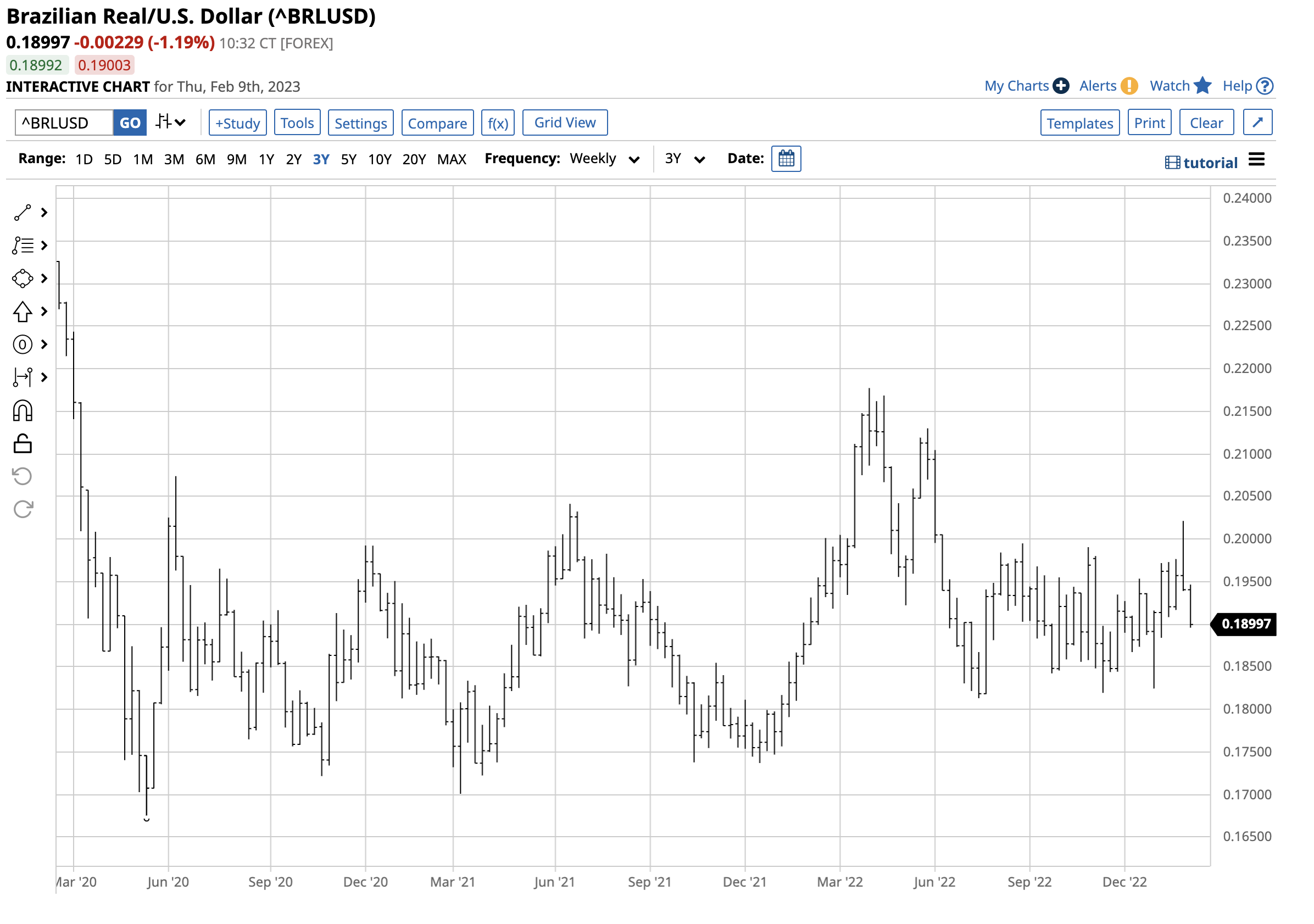

The currency relationship between the Brazilian real and the U.S. dollar is critical for soft commodity prices. In a December 29, 2022, Barchart article, I wrote, “Many issues face the Brazilian currency in the coming year. President Lula’s Democratic-Socialist ideology will impact the economy, but the government and populace remain divided as the election was close. However, rising worker wages could put upward pressure on commodity production costs. Moreover, the U.S. dollar has been trending lower since reaching a two-decade high in 2022. The fall in the dollar supports higher soft commodity prices. The highest inflation in decades continues to erode fiat currency values, leading to higher raw material prices.” On December 29, the U.S. dollar versus the real exchange range stood at $0.19077. On February 9, it had edged lower to just below $0.19000.

Brazil is the leading producer and exporter of Arabica coffee, free-market sugarcane, oranges, and a top cotton producer that trades on the Intercontinental Exchange (ICE) in the futures market. While the real has crawled marginally higher, coffee and cotton futures have moved slightly higher, while sugar and frozen concentrated orange juice futures have exploded higher, with the FCOJ rising to a new record peak and sugar to a multi-year high.

The real crawls higher- Brazil benefits from rising commodity prices

While the ICE futures use the U.S. dollar as a pricing benchmark for the four soft commodities, local production costs are in Brazilian real terms. When the real moves higher against the U.S. currency, it increases labor and other local input costs, pushing prices higher.

In March and April 2020, the global pandemic gripped markets across all asset classes, and many commodity prices fell to multi-year lows. Since then, the trend in the raw material markets has turned bullish.

The chart highlights the Brazilian real has made higher lows against the U.S. dollar since the March 2020 $0.16756 low.

The bullish price action in soft commodities could be a function of the rising real and supports the Brazilian currency’s value as it increases tax and corporate revenues.

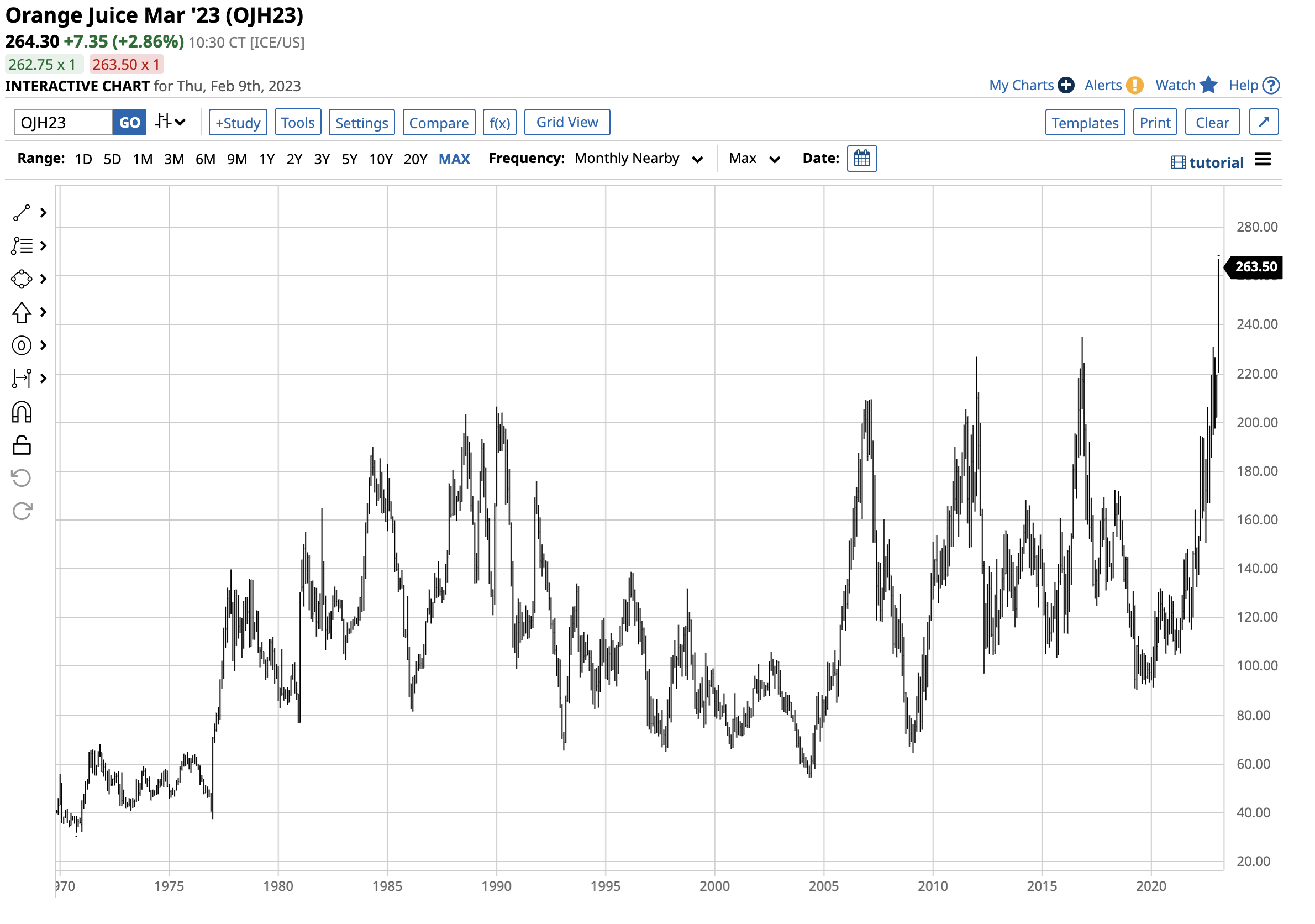

FCOJ explodes to the upside

In February 2023, frozen concentrated orange juice futures on ICE reached a milestone as they rose to a new record high.

The chart illustrates the explosive rally that took the price over the previous November 2016 $2.35 per pound all-time high. FCOJ futures reached $2.6695 and were over $2.60 on February 9. Brazil is the world’s leading producer and a top exporter.

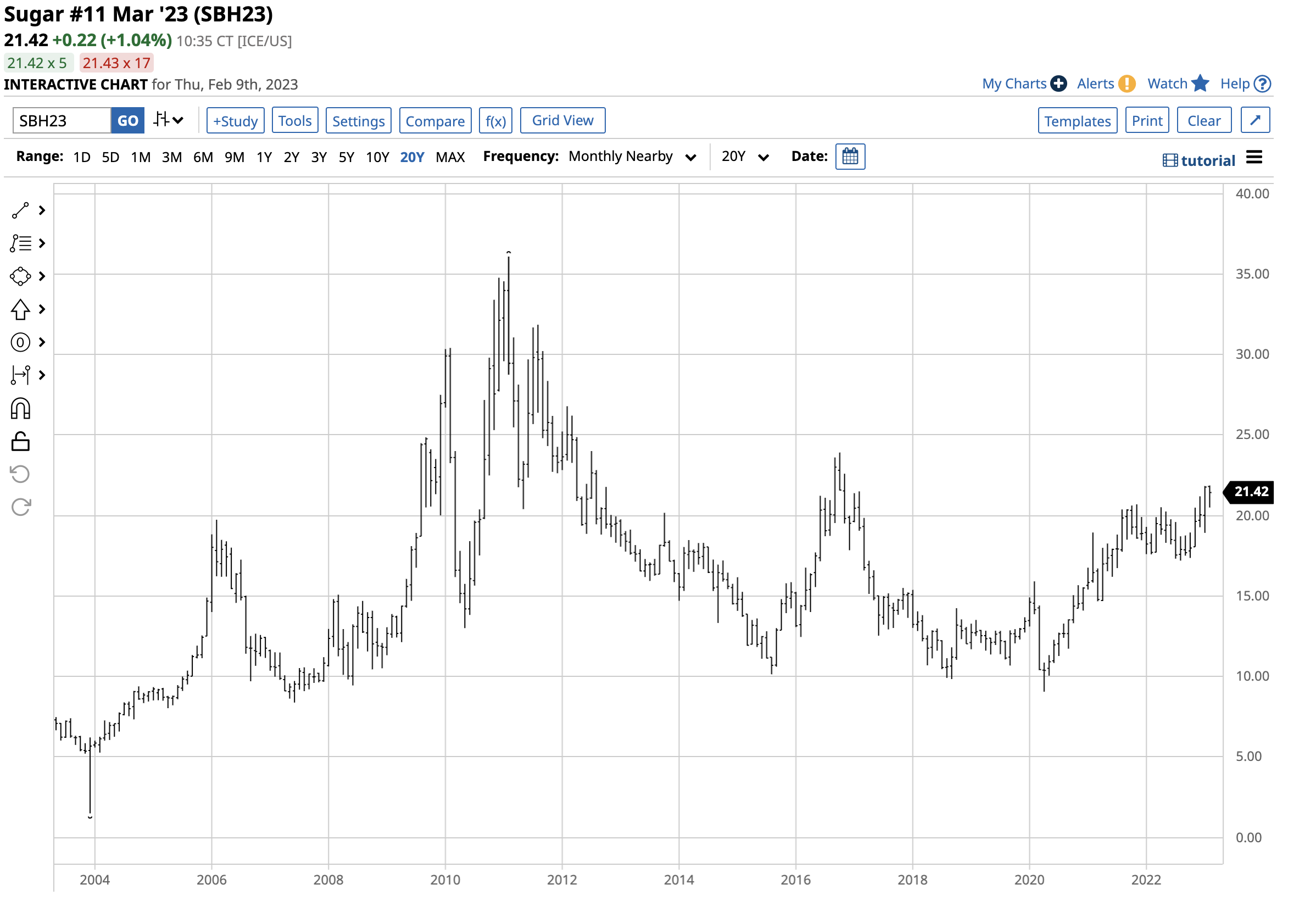

Sugar rallied to its highest price since 2016

While many countries worldwide subsidize beet and sugarcane production, Brazil leads the world in sugar production and exports, and Brazil produces sugarcane.

The chart illustrates the rise in world sugar prices that reached 21.86 cents per pound in February 2023, the highest price since November 2016. World sugar futures were trading over 201.40 cents per pound on February 9, 2023.

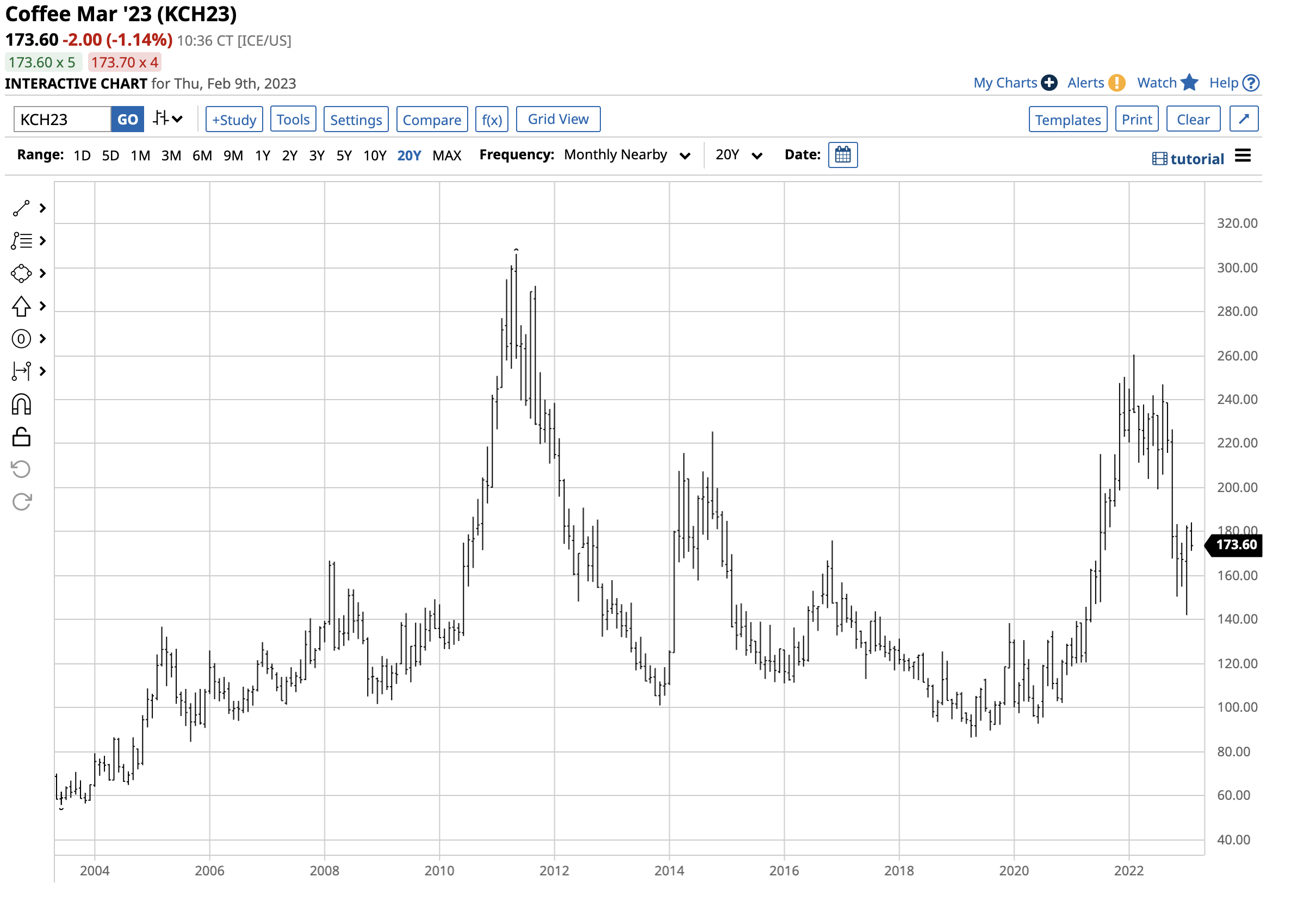

Coffee recovers to over the late December level, and cotton futures edge higher

Brazil leads the world in Arabica coffee bean production. After reaching a low of 86.35 cents per pound in April 2019, the lowest price since November 2004, the price took off on the upside.

The chart illustrates Arabica coffee bean futures rose to $2.6045 per pound in February 2022, the highest level since 2011. After correcting to $1.4205 per pound in January 2023, coffee futures were back above the $1.73 level on February 9.

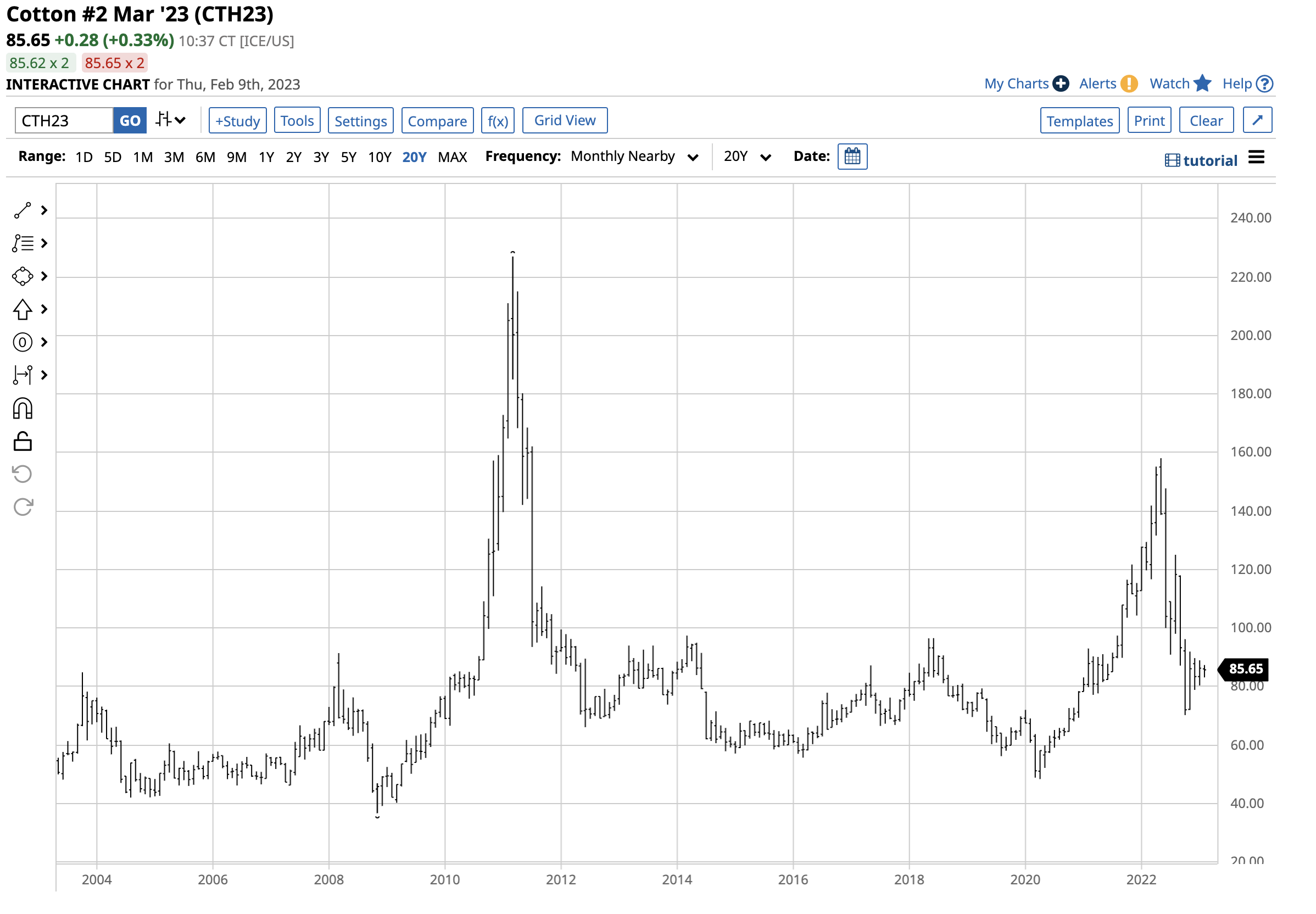

Brazil is the world’s fourth leading cotton producer and second to the United States in cotton exports.

The chart of ICE cotton futures shows a rise to $1.5802 in May 2022. After falling to a 70.21 cents per pound low in October 2022, the cotton market recovered to 85.65 cents on February 9.

The real is only one factor guiding soft commodity prices, but it can be very influential

Higher commodity prices are a chicken-and-egg situation for the Brazilian real. On the one hand, the slightly bullish trend in the real supports higher orange, sugar, coffee, and cotton prices as it increases production costs in the commodity that trade on the ICE futures exchange in U.S. dollar terms. A rising real makes it more expensive to produce these labor-intensive commodities as wages rise versus the dollar.

Meanwhile, rising soft commodity prices put upward pressure on the real as they increase tax revenues and profits, leading to GDP growth. The Brazilian real’s exchange rate against the U.S. dollar is a significant factor in the path of least resistance of soft commodity prices. However, Brazil’s weather and growing conditions are still the most important for determining prices.

Anyone trading soft commodities should keep an eye on the Brazilian currency’s value against the U.S. dollar.

More Softs News from Barchart

- Cotton Firm for Thursday

- Cotton Bounced into Close, Still Red on the Day

- Cocoa Prices Slightly Lower on West Africa Rain

- Sugar Follows Crude Prices Higher

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.