The spectacular meltdowns in gold (GCJ26) and silver (SIH26) prices on Friday sent spooked commodity bulls to the sidelines. Grains futures traders could not help but keep their eyes glued to that day’s record-setting price downdrafts in gold and silver futures. Silver’s 26% plunge on Friday was the biggest on record, while gold dropped 9% in its worst day in more than a decade. Copper (HGH26) traders were already reeling after a sudden spike past $14,500 a ton that unraveled just as fast.

Grain futures markets this week will likely continue to be impacted more than normal, on a daily basis, by the goings on in the metals, as well as the stock and financial markets.

Following is a quick analysis of the grain futures markets.

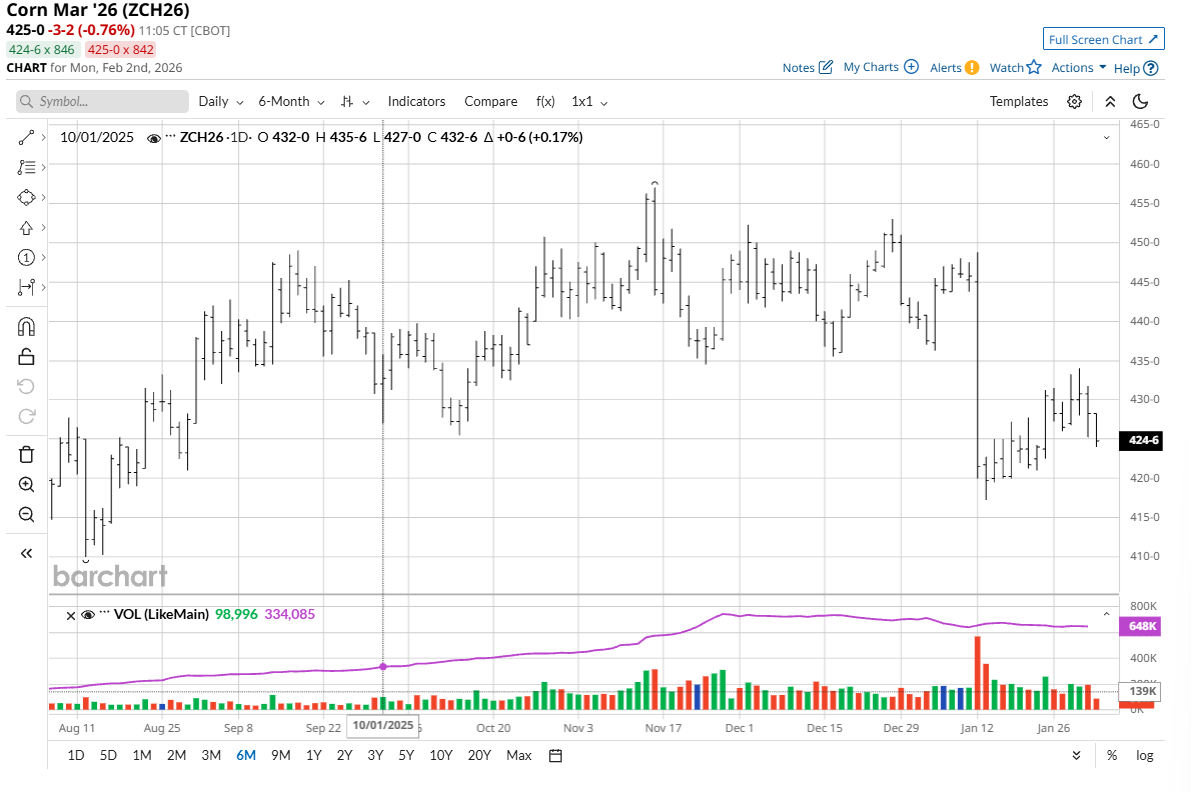

Corn Bulls Working to Keep Price Uptrend Alive

March corn (ZCH26) futures Friday saw a technically bearish weekly low close that suggests some follow-through, chart-based selling pressure is likely early this week.

Corn traders will continue to closely monitor growing conditions for South American crops. There are some dry pockets starting to develop in Argentina corn and soybean regions. Topsoil moisture is short in much of Argentina. President Donald Trump’s promise last week to deliver year-round E-15 gasoline was hardly met with lasting excitement, even as the U.S. dollar ($DXY) continued its prolific plunge and crude oil scored a six-month high.

Big U.S. corn stockpiles and technicals that still lean overall bearish will continue to limit a move higher without a catalyst.

As traders begin to look toward the 2026 crop, USDA’s late-March Prospective Plantings Report will be the next major market driver.

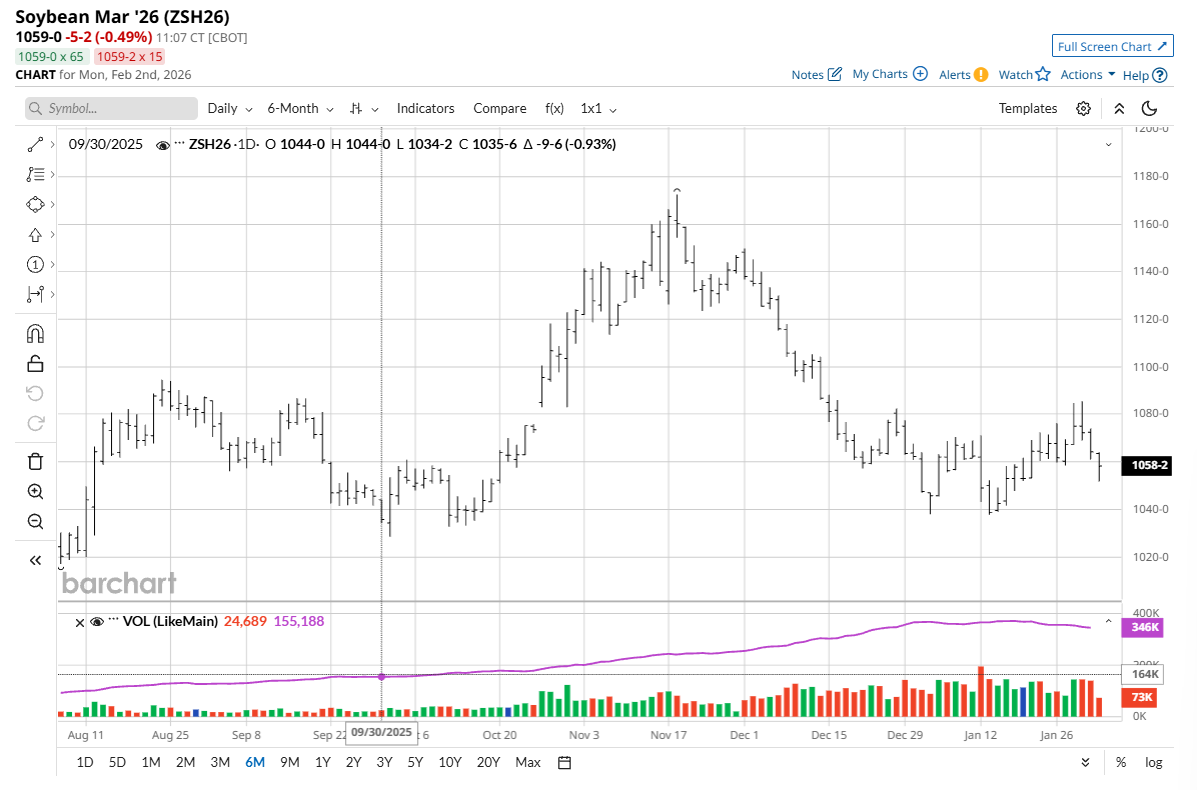

Soybean Bulls Fading and Need to Show Fresh Strength Soon

The low-range weekly closes on Friday in the soybean complex futures argue for some follow-through technical selling early this week. However, the grain markets bulls were blind-sided by the record-setting meltdowns in the gold and silver markets that sent shudders throughout the entire raw commodity futures sector. It’s likely the steep downdrafts in the metals markets will not last, which would allow grain and soy market traders to resume focus on their own supply and demand fundamentals this week.

Key for the soybean futures market is for the soybean meal (ZMH26) futures to start performing better. Soybean (ZSH26) traders need to keep an extra close eye on soybean meal in the near term.

The USDA was expected to report Monday afternoon that U.S. soybean crushers likely processed 6.914 million short tons, or 230.4 million bushels, of soybeans in December, according to analysts surveyed by Reuters. If that average of estimates is realized, the crush would be up 4.5% from the 220.5 million bushels crushed in November and up 5.9% from the December 2024 crush of 217.7 million bushels. It would also be the second largest monthly crush on record.

Reports last week said China has fulfilled, or is close to fulfilling, its commitment made last fall to purchase 12 million tons of U.S. soybeans. The reports said China is now looking to Brazil for beans. Harvest in Brazil continues to advance, with early yields proving strong.

The late-March USDA planting intentions report will be one of the most important USDA data points of the year.

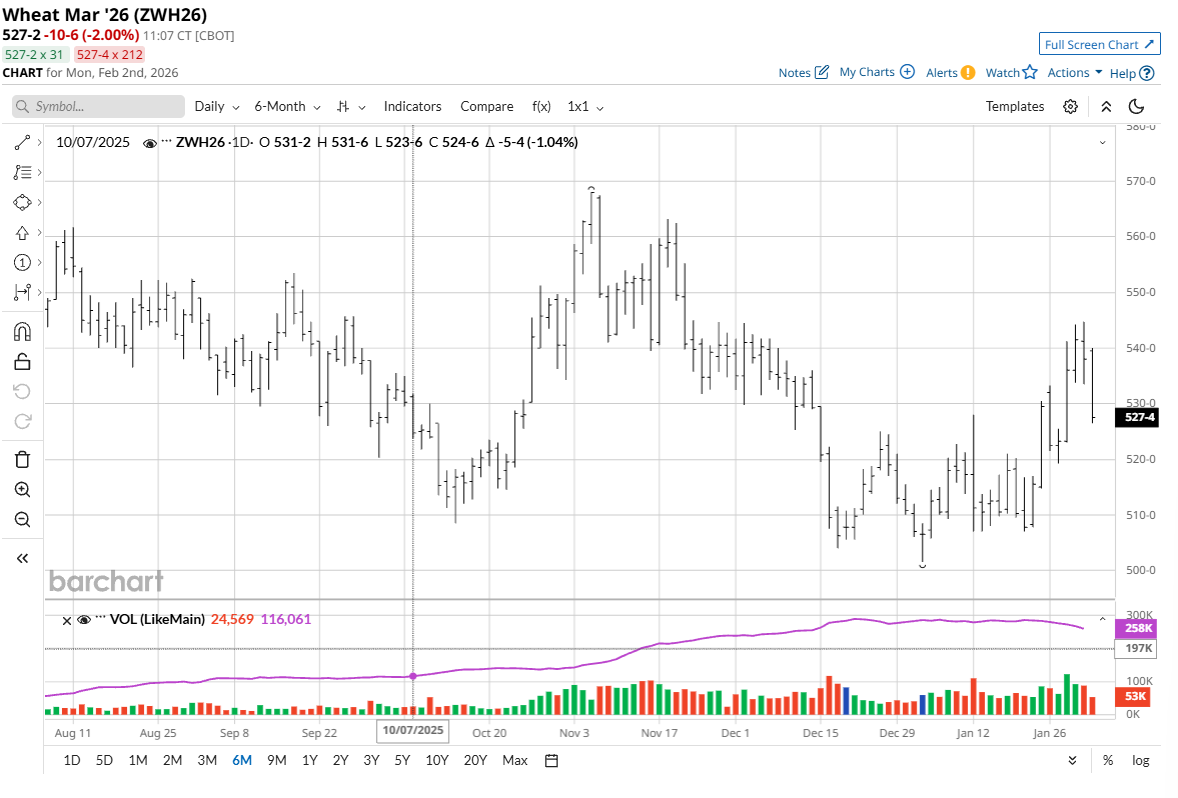

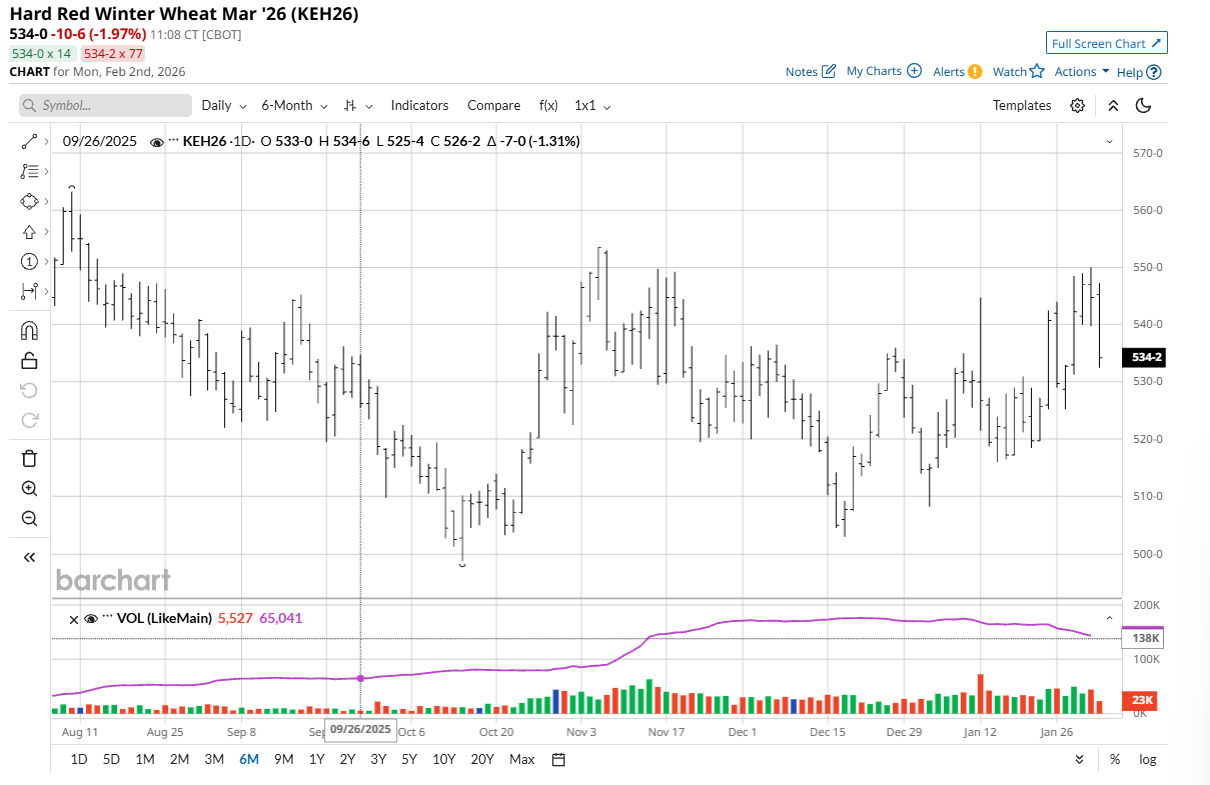

Winter Wheat Futures Bulls Still in Control

While the winter wheat (ZWH26) (KEH26) futures markets bulls on Friday ran for cover amid the record-setting meltdown in the gold and silver futures markets, the soft red winter (SRW) and hard red winter (HRW) bulls still have some technical momentum on their side.

In U.S. HRW country, weekend temperatures that were much colder than normal may have caused some winterkill of the wheat crops in eastern production areas.

The U.S. dollar index ($DXY) last week hit a four-year low. Trends in the currency markets tend to be stronger and longer-lasting than price trends in other markets. If so, a weaker greenback in the coming months is a bullish element for the U.S. wheat markets, making U.S. wheat more price-competitive on world trade markets.

I enjoy hearing from my Barchart readers all over the world. I try to respond to all your emails to me. My email address is jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)