.jpg)

Walt Disney Company (DIS) shares soared last week after the company released its fiscal first-quarter 2024 earnings. The stock had its best day in over three years after the company made a flurry of announcements and markets got a sense that CEO Bob Iger’s turnaround plan has started to show results on the ground.

Disney stock lagged the markets last year, and has been a perennial underperformer. However, thanks to the post-earnings rally last week, DIS shares are now up 22% YTD and are outperforming the S&P 500 Index ($SPX) by a wide margin. Here’s why Disney stock can go even higher over the next few years as Iger’s turnaround starts to play out.

Disney Made Key Announcements in Its Fiscal Q1 Earnings Call

The fiscal Q1 2024 earnings call was the fifth under Iger’s current tenure, and a Fortune article headline perhaps best sums up the overall mood, calling it an “Oscar-worthy performance.” Looking at the financial metrics, the company’s adjusted earnings per share (EPS) of $1.22 came in well ahead of the $0.99 that analysts expected. The media giant projected full-year EPS to be approximately $4.60, adding that the metric would rise at least 20% YoY.

Importantly, Disney’s streaming losses – which peaked at $1.47 billion in the fiscal fourth quarter of 2022 – narrowed to $216 million in the fiscal first quarter of 2024. Widening streaming losses were among the key reasons Disney replaced Bob Chapek as its CEO and bought back Iger, who started prioritizing profitability over subscriber growth.

Disney also made some other announcements during the earnings call. These include:

- A 50% increase in the semi-annual dividend and a $3 billion share buyback program – its first since 2018.

- A $1.5 billion investment in Epic Games, which is the publisher of the globally popular video game Fortnite.

- The launch of a sports streaming platform jointly with Fox and Warner Bros. Discovery (WBD) while reiterating a 2025 launch of ESPN streaming service.

- There was something for “Swifties,” too, as Disney said that it would exclusively stream her concert film "Taylor Swift: The Eras Tour (Taylor's Version)." The company also said that in November it will launch the animated sequel to “Moana,” as reviving Disney’s sagging box office fortunes has been another key leg of Iger’s turnaround plan.

DIS Stock Forecast: Markets Were Impressed with the Performance

Disney’s earnings impressed analysts, and Needham upgraded the shares from a “Hold” to “Buy” while raising the target price to $120.

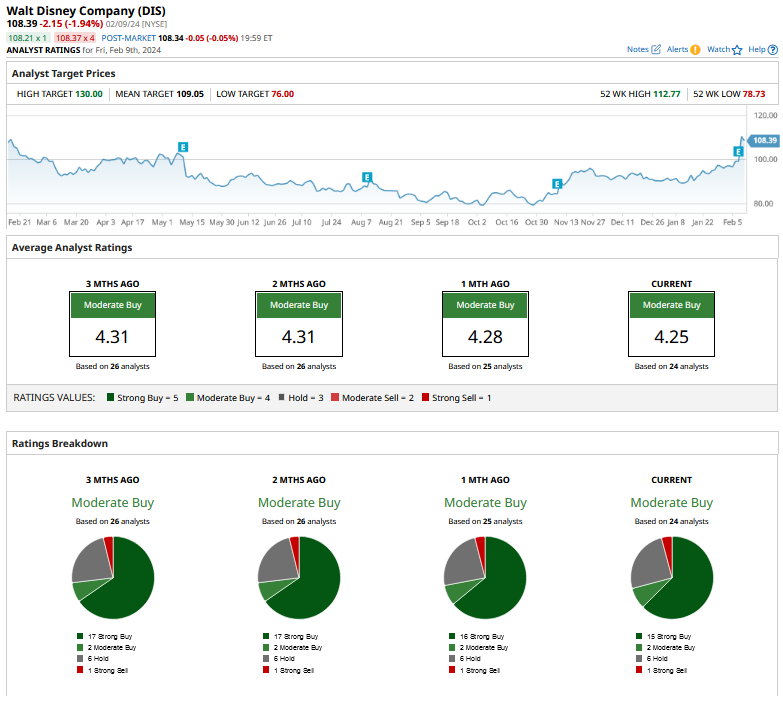

Overall, Disney has a “Moderate Buy” rating from analysts. The mean target price of $109.05 is roughly flat with the stock's current price, but the Street-high target price of $130 is almost 20% above Friday’s closing prices.

How High Can Disney Stock Go?

Disney’s turnaround has only started to take shape, and there could be more upside if the company can continue to execute the plan – including the $7.5 billion in cost savings, which Iger said it is on “track to meet or exceed.”

The eventual profitability of Disney’s streaming business could be another driver that may contribute to a rerating of the shares. As for the movie franchise, Disney is now focused on quality rather than quantity, and a couple of blockbusters could help revive sentiment towards the entertainment giant.

Disney shares trade at a next 12 months price-to-earnings multiple of 22.3x, which seems reasonable - especially considering the expected earnings growth. Moreover, the company’s earnings growth could be a multi-year story, as the cost cuts, streaming profitability, and a revival of the movie business flow to its bottom line.

The company is also doubling down on its hugely profitable parks, and has committed to invest $60 billion in the business over the next decade. These investments should help address some of the concerns about service and wait times that many visitors have flagged over the last couple of years.

Overall, I believe that Disney’s turnaround is only getting started, and the stock has room to run much higher over the next couple of years, driven by earnings growth as well as a possible expansion of its valuation multiples.

On the date of publication, Mohit Oberoi had a position in: DIS . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)