/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

Electric-vehicle (EV) stocks have cooled from their late-2023 highs, and especially since then, Tesla (TSLA) has been under particular pressure. After an AI-driven rally, Tesla’s core auto business has faced mounting headwinds, especially in China. Those pressures are now showing up clearly in recent sales data, highlighting just how quickly the competitive landscape is shifting.

For example, in January 2026, Chinese tech-maker Xiaomi’s (XIACF) new YU7 SUV sold 37,869 units in China versus 16,845 for Tesla’s Model Y. That made the YU7 the country’s top-selling EV. Tesla’s Model Y fell to 7th place among new-energy vehicles. These data follow Tesla’s first annual China sales decline in 2025, underscoring intensifying competition. Investors now question Tesla’s growth runway even as the company pours resources into AI, robotics, and energy storage.

Xiaomi Outsells Tesla

A relatively new Chinese EV maker has delivered a sharp jolt to Tesla’s dominance. In January 2026, Xiaomi’s YU7 outsold Tesla’s Model Y by more than 2-to-1. The YU7 launched mid-2025 at a price slightly below the Model Y, and analysts expected it to grab market share. The fact that the Model Y fell from No. 1 to No. 7 in China’s EV rankings overnight has alarmed investors. For a company that derives 25% of sales from China, worsening market share there could pressure revenues and margins.

The stock reaction was muted since TSLA’s share price was already down on broader concerns, but this news deepens doubts. Many traders view it as another sign that local EV brands like BYD (BYDDF) and now Xiaomi are gaining strength, forcing Tesla to compete on price. Thus, the outselling is widely seen as negative for Tesla’s auto outlook, potentially dampening 2026 growth expectations.

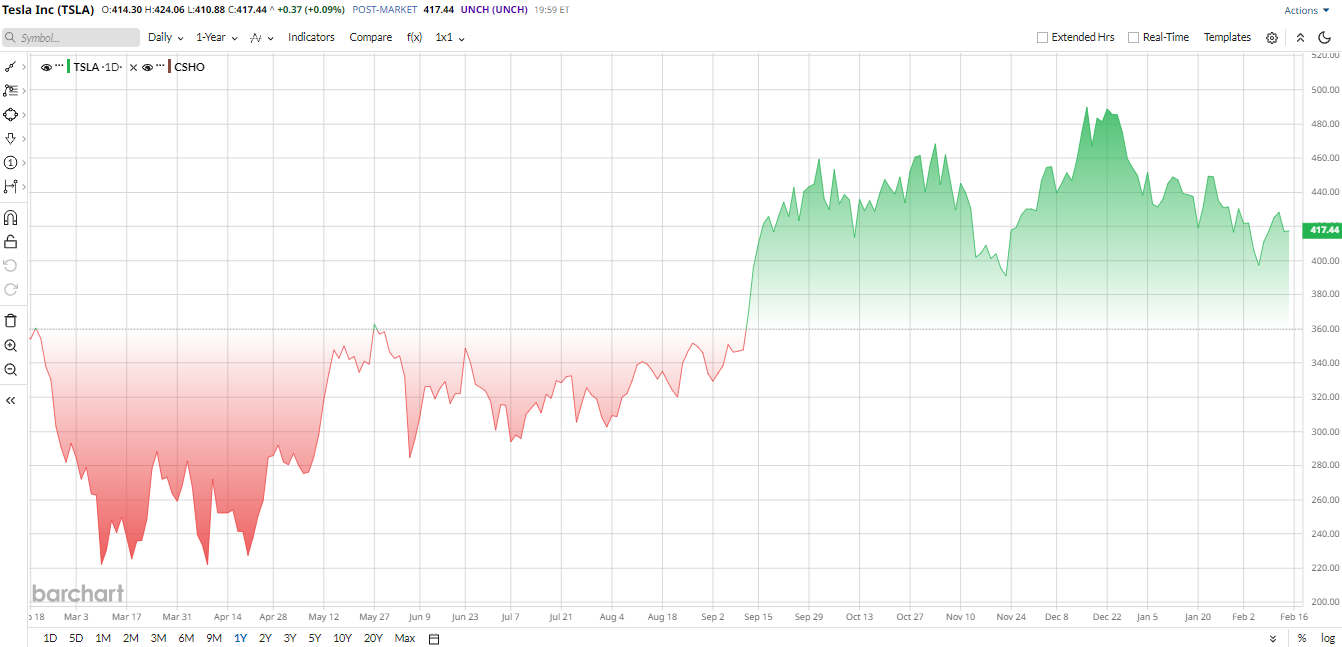

TSLA’s Wild Ride Tests Investor Conviction

TSLA stock has been through a turbulent 12 months. After peaking near $498 in December 2025, the shares slid into 2026 as execution shortfalls and headline risk eroded investor confidence. Deliveries softened, culminating in the company’s first annual delivery decline, and many buyers postponed purchases ahead of a planned Model Y refresh. High-profile controversies surrounding CEO Elon Musk compounded the downturn.

The stock staged a modest recovery later in the year as investors regained faith in Tesla’s product cadence, potential margin expansion, and long-term autonomy/robotics opportunities. Year-to-date (YTD), the stock is roughly 8% lower.

From a valuation lens, TSLA stock looks rich. Its trailing EV/EBITDA sits around 123×, and P/E measures north of the low hundreds, far above traditional auto benchmarks, e.g., Toyota (TM) at roughly 8.5× EV/EBITDA, and BYD trading at nearer the low 20s. That premium prices in sizable future wins from growth, software, and new-margin businesses.

On the other hand, bulls argue that Tesla’s rapid growth, profitability improvements, and entry into high-margin AI/robotics justify a premium. But on any metric, TSLA is well above typical auto benchmarks, implying limited near-term upside without significant new catalysts

Tesla's Revenue Slips, AI Investment Ramps Up

Tesla posted mixed fourth-quarter 2025 results that underscored both near-term challenges and its long-term ambitions. Revenue for the quarter totaled $24.9 million, down 3% year-over-year (YoY), as automotive sales declined to $17.69 million, partially offset by strength in energy generation and storage revenue of $3.84 million and services and other revenue of $3.37 million.

Profitability weakened, with net income falling 61% to $0.84 million and GAAP earnings per share sliding to $0.24, although adjusted earnings of $0.50 per share came in ahead of Wall Street expectations.

Tesla continued to generate healthy cash flow, producing $3.81 million in operating cash flow and $1.42 million in free cash flow during the quarter, and ending 2025 with $44.06 million in cash and marketable securities.

Looking ahead, management offered no formal guidance but signaled heavier spending, with capital expenditures expected to exceed $20 million in 2026. CEO Elon Musk described the results as part of a strategic pivot toward artificial intelligence, robotics, and manufacturing, even confirming plans to wind down Model S and Model X production to redirect capacity toward Optimus robots, highlighting Tesla’s focus on long-term transformation over short-term margins.

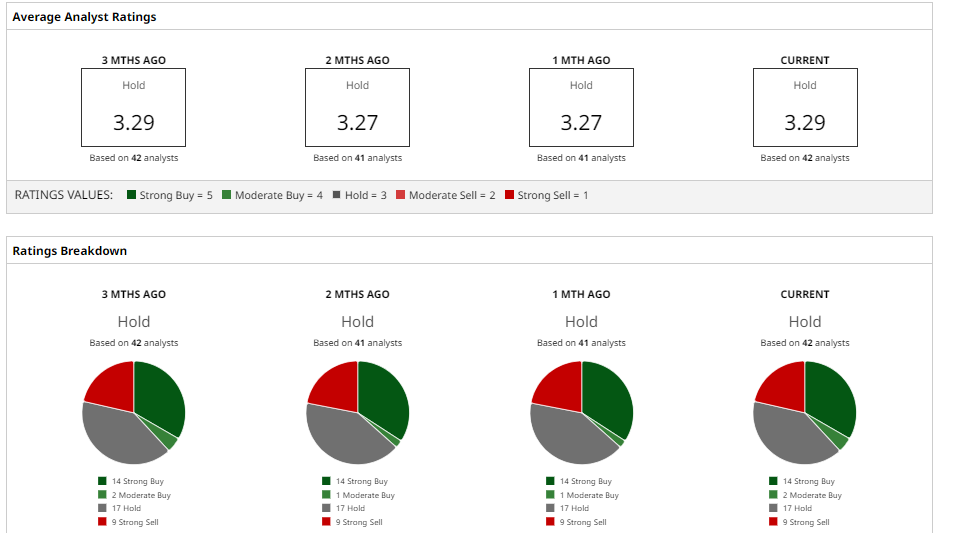

Analysts and Price Targets

Wall Street views on TSLA stock remain polarized. Morgan Stanley analyst Adam Jonas reiterated Tesla as a top U.S. auto pick and kept a $430 price target, citing the long-term potential of Tesla’s AI/robotics push even if near-term auto sales “stumble.”

By contrast, J.P. Morgan has turned negative: it slashed its TSLA target to $120 from $135, expecting 2025-26 deliveries to decline and noting brand backlash from political controversies.

Goldman Sachs remains cautious. It has a “Neutral” rating with a $275 target, highlighting weaker deliveries in early 2025.

On the bullish side, RBC Capital reiterated an “Outperform” rating with a $500 target, focusing on Tesla’s strong balance sheet and ambitious growth plans, including six new factories and AI computing.

Overall, Wall Street’s consensus 12-month median target sits around $407, implying modest downside from current levels. Individual opinions vary widely. So, the broad range reflects the debate over whether Tesla’s rapid transformation and growth prospects justify its lofty valuation.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)