With a market cap of $29.5 billion, PPG Industries, Inc. (PPG) is a global manufacturer and distributor of paints, coatings, and specialty materials. It operates through three segments: Global Architectural Coatings; Performance Coatings; and Industrial Coatings, supplying products and services to consumers, contractors, and industrial customers worldwide.

Shares of the Pittsburgh, Pennsylvania-based company have outperformed the broader market over the past 52 weeks. PPG stock has increased 14.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.9%. Moreover, shares of the company have soared 28.4% on a YTD basis, compared to SPX's marginal decline.

Looking closer, PPG stock has lagged behind the State Street Materials Select Sector SPDR ETF's (XLB) 19.2% return over the past 52 weeks.

Shares of PPG Industries rose 3.3% following its Q4 2025 results on Jan. 27 as the company delivered solid operating performance, including 3% organic sales growth, net sales of $3.9 billion, and adjusted EPS of $1.51, supported by volume and pricing growth across all regions. Additionally, confidence was boosted by robust aerospace coatings growth, double-digit packaging coatings volume growth, $75 million in realized cost savings, and upbeat 2026 guidance calling for adjusted EPS of $7.70 - $8.10 with mid-single-digit growth.

For the fiscal year ending in December 2026, analysts expect PPG's adjusted EPS to grow 5.8% year-over-year to $8.02. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

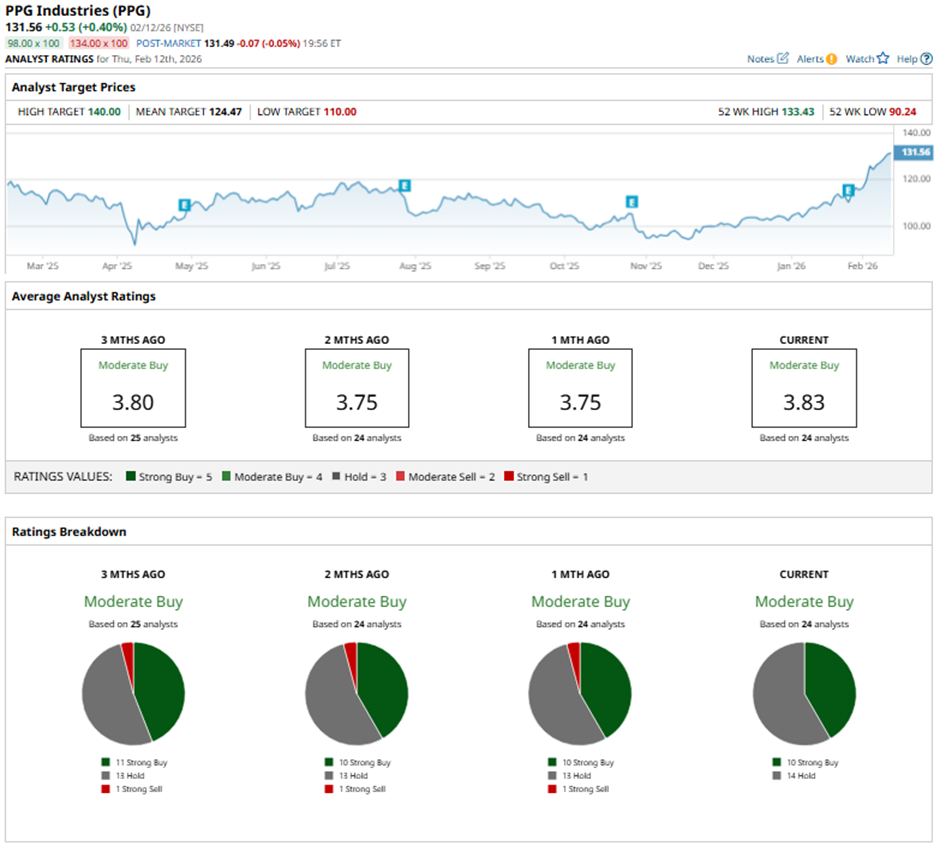

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings and 14 “Holds.”

On Jan. 29, JPMorgan analyst Jeffrey Zekauskas raised PPG Industries’ price target to $126 and reiterated an “Overweight” rating.

As of writing, the stock is trading above the mean price target of $124.47. The Street-high price target of $140 implies a potential upside of 6.4% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)