/Universal%20Health%20Services%2C%20Inc_%20logo%20on%20phone-by%20IgorGolovniov%20via%20Shutterstock.jpg)

With a market cap of $14.7 billion, Universal Health Services, Inc. (UHS) owns and operates acute care hospitals, outpatient facilities, and behavioral health centers through its Acute Care Hospital Services and Behavioral Health Care Services segments. It provides a wide range of medical, behavioral health, insurance, and management support services.

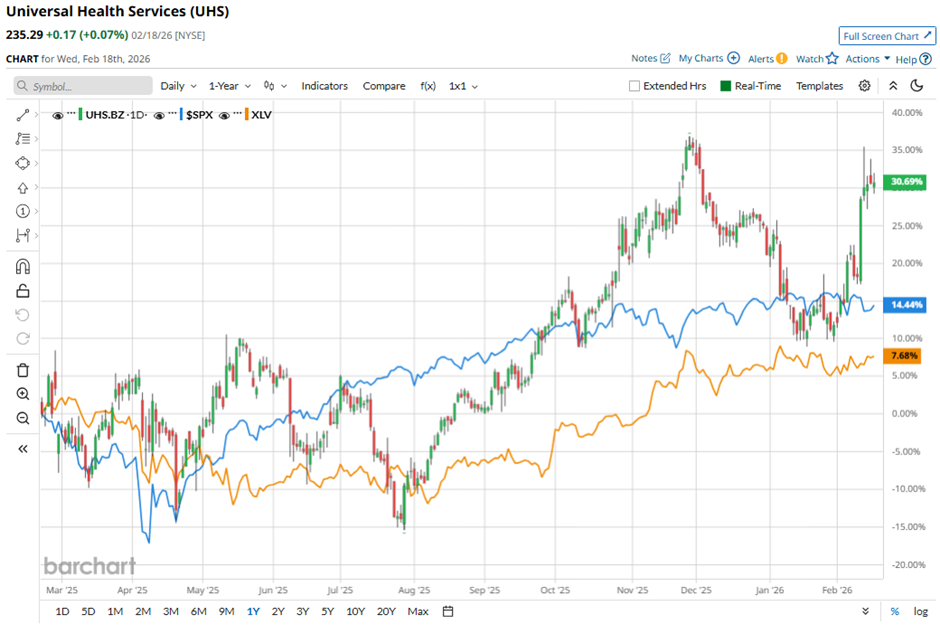

Shares of the King of Prussia, Pennsylvania-based company have outperformed the broader market over the past 52 weeks. UHS stock has soared 28.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. In addition, shares of the company have risen 7.9% on a YTD basis, compared to SPX's marginal return.

Looking closer, shares of the hospital and health facility operator have outpaced the State Street Health Care Select Sector SPDR ETF's (XLV) 9.1% increase over the past 52 weeks.

Shares of Universal Health Services rose 2.5% following its Q3 2025 results on Oct. 27 as the company reported adjusted EPS of $5.69, well above Wall Street expectations, driven by steady demand for hospital services. The results were further boosted by a $90 million pre-tax Medicaid reimbursement from a newly approved Washington, D.C. state-directed payment program, which was not included in prior forecasts. Investor sentiment also improved after UHS raised its 2025 revenue outlook to $17.31 billion - $17.45 billion..

For the fiscal year that ended in December 2025, analysts expect UHS’ adjusted EPS to grow 31.3% year-over-year to $21.80. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

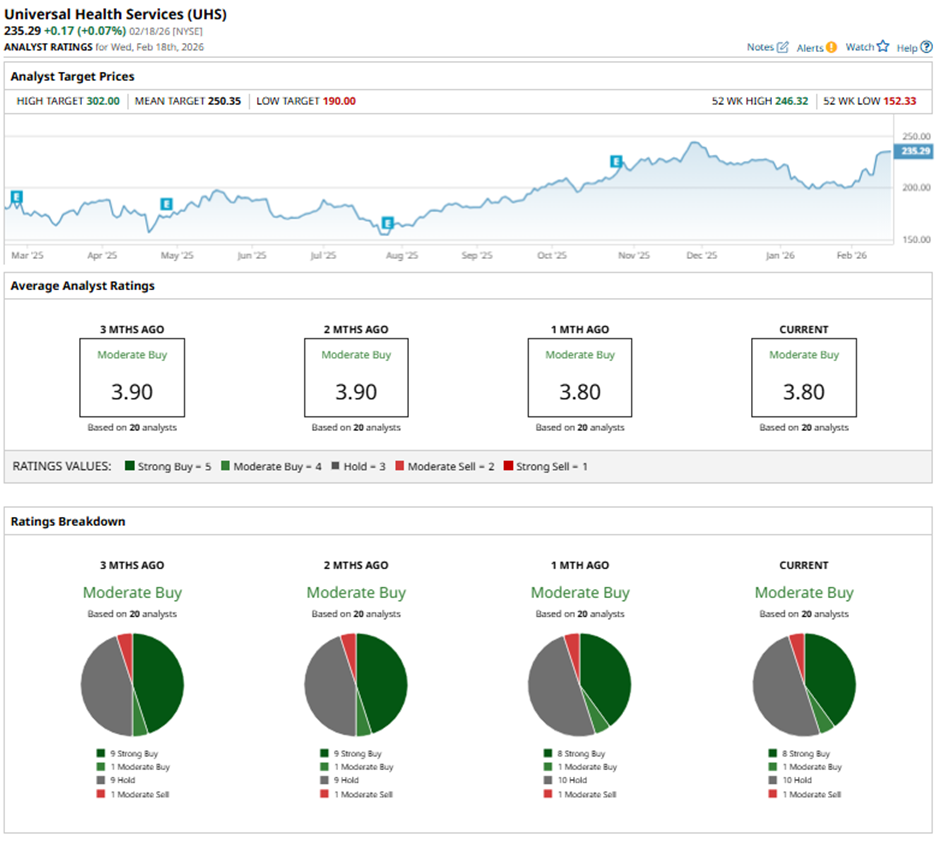

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and one “Moderate Sell.”

On Jan. 23, Barclays analyst Andrew Mok CFA reaffirmed a “Buy” rating on Universal Health Services and set a price target of $262.

The mean price target of $250.35 represents a 6.4% premium to UHS’ current price levels. The Street-high price target of $302 suggests a 28.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)