Artificial intelligence (AI) is no longer a future-facing bet, but is an operating reality, and it is getting expensive. As models grow larger and workloads heavier, the world’s biggest tech companies are spending aggressively to secure chips, expand data centers, and build the digital plumbing needed to keep AI running at scale. This surge in investment is not about experimentation anymore, but it’s about dominance, reliability, and speed in an AI-first economy.

With the tech earnings season wrapping up, Wall Street now has sharper visibility into just how fast this race is accelerating. Prominent hyperscalers are collectively expected to lift capital expenditures by over 60% from the record levels reached in 2025, signaling that AI spending is set to intensify into 2026.

Alphabet (GOOG) (GOOGL) put a bold number on that trend. The Google parent stunned markets by forecasting $175 billion to $185 billion in capital spending next year as it pushes AI deeper across Search, Cloud, and its broader ecosystem. That money won’t sit idle.

Partners like Broadcom (AVGO) the semiconductor and software powerhouse designing and helping manufacture Google’s custom tensor processing units (TPUs), stand to benefit, alongside chip heavyweights NVIDIA Corporation (NVDA) and Advanced Micro Devices (AMD), both key suppliers for Alphabet’s cloud and AI workloads. As Alphabet opens the spending taps, a clear shortlist of beneficiaries is beginning to emerge.

Let’s take a closer look at them.

Stock #1: Broadcom

Founded in 1961, Palo Alto-based Broadcom has grown into one of the most dominant forces in global technology. With a market capitalization of over $1.6 trillion, the company now sits firmly among the world’s elite. Its semiconductors are not flashy consumer products, but they are essential – powering cloud infrastructure, AI-driven data centers, smartphones, broadband networks, and industrial systems.

Alongside this, Broadcom has built a serious infrastructure software arm, anchored in long-term, mission-critical relationships. That combination of high-margin chips plus sticky enterprise software gives it a deep competitive moat in networking, wireless, and custom silicon.

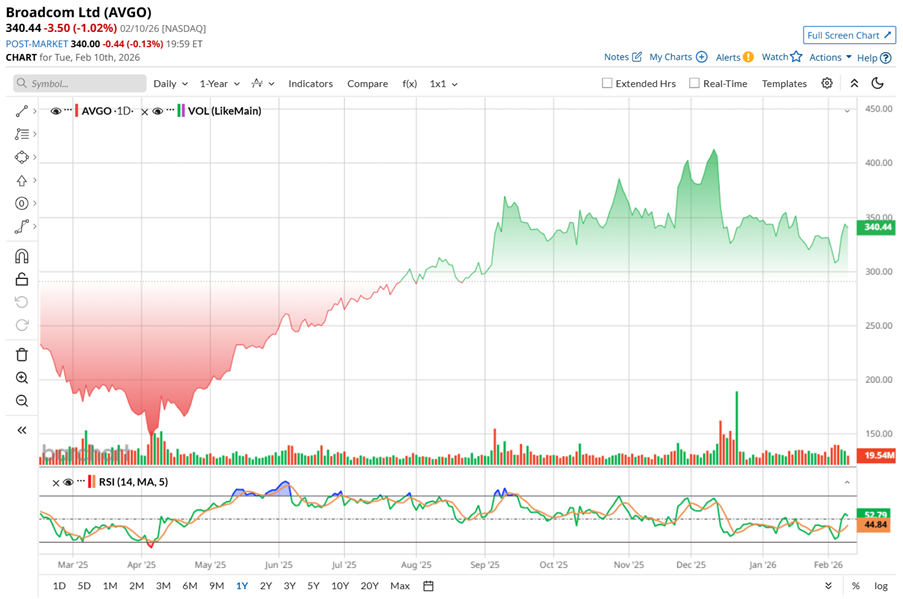

Investors have rewarded that model. Over the past 52 weeks, AVGO has surged nearly 47%, surging past the S&P 500 Index’s ($SPX) 14.5% gain and printing 35 new highs. In fact, on Dec. 10, the stock hit a high of $414.61.

Despite a modest 2.16% pullback in the last three months, momentum is perking up again, with shares up 11.79% in the past five days. Technically, the 14-day RSI sits around 54.27 – cooling from overbought levels, yet still signaling strength beneath the surface.

Broadcom’s valuation is undeniably premium. The stock trades around 39.55 times forward earnings and roughly 16.63 times forward sales, both comfortably above industry averages, leaving little margin for operational missteps. Yet, elevated multiples often signal more than optimism – they reflect confidence in durability, scale, and earnings visibility.

When viewed through the lens of cash flow and capital discipline, that valuation becomes easier to contextualize. Fiscal 2025 marked a clear inflection in cash generation, enabling management to raise the quarterly dividend by 10% to $0.65 per share for fiscal 2026. This sets a record forward annual dividend of $2.60, extending a remarkable 15-year streak of dividend increases since 2011.

While the forward annualized yield stands at a modest 0.76%, the 35.5% payout ratio preserves flexibility for reinvestment. Supported by strong quarterly execution, resilient free cash flow (FCF), and a powerful AI-driven earnings engine, Broadcom’s story is as much about disciplined capital returns and stability as it is about high-growth expansion.

Broadcom’s fourth quarter of fiscal 2025 report was released on Dec. 11, and the numbers told a clear story of scale, discipline, and accelerating relevance in the AI era. Quarterly revenue reached a record $18 billion, up 28% year-over-year (YOY), with AI semiconductor revenue surging 74% annually, a signal that Broadcom’s role in next-generation compute is no longer peripheral, but central. Profitability kept pace with growth. Non-GAAP EPS rose 37% YOY to $1.95, comfortably ahead of Wall Street’s expectations.

For the full fiscal year, adjusted EBITDA climbed 35% to a record $43 billion, while FCF remained robust at $26.9 billion. The balance sheet strengthened further, with cash and equivalents rising to $16.2 billion by quarter-end, up sharply from $10.7 billion in the prior quarter. In Q4, Broadcom generated $7.7 billion in operating cash flow, spending a modest $237 million on capital expenditures and converting nearly all of that into $7.5 billion of FCF.

Beyond the financials, the order book revealed the depth of Broadcom’s momentum. The company secured a landmark $10 billion order from Anthropic for its latest Ironwood TPU racks, followed by an additional $11 billion commitment, with delivery scheduled for late 2026. Broadcom also expanded its custom silicon footprint by adding a fifth XPU customer through a $1 billion order scheduled for the same period. These wins underscore the company’s growing position as a trusted partner for hyperscalers and AI pioneers building at scale.

AI networking has emerged as another powerful engine. As customers invest ahead of large AI deployments, Broadcom’s networking portfolio is seeing direct benefits. The backlog for AI switches has now crossed $10 billion, driven by record demand for the Tomahawk 6 switch. CEO Hock Tan also highlighted record orders across DSPs, optical components such as lasers, and PCI Express switches – critical building blocks for modern AI data centers. In total, Broadcom’s AI-related backlog exceeds $73 billion, nearly half of its $162 billion consolidated backlog, with delivery expected over the next 18 months.

Looking ahead, management’s outlook suggests this momentum is far from peaking. For Q1 fiscal 2026, Broadcom expects AI semiconductor revenue to double annually to $8.2 billion, fueled by custom AI accelerators and Ethernet AI switches. Total revenue is forecast at $19.1 billion, with adjusted EBITDA margins of approximately 67%.

Broadcom looks like a natural winner as Alphabet opens the capex taps. The company already plays a critical role in Google’s TPU program, supplying custom AI chips – often referred to as XPUs – that are purpose-built to handle massive AI workloads inside data centers. As Alphabet ramps up spending on AI compute, servers, and high-speed networking, Broadcom’s silicon sits right at the center of that buildout.

Analysts estimate shipments tied to Google’s TPUs could climb to nearly 7 million units by 2028, a scale that could push Broadcom’s AI ASIC revenue toward $78.4 billion by 2027. The momentum is already visible. Broadcom’s AI semiconductor revenue jumped in the fourth quarter, highlighting just how closely its growth is linked to hyperscaler spending cycles, like Alphabet’s.

And this isn’t a one-client story. While Broadcom expects its AI chip revenue to double annually, Street anticipates overall revenue to grow 52% to $97 billion in fiscal 2026, making it a core beneficiary of the next AI spending wave. EPS for the year is estimated to be $8.70.

UBS sees Broadcom as one of the clearest long-term winners in the AI infrastructure build-out, reaffirming its “Buy” rating and $475 price target on AVGO. The brokerage firm’s confidence rests on accelerating demand for Broadcom’s TPU portfolio, where scale and cadence are becoming increasingly visible. Analyst Timothy Arcuri expects Broadcom to ship more than five million TPU units in calendar 2027, up from roughly 3.7 million units in 2026. More than half of those 2027 shipments are projected to be v7 Ironwood models, before v8ax Sunfish becomes the dominant platform in 2028, with both built on TSMC’s N3 process.

On the revenue side, Broadcom’s AI revenue is expected reach about $60 billion in fiscal 2026, implying nearly 200% annual growth, rising to $106 billion in fiscal 2027 and $150 billion in fiscal 2028. Google is expected to remain the anchor customer, contributing around $30 billion of custom compute revenue this year and $56 billion by 2027, with Anthropic and Meta filling out the balance. UBS Group (UBS) also expects shipments of OpenAI’s ASIC to begin late this year, followed by Anthropic’s ASIC in the second half of 2027, underpinning EPS estimates of $12.70 by 2026, $18 in fiscal 2027, and $22.50 through 2028.

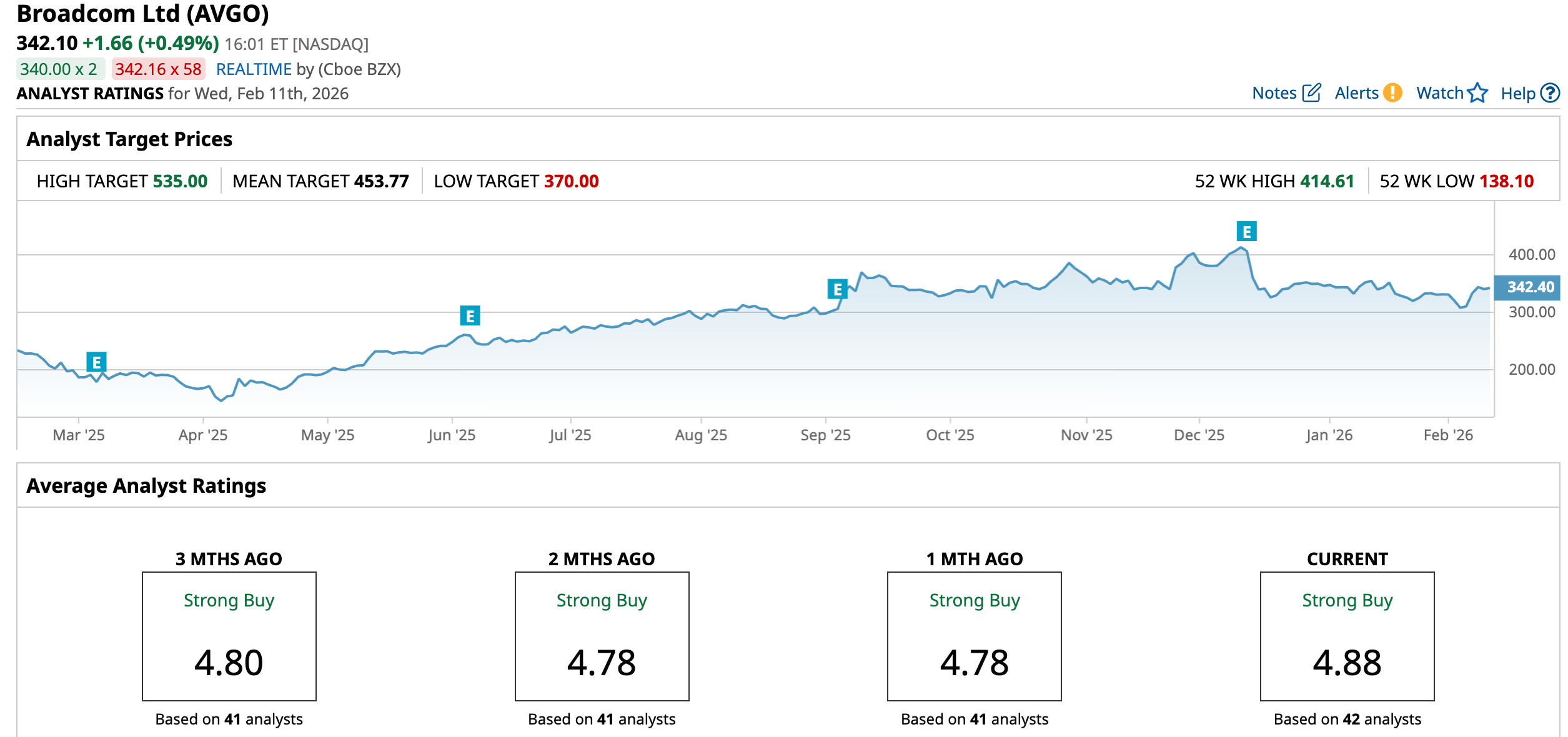

Wall Street’s confidence in Broadcom comes down to consistency, earning the stock an overall consensus “Strong Buy” rating. Of the 42 analysts tracking the stock, 38 back it with a “Strong Buy,” three have a “Moderate Buy,” while just one sits on the sidelines with a “Hold" rating.

AVGO’s average target of $453.77 suggests an upside potential of 32.6% from the current price levels. The Street’s highest $535 price target hints the stock could rally as much as 56.4%.

Stock #2: Nvidia

Santa Clara-based Nvidia hardly needs an introduction. Once celebrated as the king of gaming graphics, it quietly reinvented itself as the backbone of modern computing. Its GPUs now power data centers, AI, robotics, and immersive digital worlds. The CUDA software platform locked developers into a powerful ecosystem, turning Nvidia into an industry standard rather than a supplier. With a market capitalization of nearly $4.6 trillion, Jensen Huang’s company has become the engine of the AI economy.

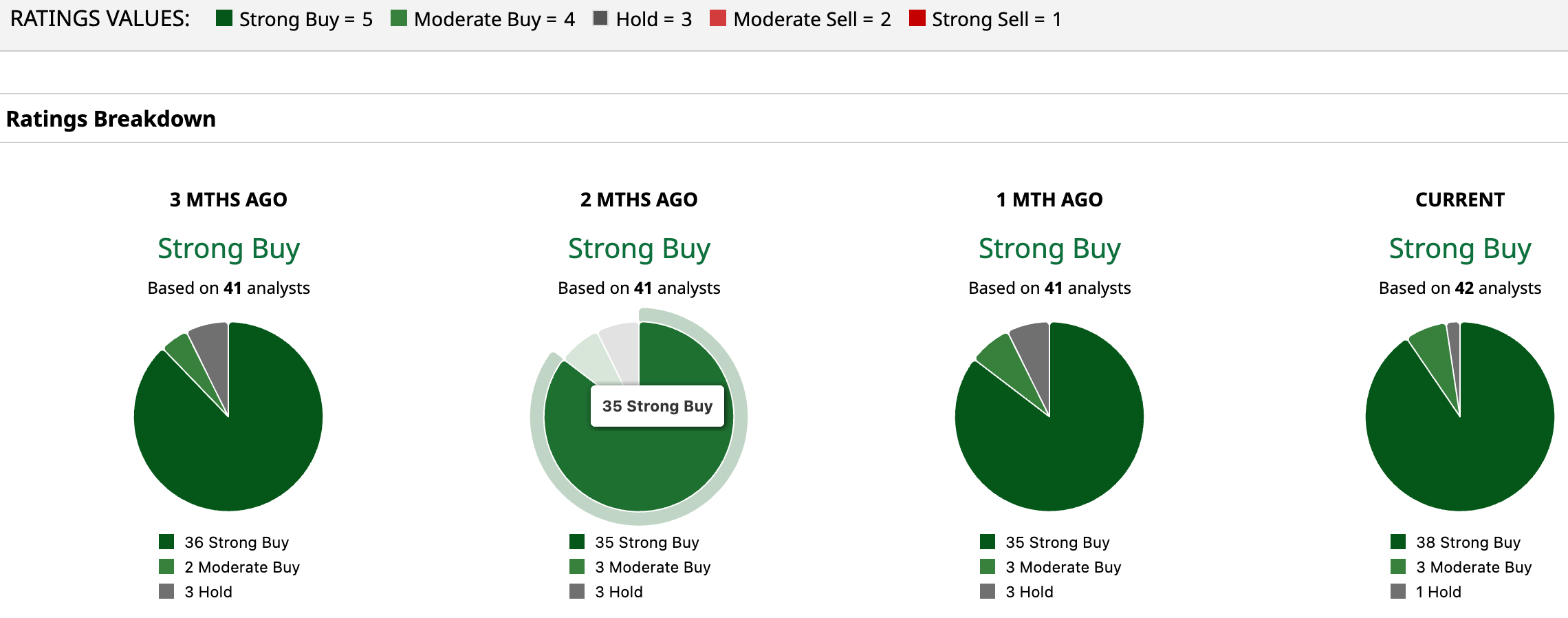

Over the past year, Nvidia’s shares have advanced in decisive waves, followed by measured pullbacks rather than reckless surges. The pattern suggests disciplined buying, with investors willing to pause and reassess without abandoning the broader thesis. After touching a high of $212.19 on Oct. 27, the shares retreated about 11.7%. Yet even with that pullback, the stock remains up about 43.1% over the past 52 weeks, highlighting the strength of the prevailing uptrend.

Technically, the chart points to a period of stabilization, not weakness. Momentum has cooled but remains intact. The 14-day RSI, which moved into overbought territory during October’s peak, has eased to 55.16. That moderation signals a healthy reset rather than structural damage. Trading volumes have also settled, suggesting the stock is simply taking a breather, not falling apart.

NVDA stock can feel pricey at first, trading around 40.18 times forward adjusted earnings, above most peers. But that’s below its own historical average. With double-digit growth and elite margins, the premium makes sense. Plus, the AI chip giant has paid dividends to shareholders for 13 consecutive years.

Stepping into Nvidia’s world, and it’s clear why leaving isn’t easy. Once customers build their systems on its chips, software, and networking, the ecosystem locks them in. That stickiness shows in the numbers: growth compounds, cash piles up, and the balance sheet stays rock solid. Over the past decade, revenue has surged at an impressive 44% annual pace, while earnings have exploded at 65% - a rare combination of scale and profitability

Under Jensen Huang, momentum has not slowed. Fiscal Q3, reported on Nov. 19, delivered another strong chapter: revenue jumped 62% YOY to $57.1 billion, and adjusted EPS climbed 60% annually to $1.30, comfortably ahead of expectations. The engines of growth remain broad. Data centers, powered by AI demand, grew 66% YOY to $51.2 billion. Networking exploded 162% to $8.2 billion as NVLink, InfiniBand, and Spectrum-X gained adoption. Gaming held steady with 30% growth, while automotive quietly advanced 32%, proving Nvidia is not reliant on a single lane.

The cash story is just as compelling. Operating cash flow grew to $23.8 billion, FCF jumped 65% to $22.1 billion, and $37 billion returned to shareholders in the first nine months of fiscal 2026. Even after that, $62.2 billion remains in buyback authorization. The balance sheet shows its muscle with $60.6 billion in cash and cash equivalents, long-term debt of just $7.5 billion, and short-term debt under $1 billion.

NVIDIA stands to gain meaningfully as Alphabet doubles down on AI compute. Alphabet’s management highlighted strong returns from its existing AI investments and made it clear that future spending will focus on frontier model development at Google DeepMind – the kind of cutting-edge work that typically leans on Nvidia’s most advanced GPUs.

Also, Alphabet named Nvidia as a key partner and said it would be among the first customers to access Nvidia’s next-generation Vera Rubin platform. At a time when AI-driven disruption has pressured software stocks and dragged chip names with them, Alphabet’s massive capex commitment sends a different signal. The AI buildout is not slowing but accelerating, and that backdrop continues to support Nvidia’s long-term growth story.

NVIDIA is gearing up to release its Q4 report on Wednesday, Feb. 25, after the market closes. Management estimates revenue at approximately $65 billion, plus or minus 2%. Meanwhile, analysts tracking Nvidia forecast its Q4 fiscal 2026 revenue to be $65.6 billion, and EPS is anticipated to grow 70.6% YOY to $1.45. For the full fiscal 2026, the bottom line is projected to increase 51.2% annually to $4.43 per share before rising by another 58.7% to $7.03 in fiscal 2027.

With Nvidia set to report earnings soon, expectations are running hot, and Goldman Sachs thinks the company can still surprise to the upside. Despite rising competition from peers, Goldman Sachs expects a $2 billion revenue beat, forecasting fiscal Q4 revenue of $67.3 billion, with outperformance on the bottom line as well. The firm believes hyperscaler spending is accelerating faster than previously modeled. While the bank had estimated data center capex would rise above $527 billion from $394 billion in 2025, recent disclosures – $200 billion from Amazon and $185 billion from Alphabet alone – suggest even more upside.

Goldman also sees optionality beyond hyperscalers. Stronger GPU demand from OpenAI, Anthropic, and sovereign governments could lift guidance, especially if Nvidia offers visibility into 2027 data center revenue, which Goldman already sees well above Street estimates. Adding in potential upside from renewed China demand following approval of H200 sales, and progress on the Rubin chip ramp replacing Blackwell in 2026, Goldman sees several catalysts that could keep Nvidia’s shares moving higher.

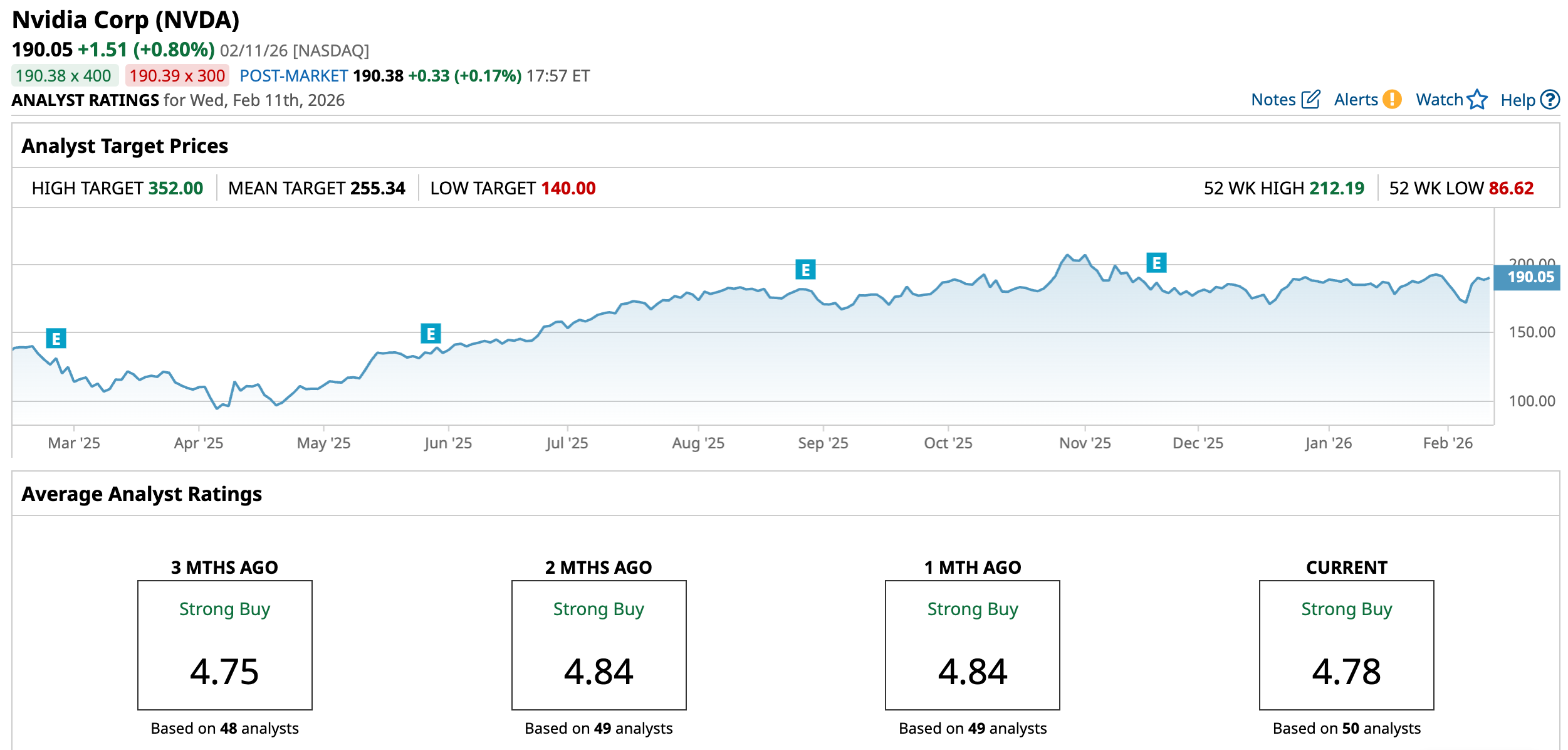

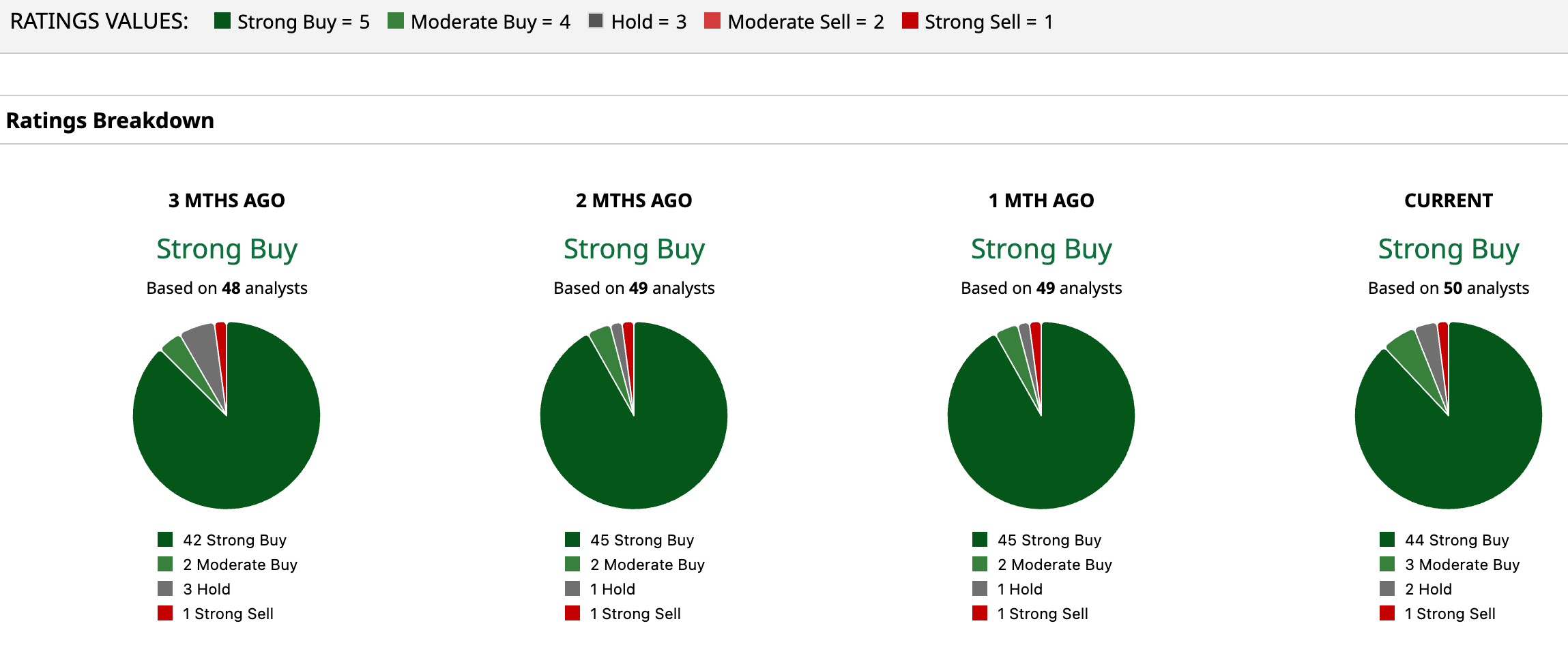

Overall, analysts are bullish about NVDA’s growth prospects, giving the stock a consensus rating of “Strong Buy.” Of the 50 analysts covering the stock, 44 advise a “Strong Buy,” while three suggest “Moderate Buy,” two advise a “Hold,” and only one suggests a “Strong Sell.”

The average analyst price target for NVDA is $255.34, indicating potential upside of 34.5%. The Street-high target price of $352 suggests that the stock could rally as much as 85% from here.

Stock #3: Advanced Micro Devices Stock

Founded in 1969, Santa Clara-based AMD has spent more than five decades pushing the boundaries of high-performance computing. Today, with a market capitalization of $348.2 billion, AMD is a global semiconductor powerhouse, fueling everything from gaming rigs to hyperscale data centers with its Instinct MI350 GPUs, designed for speed, efficiency, and broad accessibility.

The company’s stock performance over the past year has been equally impressive. AMD shares ignited, climbing 92.24% over the past 52 weeks, far outpacing the broader market. In the past six months alone, the stock rose 23.97%, driven by AI chip enthusiasm, strong analyst upgrades, and renewed investor confidence. AMD reached a peak of $267.08 in October and has since pulled back about 25%, reflecting traders taking a pause after the massive run.

From a technical perspective, the stock appears to be catching its breath. The 14-day RSI sits at 44.18, down from January’s overbought levels, suggesting the recent consolidation may be a healthy pause before the next move.

AMD stock is priced at 31.92 times forward earnings and 7.50 times sales, rich versus peers but below its historical medians. Investors are banking on AMD’s AI momentum, and if double-digit earnings and sales growth continue as expected, today’s high multiples could look far more reasonable in the near future.

AMD’s fourth-quarter report on Feb. 3 generated a record revenue of $10.27 billion, up 34% YOY, comfortably beating expectations. At the heart of that growth was the data center business, where sales climbed to roughly $5.38 billion, a 39% annual increase, reflecting continued demand for high-performance compute. Client and gaming segments also performed well, posting growth of around 37%, a reminder that AMD’s recovery is broad-based rather than reliant on a single engine.

Profitability followed the same upward arc. Non-GAAP gross margin expanded to 57%, signaling improving mix and operating leverage. Non-GAAP EPS reached $1.53, nearly 40.4% higher than a year ago and surpassing Wall Street’s projections.

Cash generation stood out as well. FCF came in at approximately $2.1 billion, almost double last year’s level, leaving AMD with about $10.6 billion in cash and short-term investments by quarter's end.

That financial strength is being put to work. For fiscal 2025, capital expenditures rose to around $974 million, up from $636 million the prior year, as AMD invests in capacity, platforms, and long-term R&D. Management described 2025 as a “defining year,” and CFO Jean Hu pointed to record operating income and FCF as proof that the company can fund growth while maintaining discipline.

The near-term outlook is measured but steady. For Q1 2026, AMD guided revenue to about $9.8 billion, plus or minus $300 million, implying a modest 5% sequential dip but roughly 32% annual growth. Gross margin is expected to hover near 55%. Management acknowledged a double-digit decline in semi-custom SoC sales as the console cycle cools, but that softness is expected to be offset over time by rising AI momentum, with demand for new Instinct MI450 GPUs anticipated to build later in 2026.

Meanwhile, analysts tracking AMD expect Q1 revenue to rise to $9.85 billion, with EPS expected to be $1.04. Looking further ahead, profit is anticipated to jump nearly 72.17% to $5.63 per share in fiscal 2026 and surge another 60.04% in 2027 to $9.01 per share.

AMD may have stumbled out of the gate in early 2026 as investors questioned how far the AI rally could run, but analysts are not losing the plot. Benchmark reiterated its “Buy” rating with a $325 price target, pointing to strong Q4 execution and accelerating AI demand. Analyst Cody Acree highlighted AMD’s growing leverage to AI data centers across CPUs and GPUs, with rising traction at OpenAI, Oracle, Meta, and sovereign AI projects. With customers actively seeking an open alternative to Nvidia’s closed ecosystem, Benchmark sees AMD’s competitive positioning steadily improving.

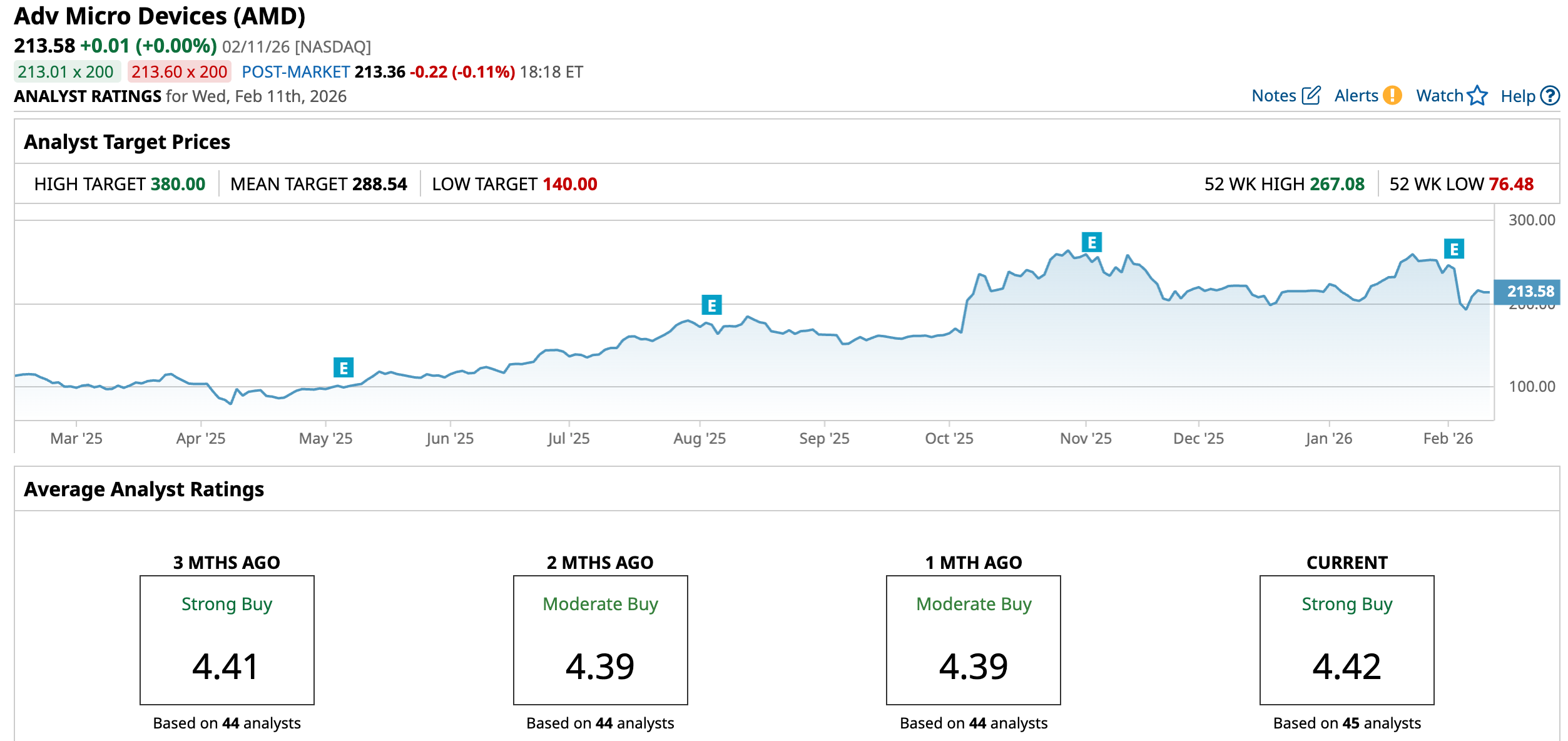

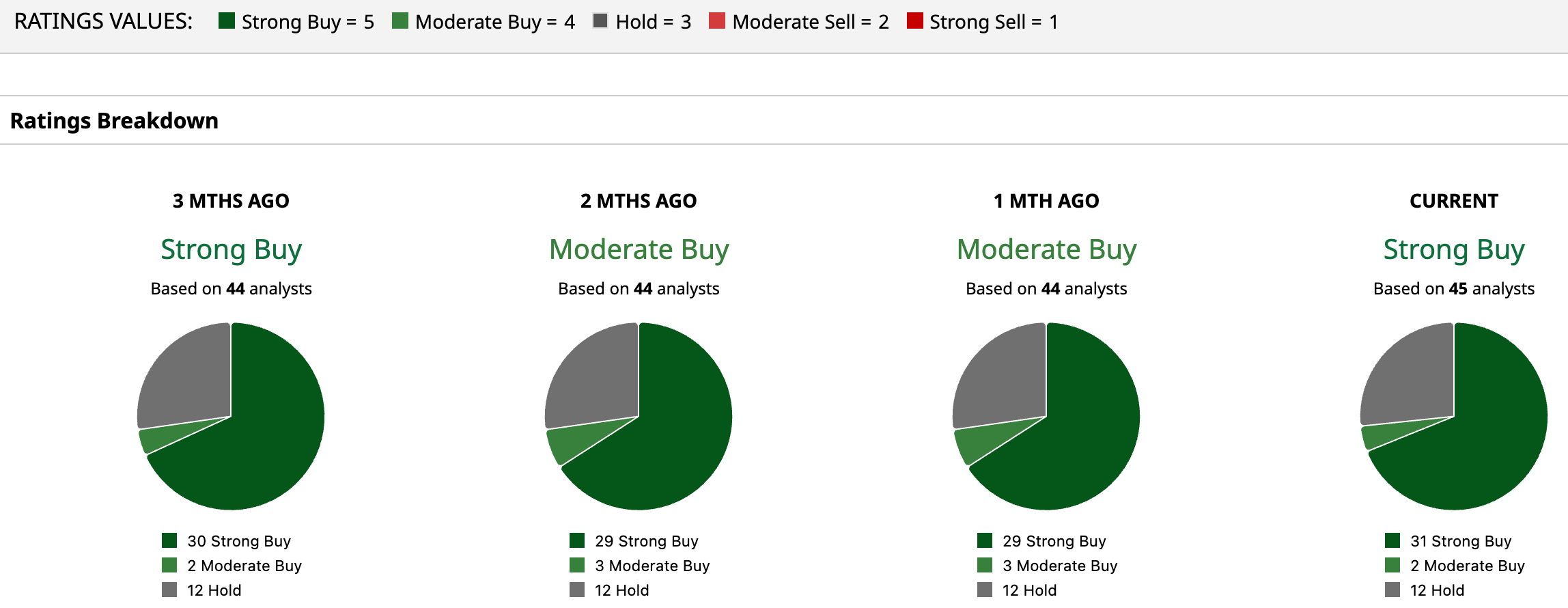

The stock carries a “Moderate Buy” consensus overall. Among the 45 analysts tracking the stock, 31 issue a “Strong Buy,” two give a “Moderate Buy,” and 12 advise a “Hold.” The average analyst price target of $288.54 suggests an upside potential of 35%. The Street-high target of $380 suggests that the chip stock can still rally as much as 78% from current levels.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)