/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)

The 13Fs for Q4 2025 have poured in, and Bill Ackman, Seth Klarman, and Stanley Druckenmiller are among the leading fund managers who added Amazon (AMZN) shares in the final quarter of the year. All three are legendary investors in their own right. Ackman rose to fame with his $27 million bet on credit default swaps in March 2020. It went down in history as one of the most iconic trades of all time, as that tiny bet soared to a whopping $2.6 billion within a month.

Klarman is known for his value investing credentials and is often hailed as the “Oracle of Boston” and the “next Warren Buffett.” Druckenmiller, on the other hand, generated average annual returns of over 30% for three decades without even a single down year. With three of the best fund managers of the era betting on the Seattle-based tech giant, should you also follow suit? Let’s explore, beginning with the stock’s recent price action.

Why Is Amazon Stock Underperforming?

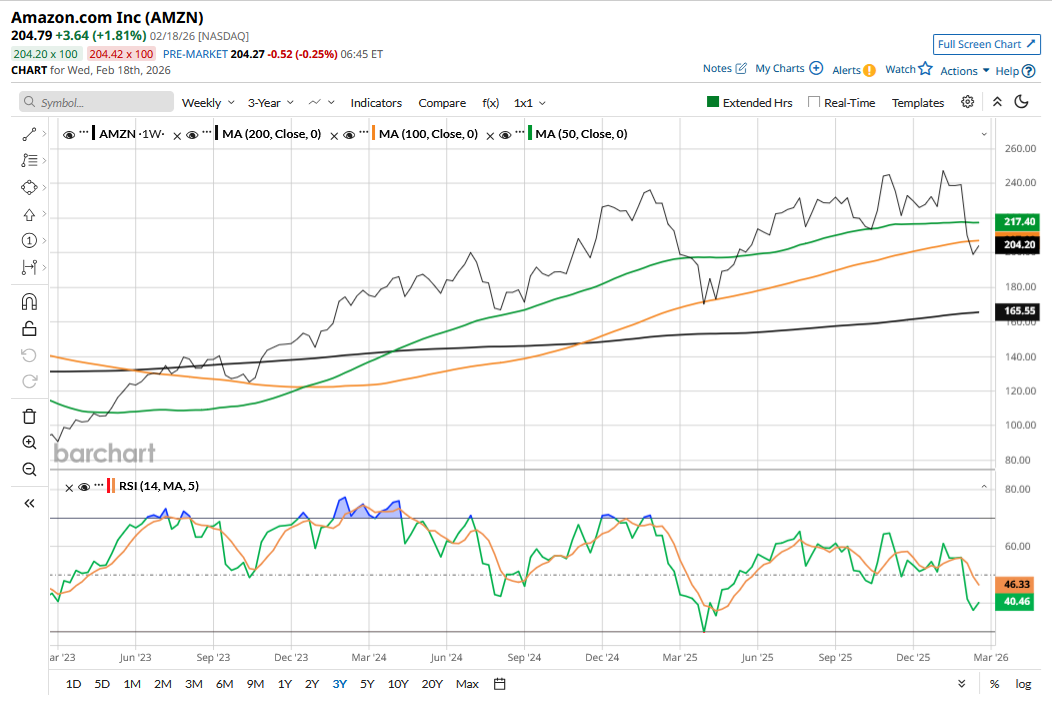

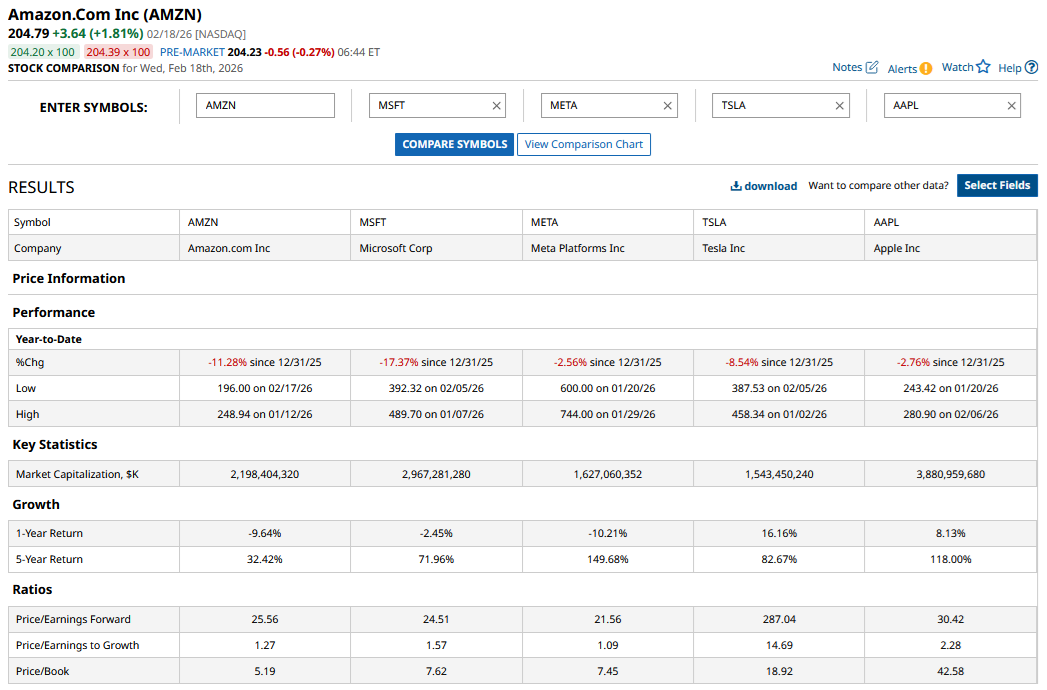

The e-commerce and cloud giant was the worst-performing “Magnificent 7” stock last year, and while it started 2026 on a strong note, it crashed following its Q4 confessional and is now down over 11% for the year, which makes it the second-worst Mag 7 after Microsoft (MSFT), whose post-earnings slump was the worst in the group.

There are a couple of things that are making markets apprehensive about Amazon. The first is that it is gradually losing market share in the cloud sector to Alphabet (GOOG) (GOOGL) and Microsoft. While Amazon underscores that it is still growing more in absolute dollar terms, the observation has failed to cut ice with investors.

The second is a long-term question regarding the company’s digital advertising business, which is its second cash cow after the cloud business. Some see the rise of artificial intelligence (AI) agents as a death blow to that business, and no wonder Amazon sent a “cease and desist” letter to Perplexity over its Comet shopping agent.

Finally, Amazon’s AI spending spree is making investors jittery, and the company forecasts a 2026 capex at $200 billion—well ahead of last year’s $131 billion and over $50 billion higher than what the Street was expecting. For context, it would be the highest ever annual capex by any company in history. Markets have been particularly unforgiving of Amazon’s burgeoning AI capex as it hasn’t seen much incremental growth for now. In contrast, Meta Platforms’ (META) revenues are growing at the fastest pace in years, and it forecasts a 30% year-over-year (YoY) topline growth for Q1 2026, as it reaps the rewards of its AI investments.

AMZN Stock Looks Undervalued

Meanwhile, the recent underperformance has led to a contraction in Amazon’s multiples, and it now trades at a forward price-to-earnings (P/E) multiple of 25.5x. The current multiples are the lowest that they have ever been, and while there are genuine concerns over Amazon turning free cash flow negative amid its soaring capex, I am on the same page as Klarman, Ackman, and Druckenmiller and have been buying the dip in AMZN stock.

Should You Buy Amazon Stock?

I remain constructive on AMZN stock and find it among the best value opportunities in the market currently, given the tepid valuations and reasonably strong growth outlook. AI initiatives should make the company’s e-commerce platform an even better proposition by further improving customer experience. Incidentally, Amazon’s shopping agent Rufus is gaining traction, with over 300 million people using it last year.

Prime is another key part of Amazon’s flywheel, as it not only brings in subscription and ad revenues, but these customers tend to order more frequently on its e-commerce platform.

The company has still just about scratched the surface in initiatives like grocery, pharmacy, and business-to-business (B2B), as well as the recently added low-cost platform Haul, which would help it take on the likes of Temu and Shein.

Amazon Web Services (AWS) should also continue to benefit from strong AI demand even as its growth rates have lagged those of the other major players. Amazon’s chips business is also gaining momentum and is running at a $10 billion annualized revenue run rate.

Amazon continues to work on efficiencies and is cutting its workforce by automating several jobs. These cost-cutting measures will help it offset the increase in depreciation expenses, which would stay elevated for the next few years as the AI capex flows into its income statement as depreciation expense.

Overall, I am in the camp that believes that the tech selloff is overdone and am doubling down on names like Amazon, which provide quite attractive risk-reward after the crash.

On the date of publication, Mohit Oberoi had a position in: AMZN, GOOG, MSFT, META. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)