Disney (DIS) stock has been a perennial underperformer, losing more than 40% of its market capitalization over the last five years. Amid this frustrating underperformance, the company rehired its former CEO, Bob Iger, to lead the company again as chief exective in late 2022. Now, Iger is set to hang up his spurs next month, handing over the baton to Josh D’Amaro. However, Iger will remain a strategic advisor until the end of the year to ensure a smooth transition.

What should investors know as the C-suite shifts for Disney? Let's take a closer look.

Disney’s Streaming Business Has Turned Profitable

Iger made several strategic changes at Disney, particularly in the streaming business, where the focus shifted from growth to profitability. The strategy paid off, and the segment posted an operating profit of $450 million in the first quarter of fiscal 2026, representing a margin of 8.4%. For the full year, the company expects margins to be at 10%, which would be no mean achievement considering that the segment posted an operating loss of almost $1.5 billion in fiscal Q4 2022, which was the last full quarter under former CEO Bob Chapek.

Disney’s Experiences business, which houses the Parks, posted revenues in excess of $10 billion in the most recent quarter, marking the first time it hit that milestone. The segment accounts for the bulk of Disney’s profits and was plagued by multiple issues that negatively impacted guest experience. Under Iger, Disney doubled down on customer satisfaction at its theme parks and announced a multi-year, multi-billion-dollar investment to revamp and expand the segment, which is its crown jewel.

While mixed, Disney’s box office performance has also improved under Iger. Disney was the top-grossing studio in 2024 and 2025.

Disney’s Financial Performance Improved Under Iger

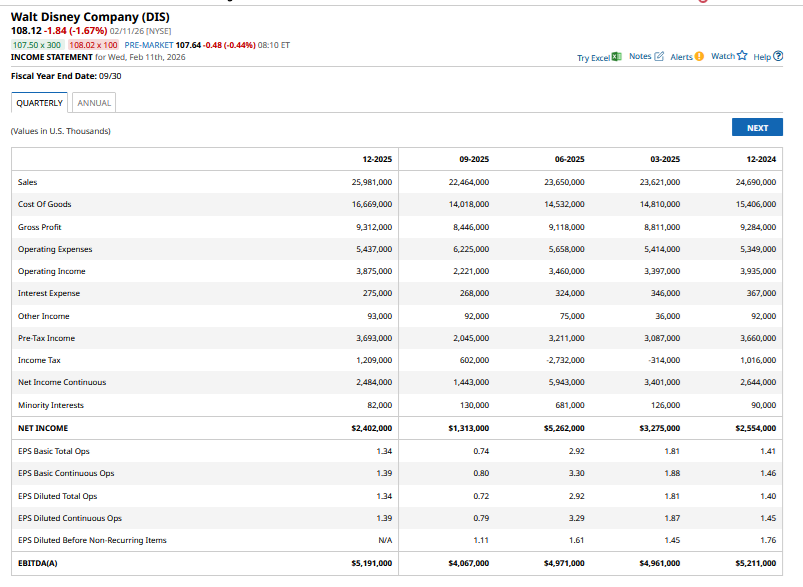

Looking at consolidated numbers, Disney reported revenues of $26 billion in fiscal Q1 2026 as compared to $23.5 billion in fiscal Q1 2023, which was the first quarter under Iger. The impact is even more pronounced in the bottom line. Disney’s adjusted EPS rose from $0.99 to $1.63 over the same stretch as the CEO's pivot toward profitable growth paid off.

Meanwhile, despite the visible improvement in Disney’s performance, it failed to cut ice with the markets. DIS stock soared the day taht Disney announced Iger’s appointment in November 2022, but since then, it has practically gone nowhere, underperforming the markets badly over the period.

This divergence between earnings growth and price action has meant that Disney’s valuations have plummeted over the last three years. DIS stock trades at a forward price-to-earnings (P/E) multiple of 16.4 times. That's a discount to the average S&P 500 Index ($SPX) constituent, whereas DIS was trading at a premium a few years back.

Should You Buy or Sell Disney Stock?

Disney boasts some of the most iconic intellectual property (IP) in the entertainment space and is the literal “cradle to grave” business offering something for practically every age group. The business has many moving parts that gel well into the broader flywheel.

Box office success particularly creates “magic” and leads to better visibility for Disney, which in turn leads to higher attendance at the company's theme parks and more merchandise sales. The company has a massive content library — that continues to get better with every blockbuster movie — adding to its streaming proposition. The bidding war for Warner Bros. Discovery (WBD) only underscores the importance of IP, something that Disney has in plenty. DIS stock would appear attractive considering the money that Netflix (NFLX) and Paramount Skydance (PSKY) are willing to shell out for Warner Bros. Discovery’s assets.

I continue to stay constructive on Disney despite the frustrating underperformance. However, I've trimmed my positions in the company — not because I find its outlook particularly dim, but because I believe the recent selloff has created opportunities in tech stocks with better risk-reward compared to Disney.

Investors should keep an eye on any strategic pivot that Disney makes under D'Amaro. The new CEO will get to lead Disney in a much better position than his predecessor, but it remains to be seen whether his leadership will produce different results for DIS stock.

On the date of publication, Mohit Oberoi had a position in: DIS , NFLX . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)