With a market cap of $31.1 billion, Salt Lake City, Utah-based Extra Space Storage Inc. (EXR) is a self-administered, self-managed REIT. As the largest self-storage operator in the United States, the company owned and/or operated 4,238 stores across 43 states and Washington, D.C., offering nearly 326.9 million square feet of rentable space under the Extra Space brand as of September 30, 2025.

Shares of Extra Space Storage have underperformed the broader market over the past 52 weeks. EXR stock has dropped 5.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.8%. However, shares of the company are up 12.8% on a YTD basis, outpacing SPX’s marginal drop.

Zooming in further, shares of the REIT have lagged behind the State Street Real Estate Select Sector SPDR ETF’s (XLRE) 3.5% rise over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 core FFO of $2.08 per share on Oct. 29, Extra Space Storage shares fell 4.9% the next day as the company missed revenue expectations, posting $858.46 million for the quarter. In addition, net income fell 14.3% year over year to $0.78 per share, hurt by a $105.1 million loss on assets held for sale.

For the fiscal year that ended in December 2025, analysts expect EXR’s core FFO to decline 10.5% year-over-year to $8.16 per share. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

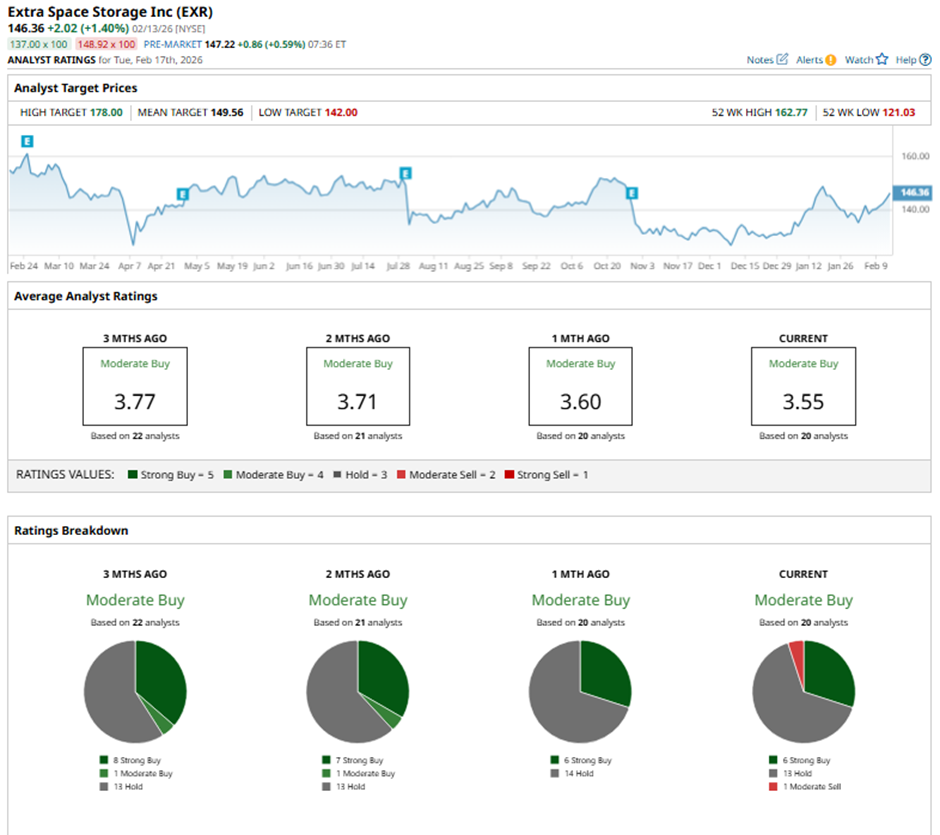

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, 13 “Holds,” and one “Moderate Sell.”

On Feb. 5, Wells Fargo cut its price target on Extra Space Storage to $150 while maintaining an “Overweight” rating.

The mean price target of $149.56 represents a 2.2% premium to EXR’s current price levels. The Street-high price target of $178 implies a potential upside of 21.6% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)