With a market cap of $62.3 billion, Air Products and Chemicals, Inc. (APD) is a global supplier of atmospheric, process, and specialty gases, serving a wide range of industries including energy, chemicals, manufacturing, electronics, food, and healthcare across the Americas, Asia, Europe, the Middle East, and India. It also designs and manufactures advanced equipment for air separation, hydrocarbon processing, natural gas liquefaction, and liquid hydrogen and helium storage and transport.

Shares of the Allentown, Pennsylvania-based company have underperformed the broader market over the past 52 weeks. APD stock has declined 11.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.8%. However, the stock has returned 13.3% on a YTD basis, outpacing SPX's marginal dip.

Looking closer, shares of the industrial gases giant have lagged behind the State Street Materials Select Sector SPDR ETF's (XLB) 18.3% increase over the past 52 weeks.

Shares of Air Products and Chemicals surged 6.4% on Jan. 30 after the company reported fiscal Q1 2026 adjusted EPS of $3.16, up 10% year-over-year and well above both Wall Street expectations and the top end of its own guidance. Investors also reacted positively to strong operating performance, with adjusted operating income rising 12% to $757 million, operating margin expanding to 24.4%, and revenue climbing 6% to $3.1 billion, all reflecting resilience in the core industrial gas business. Additional confidence came from management maintaining full-year adjusted EPS guidance of $12.85 - $13.15.

For the fiscal year ending in September 2026, analysts expect APD's adjusted EPS to rise 8.2% year-over-year to $13.01. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

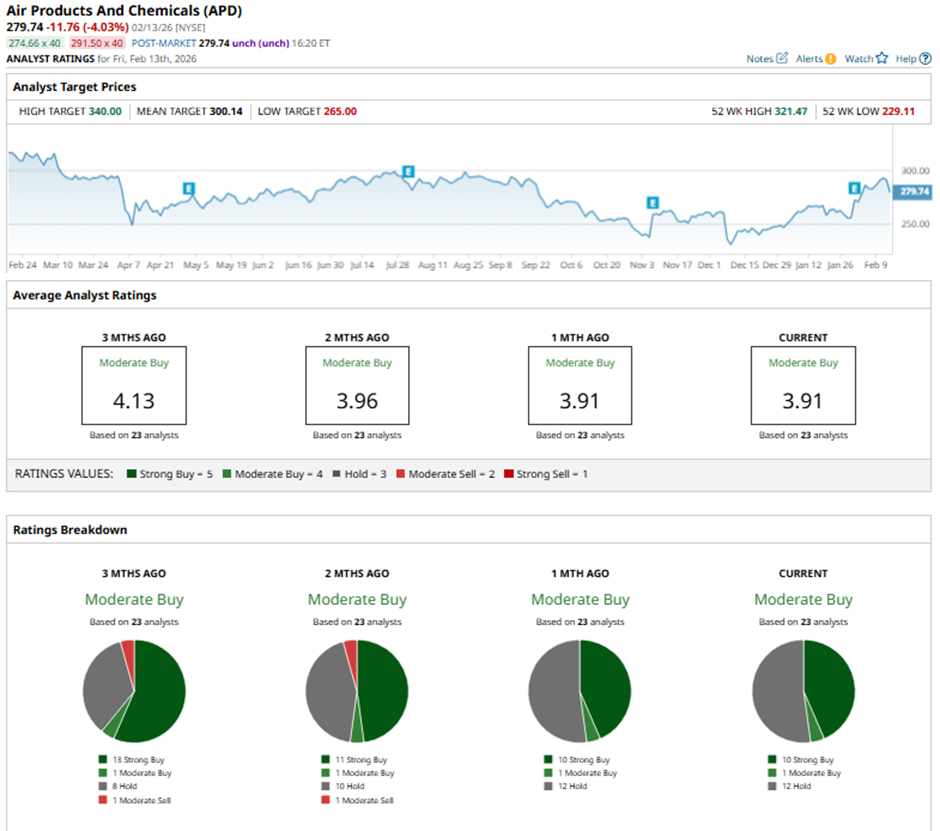

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” and 12 “Holds”

On Feb. 2, Wells Fargo analyst Michael Sison raised the price target on Air Products and Chemicals to $270 and maintained an “Equal Weight” rating.

The mean price target of $300.14 represents a 7.3% premium to APD’s current price levels. The Street-high price target of $340 suggests a 21.5% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)