/Genuine%20Parts%20Co_%20logo%20on%20phone%20by-%20IgorGolovniov%20via%20Shutterstock.jpg)

Valued at a market cap of $20.5 billion, Genuine Parts Company (GPC) distributes automotive and industrial replacement parts for hybrid and electric vehicles, trucks, SUVs, buses, motorcycles, farm equipment, and heavy-duty equipment. It is based in Atlanta, Georgia.

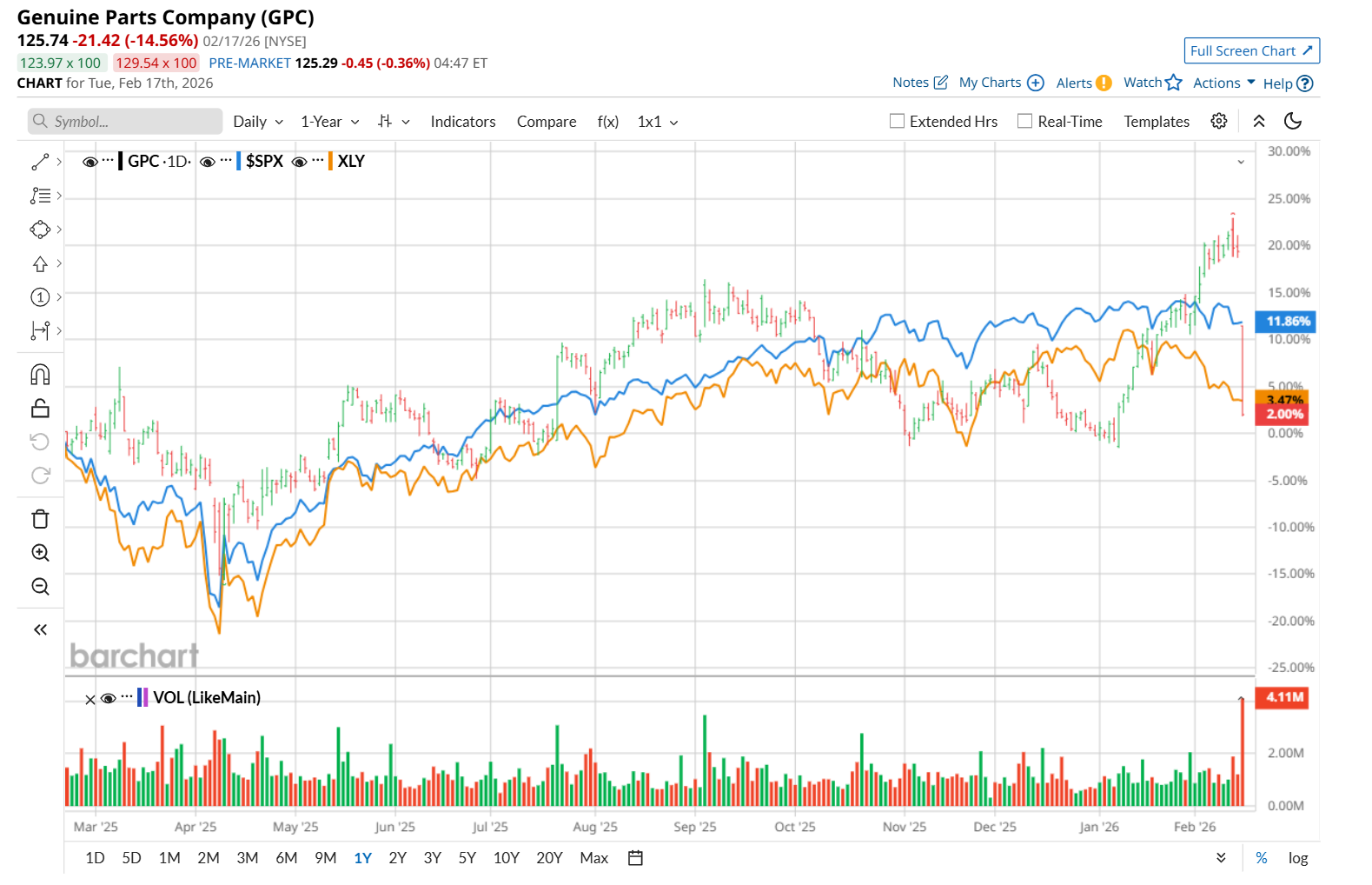

This auto parts provider has lagged behind the broader market over the past 52 weeks. Shares of GPC have gained marginally over this time frame, while the broader S&P 500 Index ($SPX) has soared 11.9%. However, on a YTD basis, the stock is up 2.3%, outpacing SPX’s slight drop.

Narrowing the focus, GPC has also underperformed the State Street Consumer Discretionary Select Sector SPDR ETF (XLY), which gained 2.2% over the past 52 weeks. Nonetheless, it has outperformed XLY’s 2.8% YTD drop.

On Feb. 17, shares of GPC tumbled 14.6% after delivering weaker-than-expected Q4 earnings results. Its total revenue rose 4.1% year over year to $6 billion, supported by higher comparable sales and contributions from acquisitions, but still came in slightly below analysts’ estimates. Softer comparable sales in the international automotive segment likely weighed on the top-line performance. On the profitability front, its adjusted EPS fell 3.7% from the prior-year quarter to $1.55, primarily due to lower EBITDA in both the North America and international automotive segments. The figure missed consensus expectations by a notable margin of 13.4%, further pressuring the stock.

For fiscal 2026, ending in December, analysts expect GPC’s EPS to grow 5.2% year over year to $7.75. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

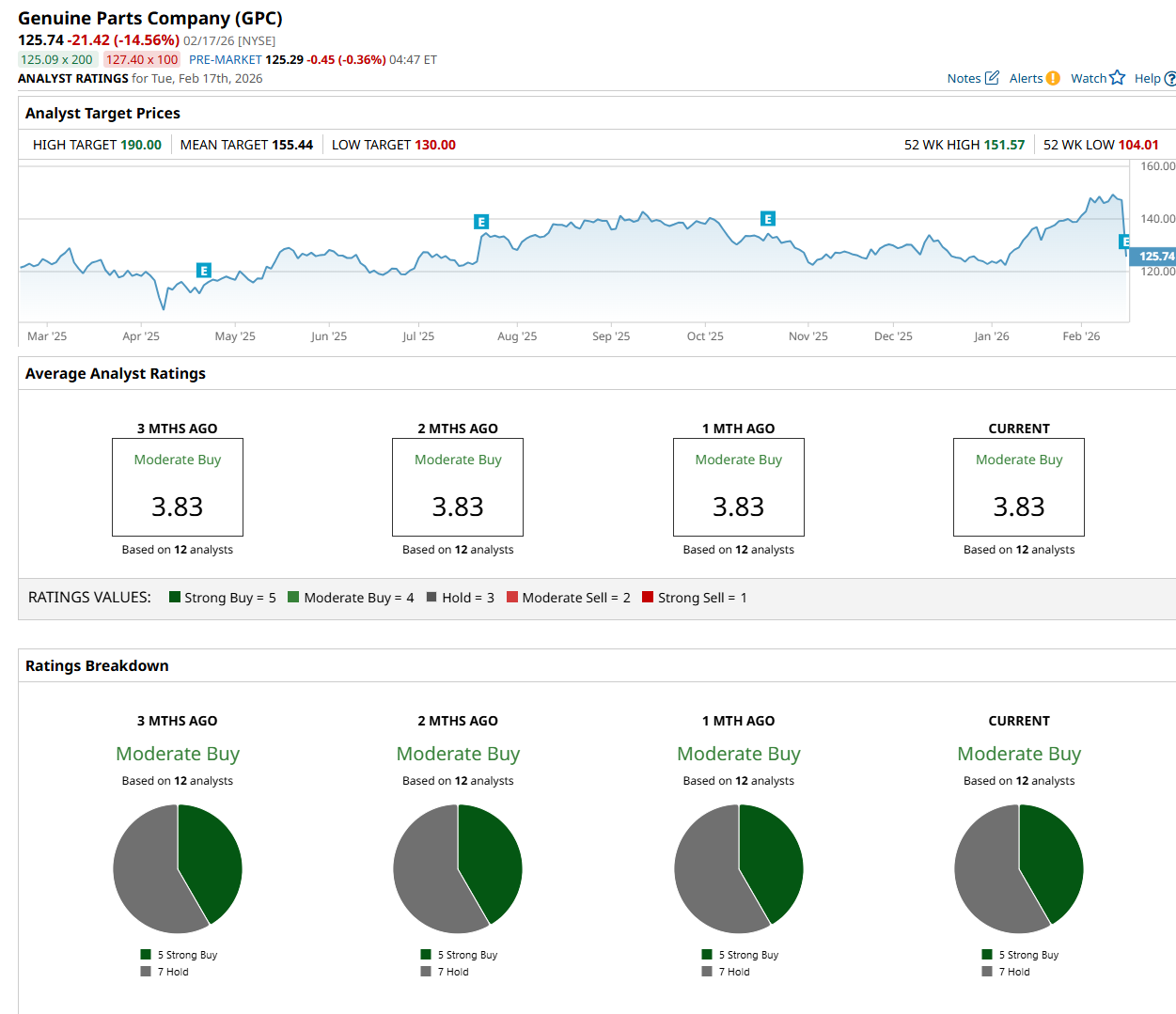

Among the 12 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on five “Strong Buy” and seven “Hold” ratings.

The configuration has remained consistent over the past three months.

On Feb. 12, Truist Financial Corporation (TFC) maintained a "Buy" rating on GPC and raised its price target to $162, indicating a 28.8% potential upside from the current levels.

The mean price target of $155.44 suggests a 23.6% potential upside from the current levels, while its Street-high price target of $190 suggests a 51.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)