/Brown%20%26%20Brown%2C%20Inc_%20magnified-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

Valued at a market cap of $14 billion, Brown-Forman Corporation (BF-B) is a family-controlled leader in the global spirits and wine industry. The Kentucky-based company’s portfolio features iconic brands such as Jack Daniel’s, Woodford Reserve, Old Forester, and several Scotch, tequila, and liqueur labels.

BF-B’s shares have significantly lagged behind the broader market over the past 52 weeks. Brown-Forman has surged marginally over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.9%. However, the stock has been on an impressive run, soaring 17.7% on a YTD basis, compared to SPX’s marginal fall during the same time frame.

Zooming in further, BF-B’s underperformance looks even more pronounced when compared to the State Street Consumer Staples Select Sector SPDR Fund’s (XLP) 10.8% return over the past 52 weeks and 14.8% gain on a YTD basis.

On Jan. 14, Brown-Forman shares rose 2.7% after the company announced a national re-release of its highly sought-after Woodford Reserve Double Double Oaked Bourbon, with investors focusing on the potential sales lift from the popular product.

For the current fiscal year, ending in April 2026, analysts expect BF-B’s EPS to decline 9.2% year over year to $1.67. The company’s earnings surprise history is mixed. It topped the Wall Street estimates in only one of the last four quarters while missing on the other three occasions.

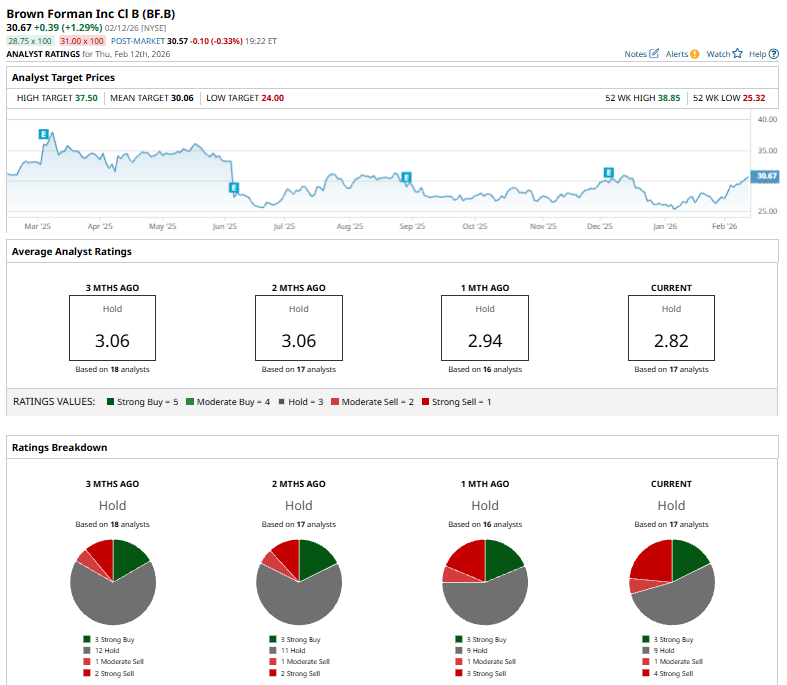

Among the 17 analysts covering the stock, the consensus rating is a “Hold,” which is based on three “Strong Buy,” nine “Hold,” one “Moderate Sell,” and four “Strong Sell” ratings.

On Jan. 20, BNP Paribas Exane downgraded the spirits and wine company to “Underperform” from “Neutral” and cut its price target to $24 from $31, signaling a more cautious view on the company’s outlook.

The stock currently trades above its mean price target of $30.06, and the Street-high target of $37.50 implies that the stock could soar by 22.3% from the prevailing levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)