.jpg)

Despite its recent gains, Walt Disney Company (DIS) stock trades near its lowest price levels in a decade. Also, despite being listed for almost seven decades, DIS shares trade under $100. Here’s why Disney stock is trading so low, even as streaming competitors like Netflix (NFLX) have soared.

Disney IPO-ed in 1957

Disney priced its IPO at $13.88 per share in 1957, after previously having issued shares in the over-the-counter market as Walt Disney Productions. The IPO came two years after the company’s theme park opened in California.

Since then, the company’s business has grown exponentially, and it has opened theme parks outside the U.S., also. Disney also pivoted to streaming more recently, and the service reached 100 million subscribers in just 16 months.

Disney is among the most iconic global brands, and is the proverbial “cradle to grave” business – offering something to every age group.

Why Is Disney Stock So Low?

Despite Disney’s strong business model, the stock just trades under $100. One reason Disney stock is so low compared to the IPO price is because of the multiple stock splits over the years, with the most recent being a 3-for-1 split in July 1998. Companies will typically undergo a stock split when the stock rises significantly and the per-share price becomes out of reach of small investors.

But splits are only one reason behind Disney's stock being so low. The stock peaked at over $200 in early 2021, and is currently down by over half from its all-time highs, thanks to the massive underperformance for three consecutive years. Currently, the stock is trading back around its 2014 levels, as it has created virtually zero investor wealth over the last decade.

The Reason Behind Disney Stock’s Underperformance

A cursory look at Disney’s earnings might tell us why the stock recently fell to its lowest levels since 2014. The company generated an operating profit of $10.7 billion in fiscal year 2013, which rose to all of $12.8 billion by the most recent fiscal year. The metric peaked at $15.7 billion in fiscal year 2018 - and although profit has risen from the COVID-19 lows, it has shown anemic growth over the last decade, and so have Disney shares.

Many of Disney’s recent releases, including “Wish” and “The Marvels” from the popular Marvels franchise, have tanked at the box office. Disney also replaced its CEO Bob Chapek with his predecessor Bob Iger in late 2022, and while Iger has taken several actions to revive the company, the stock has continued to sag even under his leadership.

Another reason for Disney’s underperformance has been the decline in the fortunes of linear TV, as consumers have pivoted to streaming. To be sure, Disney read the writing on the wall and started Disney+ in 2019. The timing couldn’t have been better, and its streaming subscribers soared over the next two years amid the COVID-19 pandemic.

Meanwhile, despite adding millions of streaming subscribers, Disney’s direct-to-home business is posting losses, including a $387 million operating loss in the most recent quarter. While those losses have narrowed from the peak, Disney’s streaming business has been a perennial money loser.

Disney vs. Netflix: A Curious Case Study

Per its most recent update, Disney had a total of 198.7 million streaming subscribers. Of these, 112.6 million are for core Disney+ service – of which 46.5 million are in the U.S. and Canada and the remaining 66.1 million are in the international market. This excludes the low-priced Disney+ Hotstar service, which has another 37.6 million subscribers. In addition, Disney has 48.5 million Hulu subscribers.

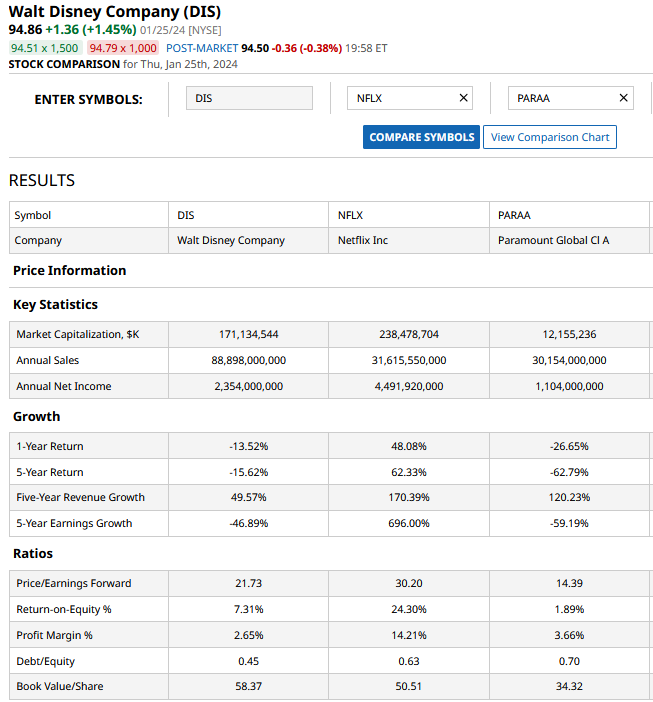

In mid-2022, Disney reached a milestone when its total streaming subscribers surpassed that of Netflix. However, Disney has lost subscribers since then, while Netflix’s total subscriber count soared to 260.8 million by the end of 2023. Still, Netflix’s subscriber count is just about 30% higher than that of Disney. However, when we look at their market cap, with all its other businesses - including the hugely profitable Parks and the movie franchise - Disney’s market cap is just around $174 billion, which is below Netflix’s nearly $245 billion market cap.

Streaming Subscribers vs. Profitability

No wonder both Disney and Netflix have toned down their focus on streaming subscriber growth. While DIS withdrew its long-term subscriber guidance, NFLX stopped providing quarterly subscriber guidance, and said that revenue growth would be the most relevant top-line growth metric going forward.

That said, while Netflix’s subscriber count has grown – and profitably so – with the company’s password-sharing crackdown and ad-supported tier, Disney’s streaming business has yet to see a major revival, even as its losses have arguably narrowed considerably since the 2022 trough. Netflix has also mocked streaming competitors, and said that the industry is losing billions of dollars every year while it churns out a fat profit annually.

Markets have given a premium valuation to Netflix, as well. Its next 12-month price-to-earnings multiple – which is the other key driver of stock price, along with earnings – is 33.2x, compared to Disney’s 21.7x.

While a section of Wall Street continues to remain bearish on Netflix, the company has surprised markets with impressive growth. As for Disney, investors continue to await some kind of “magic” under Iger’s leadership, and in the meantime, DIS shares continue to sag at low levels.

On the date of publication, Mohit Oberoi had a position in: DIS . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)