/Parker-Hannifin%20Corp_%20logo%20on%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $126.4 billion, Parker-Hannifin Corporation (PH) is a global manufacturer of motion and control technologies serving aerospace and defense, industrial, transportation, energy, and HVAC and refrigeration markets across North America, Europe, Asia Pacific, and Latin America. It operates through its Diversified Industrial and Aerospace Systems segments, delivering a broad portfolio of advanced systems and components to OEMs, distributors, and direct customers worldwide.

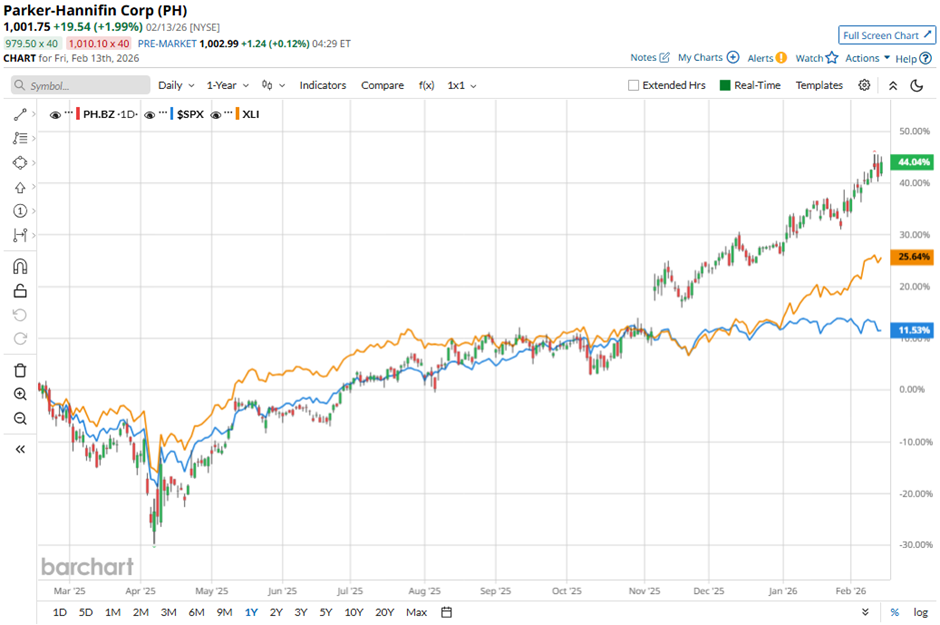

Shares of the Cleveland, Ohio-based company have exceeded the broader market over the past 52 weeks. PH stock has climbed 44.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.8%. Moreover, shares of the company have increased nearly 14% on a YTD basis, compared to SPX’s marginal dip.

Focusing more closely, shares of the motion and control products maker have outpaced the State Street Industrial Select Sector SPDR ETF’s (XLI) 26.3% return over the past 52 weeks.

Shares of Parker-Hannifin rose 3.5% on Jan. 29 after the company reported Q2 2026 adjusted EPS of a record $7.65, beating Wall Street estimates, alongside record sales of $5.17 billion, up 9% year-over-year. Investors also reacted positively to strong operating performance, including an adjusted segment operating margin of 27.1%, adjusted net income growth of 15% to $980 million, and order rates up 9% with backlog climbing to a record $11.7 billion.

The rally was further supported by raised full-year guidance, with adjusted EPS expected in the range of $30.40 to $31, reflecting robust aerospace demand and improving industrial markets.

For the fiscal year ending in June 2026, analysts expect Parker-Hannifin’s adjusted EPS to grow 13.3% year-over-year to $30.97. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

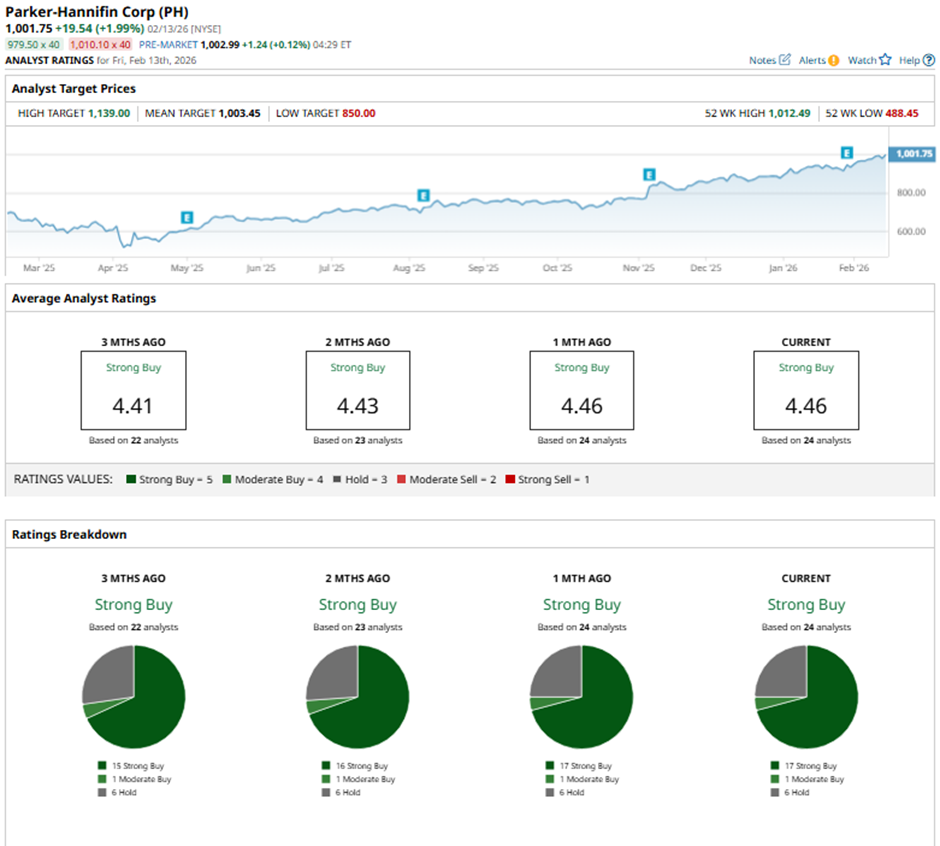

Among the 24 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

This configuration is more bullish than three months ago, with 15 “Strong Buy” ratings on the stock.

On Jan. 30, Citigroup raised its price target on Parker-Hannifin Corporation to $1,092 and maintained a “Buy” rating.

The mean price target of $1,003.45 represents a marginal premium to PH's current price. The Street-high price target of $1,139 suggests a 13.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)