Energy stocks are back in favor with income investors, and for good reason. The sector's dividend yields now average around 4.2%, well above the S&P 500's ($SPX) 1.3%, while major producers are generating record free cash flow and returning billions to shareholders through buybacks and growing payouts. At the same time, the energy transition is accelerating, with global renewable capacity additions hitting a record 585 gigawatts in 2024, driven by solar's 452 GW contribution.

TotalEnergies SE (TTE) is capitalizing on both trends. The French energy major offers a forward dividend yield of 5.2%. It has raised its payout for three consecutive years, supported by a diversified portfolio spanning oil, gas, and rapidly growing renewable assets.

On Feb. 9, 2026, the French energy giant announced two long-term Power Purchase Agreements (PPAs) with Google (GOOG) (GOOGL) to deliver 1 gigawatt of solar capacity, which equals 28 terawatt-hours of renewable electricity over 15 years, to supply Google’s data centers in Texas. The power will flow from TotalEnergies' 805-megawatt Wichita project and 195-megawatt Mustang Creek facility, with construction set to begin in Q2 2026.

But can a traditional energy major successfully pivot to renewables while maintaining the dividend income investors depend on? Let’s find out.

What TTE’s Latest Numbers Reveal

TotalEnergies is a diversified, integrated energy major. It runs large oil and gas operations while also growing its LNG, power, and renewables businesses to meet demand from both industrial customers and the digital economy.

Over the past 52 weeks, TTE stock climbed 26%, and it has already added 18% year-to-date (YTD).

On valuation, TotalEnergies trades at a forward price-to-earnings multiple of 11.14x versus about 14.86x for its sector. That gap suggests the stock is priced at a discount compared with the broader group, even with its mix of businesses and growth paths.

For income investors, the headline dividend yield of 2.11% on an annualized basis, about 2.85% in practical terms, sits below the roughly 4.24% energy-sector average. Still, the company returns cash consistently, with a forward payout ratio of 40.14% and a quarterly dividend of $0.735.

Annual sales of about $195.6 billion translate into roughly $15.8 billion in net income, supporting earnings per share of $7.07 and the most recent quarterly earnings of $1.77 as of Oct. 30, 2025. In its third-quarter 2025 report, adjusted net income held at $4.0 billion despite a roughly $10 drop in oil prices year-over-year (YoY), while cash flow rose 4% to $7.1 billion, showing the strength of its integrated model.

Exploration & Production delivered $2.2 billion in adjusted net operating income and $4.0 billion in cash flow, up 10% and 6% sequentially, helped by new projects that contributed around $400 million of incremental cash flow at margins above the portfolio average.

Why TotalEnergies’ Growth Story Is Getting Clearer

TotalEnergies and Airbus (EADSY) have signed two “clean firm power” contracts to supply 3.3 TWh to Airbus’ major sites in Germany and the United Kingdom. The electricity will extend “into the next decade,” come with a baseload profile, and be sourced from new renewable assets totaling 200 MW, so it is not just a paper PPA; it is tied to an actual new buildout. The supply is expected to cover half of the electricity needs of the Airbus sites concerned, starting from 2027, which gives the deal a clear runway and clear volumes behind it.

In Kuwait, TotalEnergies and Kuwait Oil Company signed a Memorandum of Understanding at the opening of the fifth Kuwait Oil & Gas Show and Conference (KOGS) to strengthen cooperation, exchange expertise, and conduct technical studies. The MoU also includes studies related to new exploration opportunities in the country, with TotalEnergies mobilizing its technical expertise, which is real groundwork that can lead to future production and cash flow.

In Bahrain, TotalEnergies and Bapco Energies are launching BxT Trading, an equally owned trading joint venture backed by flows from Bapco Energies’ refinery, which adds more scale and flexibility to TotalEnergies’ trading business. The signing ceremony was witnessed in Abu Dhabi by Shaikh Nasser bin Hamad Al Khalifa and TotalEnergies CEO Patrick Pouyanné, and the company positioned it as a way to strengthen its trading presence in the Middle East alongside hubs in Houston, Geneva, and Singapore—another piece of the integrated model that supports shareholder returns while it expands the renewables book.

Wall Street’s Read on TTE

For the December 2025 quarter, the average EPS estimate sits at $1.80, versus $1.90 in the prior year, which implies a -5.26% YoY growth rate estimate. Looking at the bigger picture, the average estimate for fiscal 2025 is $7.15 versus $7.77, down -7.98%, and for fiscal 2026 it is $6.58 versus $7.15, down -7.97%. On volumes, TotalEnergies expects Q4 2025 hydrocarbon production of 2.525 to 2.575 Mboe/d, which is more than 4% growth versus Q4 2024.

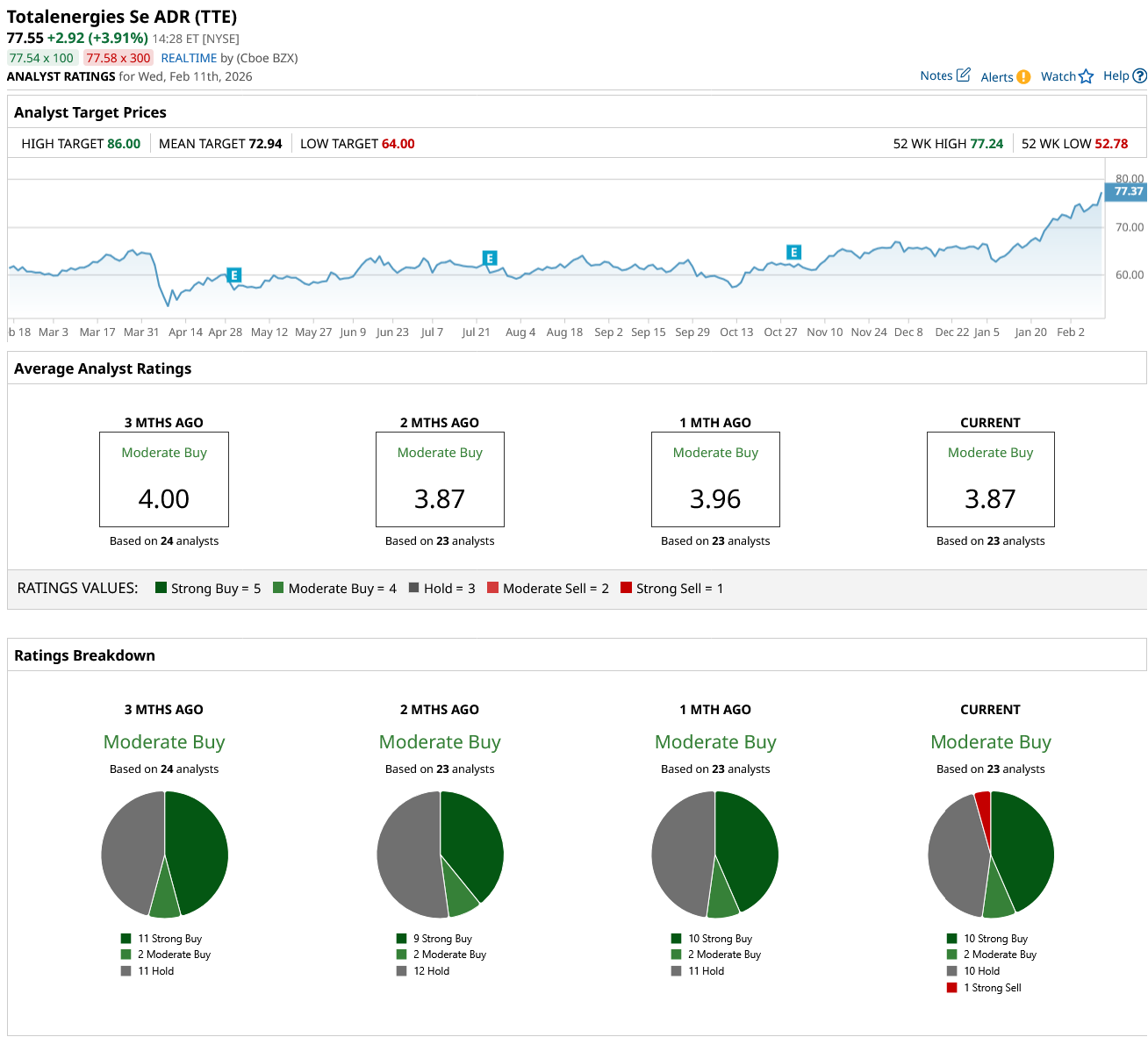

Jefferies upgraded TotalEnergies from “Hold” to “Buy” on Jan. 26, tied to a broader rethink of the company’s ability to sustain cash flows, which matters a lot for dividend-focused investors. From the other angle, J.P. Morgan downgraded the stock from “Overweight” to “Neutral” in December 2025, showing a more cautious view, even though the macro factors in play are the same ones everyone is tracking.

Even with those mixed calls, the overall analyst stance is still positive. All 23 analysts surveyed rate the stock a “Moderate Buy,” and the mean price target is $72.94. With shares recently around $74.71, the stock is about 2.43% above that average target, which suggests the market is leaning toward the view that contracted growth can keep cash flows more stable than the typical model assumes.

Conclusion

TotalEnergies looks like a solid “buy hand over fist” dividend name for February 2026 because it is still priced at a sector discount while layering in long-dated, contracted renewable cash flows like the new Google Texas solar PPAs. With Q4 and full-year EPS estimates drifting lower and the stock already about 2.43% above the mean analyst target, the near-term path likely depends on execution and the tone of the Feb. 11 earnings update, but the setup still favors resilience over fragility. If energy prices stay range-bound, shares are more likely to grind higher or consolidate than break down sharply, with the Google and broader clean-power contracting story acting as a floor for sentiment.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)