In the three months to December 2025 compared to September 2025, real GDP increased by 0.1%, rebounding from consecutive declines in October and November. Services output remained unchanged, while production rose by 1.2%. Construction declined by 2.1%, marking its lowest three-month growth since September 2021.

For December 2025, monthly GDP grew by 0.1%, following a 0.2% increase in November and a 0.1% decrease in October. Services expanded by 0.3%, but production dropped 0.9% and construction fell 0.5%.

Meanwhile comparing the Euro to the greenback, we expected choppy movement for EUR/USD with a potential bounce off $1.1672, but price did not reach that level. Now, a stronger than expected US jobs and earnings data has apparently strengthened the US Dollar which despite POTUS claim of making the currency move like a YoYo on demand, is pushing EUR/USD below $1.1887 support, before it is likely to find a base at $1.1833. The pair may move higher if price and find its way above $1.1887; two hourly closes above this level without upper “lack of material excess” wicks would signal a long position towards $1.1949.

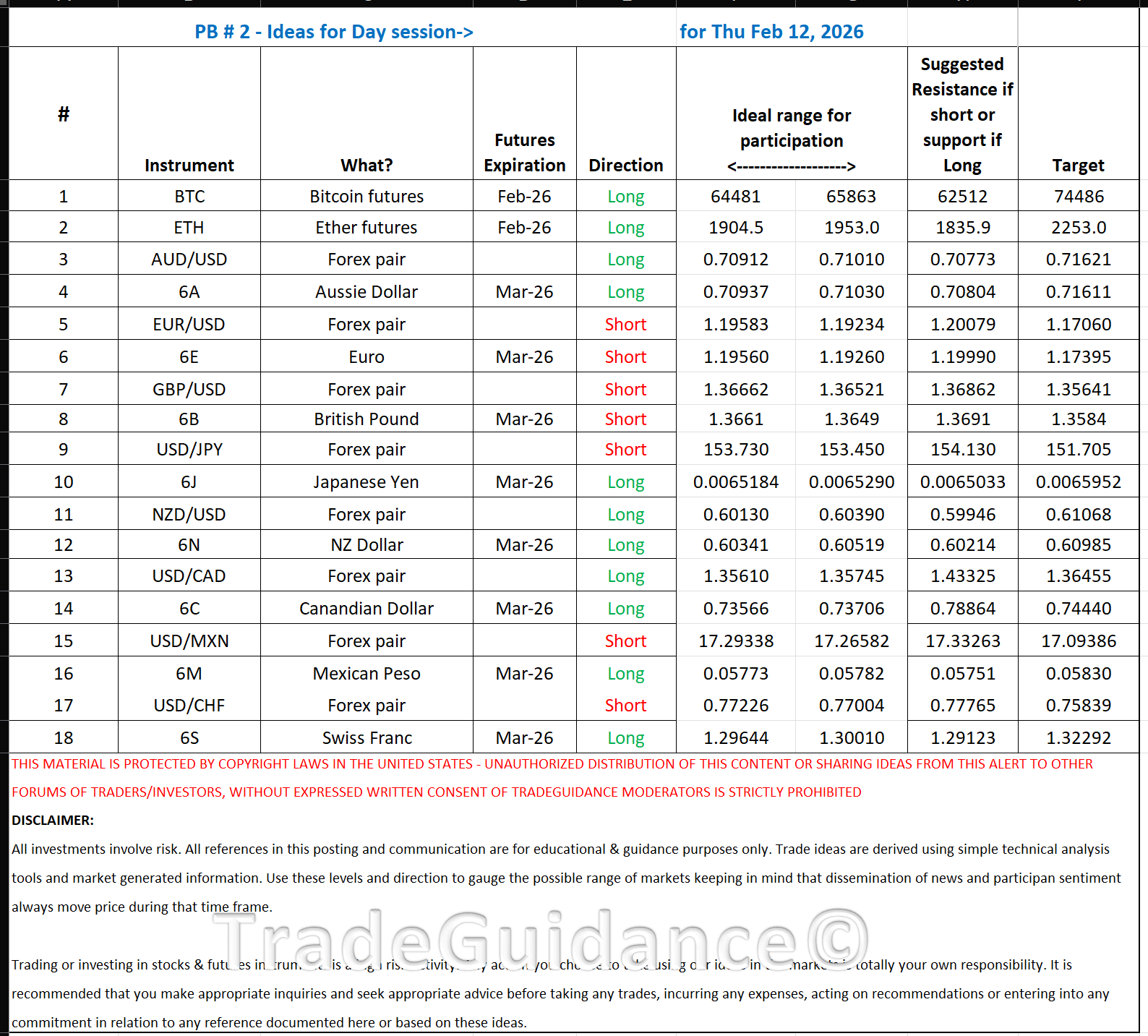

Here is our intraday playbook for Thursday Feb 12, 2026. Trade these setups with confidence that we use our best judgment to measure so trading with the stated risk stops and of course aligning with your own personal risk tolerance is essential.

Playbook for actively traded pairs and associated currencies

(USDJPY) (USDCHF) (AUDUSD) (USDCAD) (EURUSD) (NZDUSD) (USDCHF) (BTC) (ETH26)

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)