The U.S. Department of Labor today reported the American economy added 130,000 non-farm payrolls in January, much higher than 48,000 in December (downwardly revised) and well above forecasts of up 55,000. It is the highest NFP figure since December 2024.

Meanwhile, the department reported that total U.S. non-farm employment growth for the year 2025 was revised down to +181,000 from +584,000, implying average monthly job gains of just 15,000. This is well below the previously reported 49,000. The overall unemployment rate dropped to 4.3% in January, from 4.4% in the December report. “This report is a blockbuster,” summed up one analyst.

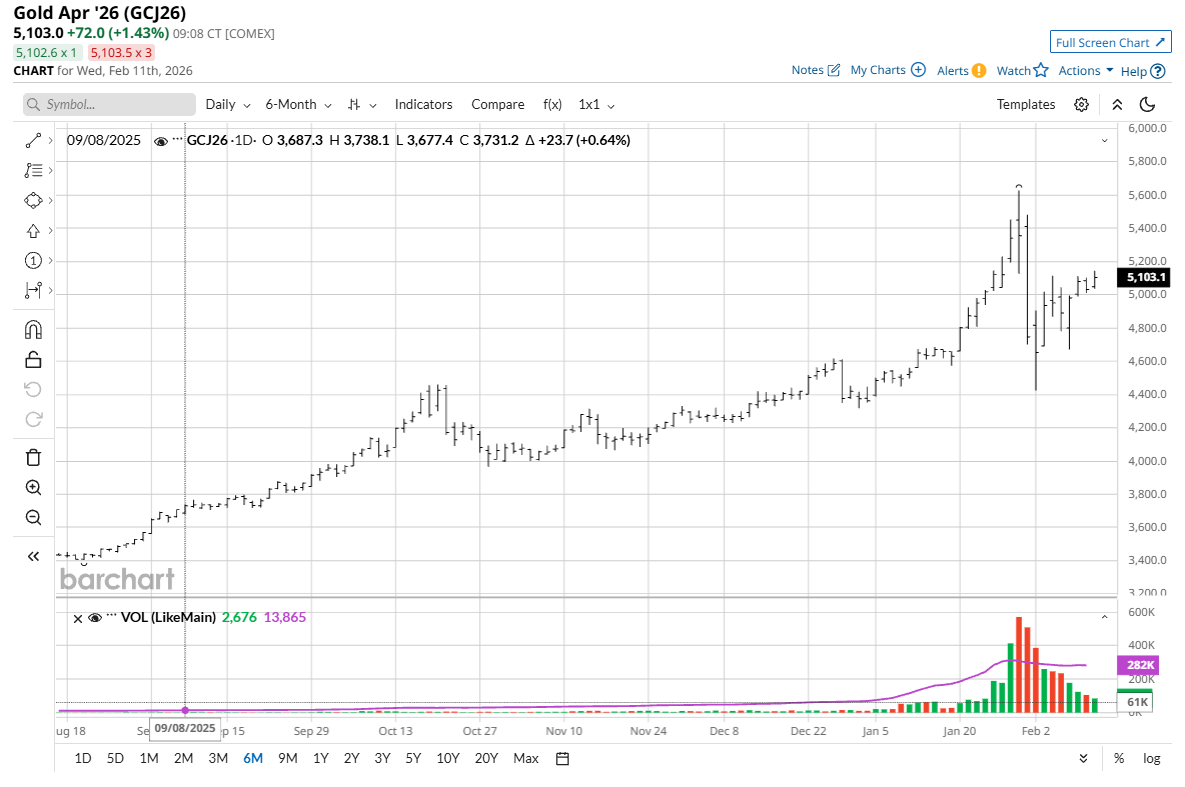

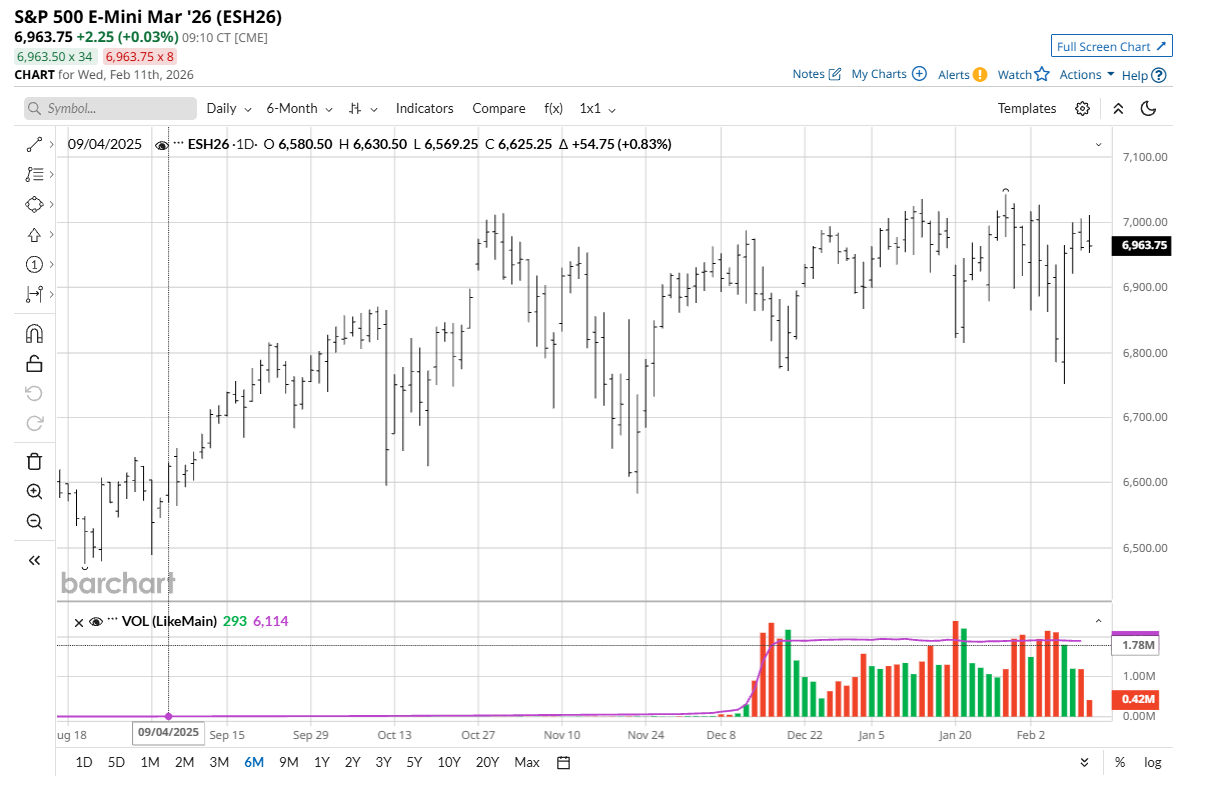

Surprisingly, gold (GCJ26) and silver (SIH26) futures markets held their solid overnight gains in the wake of the strong U.S. jobs report that pushed up U.S. Treasury yields and the U.S. dollar index ($DXY), while U.S. stock indexes rallied. Many in the marketplace would have reckoned a solid employment report would put price pressure on the precious metals, mainly due to notions that a strong U.S. economy would prevent the Federal Reserve from raising interest rates.

The marketplace is now reckoning the likelihood of a March U.S. interest rate cut by the Fed has dropped to less than 15%, with markets now expecting the Fed to maintain its 3.5%–3.75% Fed funds range, Bloomberg reports. Traders and investors are shifting to expectations of only two potential U.S. rate cuts later in the year, rather than immediate action, CNBC reported after today’s jobs report.

The surprising element for today’s post-jobs-data price action in gold and silver is that in late January, both metals plummeted due in part to President Donald Trump choosing a known U.S. monetary policy hawk — Kevin Warsh — as his nominee for chair of the Federal Reserve. Gold and silver prices saw record downdrafts in the aftermath of the Warsh news.

History shows a strong, but not absolute, inverse price relationship between U.S. Treasury yields, the U.S. dollar index, and the gold and silver markets. Rising Treasury yields and a strong greenback have historically been bearish for the metals. But not today.

What today’s price action in gold and silver markets suggests is that underlying supply and demand fundamentals — namely safe-haven demand, hoarding, and central bank buying of gold — remain firmly in place and are superseding notions of fewer U.S. interest rate cuts amid a stronger U.S. economy.

If the gold and silver futures markets can hold their solid gains into the close today (which is not at all a given as prices were well off their daily highs as of this writing), then the bulls would be more confident that the recent record highs can be at least challenged, if not overtaken.

Tell me what you think. I read every one of your emails. My email address is jim@jimwyckoff.com. I enjoy getting feedback from all of you, my valued Barchart readers.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)