes AirPods, Apple Watch, Vision Pro, and related products, also slipped about 2% during the quarter.

The CEO also revealed that Apple’s active installed base has now climbed to 2.5 billion devices, up from 2.35 billion announced last January, a sign of the company’s massive global footprint. The services business, which includes subscriptions like Apple TV+ and iCloud, advertising revenue from licensing agreements with Google, AppleCare warranties, and other offerings, grew 14% YOY to $30 billion in revenue.

On the bottom line, Apple posted earnings per share of $2.84, up 18.3% YOY and well ahead of estimates of $2.65. CFO Kevan Parekh noted that the company generated nearly $54 billion in operating cash flow during the quarter, allowing it to return almost $32 billion to shareholders.

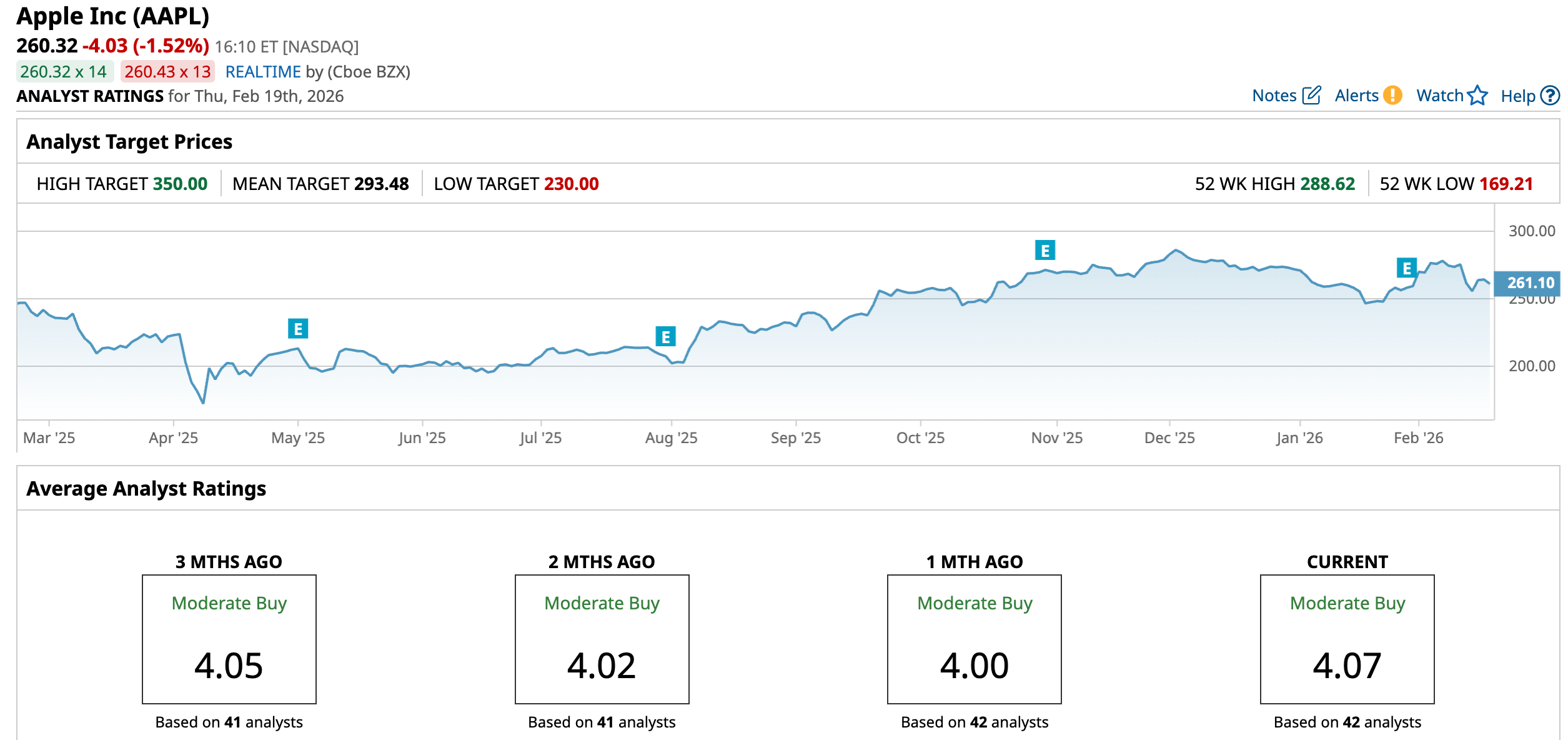

How Are Analysts Viewing Apple Stock?

Recently, Wedbush made a bold call, arguing that 2026 could mark the year Apple truly steps into its role as a heavyweight in the AI era. Analyst Dan Ives pointed to Apple’s enormous installed base of 2.5 billion iOS devices, including 1.5 billion iPhones, as a built-in advantage few companies can match. In his view, Apple has yet to fully unlock the AI opportunity within that ecosystem, but the foundation is already in place.

If the company accelerates its AI rollout and successfully monetizes new features and services, Ives believes the payoff could be substantial. The analyst estimates that AI-driven initiatives could add between $75 and $100 per share over the next few years, potentially becoming a powerful catalyst for the stock beginning in 2026.

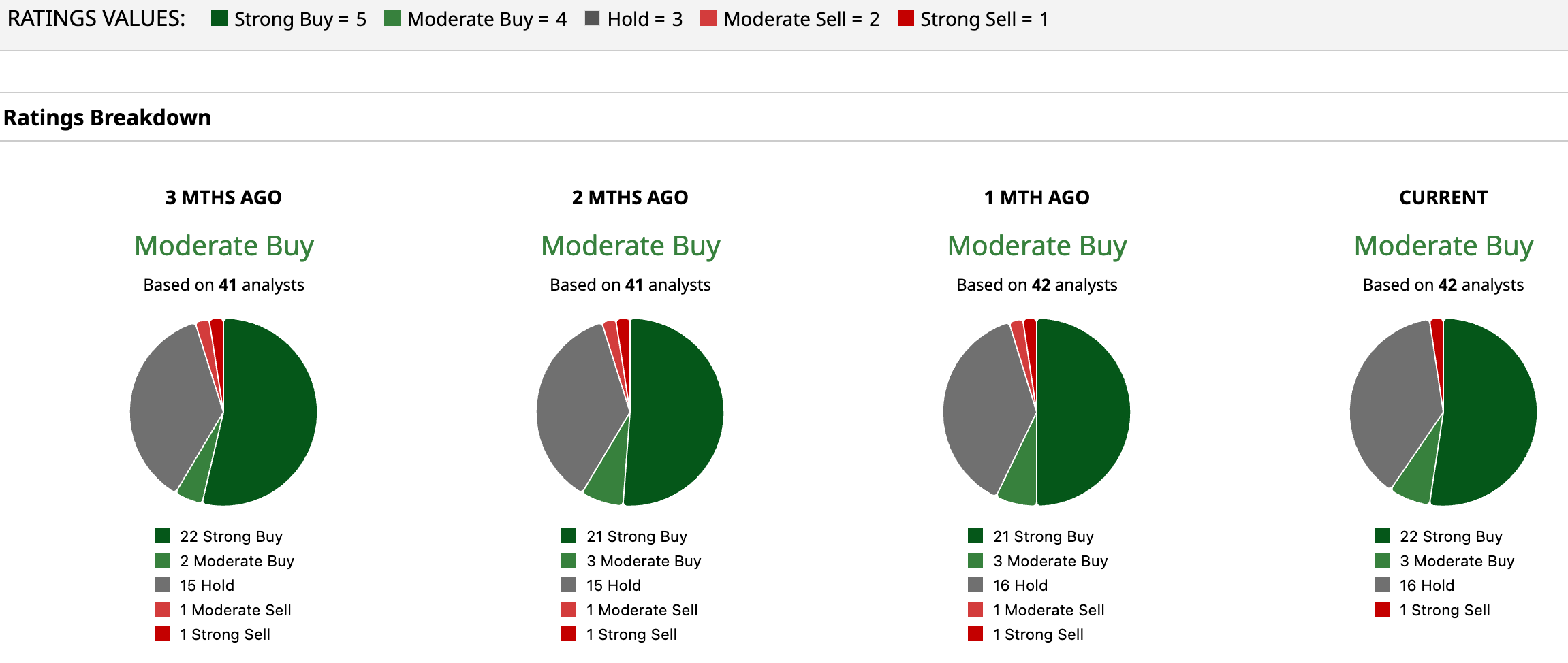

Wall Street, for the most part, is still leaning bullish on Apple. The stock carries a consensus “Moderate Buy” rating, reflecting steady, if not overwhelming, confidence. Of the 42 analysts covering the shares, 22 assign a “Strong Buy,” three recommend “Moderate Buy,” 16 remain at “Hold,” and just one stands firmly bearish with a “Strong Sell.”

Targets suggest there’s still room to run. The average price objective of $293.48 implies roughly 12.7% upside from current levels, while the highest target on the Street of $350 points to potential gains of as much as 34.5%.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)