Markets reflect the economic and political landscapes. In Brazil, the leadership is shifting from a business-friendly capitalist leader to a democratic socialist President. Incoming President Lula was a trade unionist who defeated President Bolsonaro in the late-October runoff election.

The Brazilian real versus the U.S. dollar currency relationship has been sitting below the $0.20 level over the past years. The path of least resistance of the currency relationship could significantly impact soft commodity prices as Brazil is the world’s leading producer and exporter of free-market sugarcane, Arabica coffee beans, and oranges. Sugar, coffee, and FCOJ futures trade on the Intercontinental Exchange (ICE) with the U.S. dollar as the pricing currency. However, local production costs are in Brazilian real, making the soft commodity prices highly sensitive to currency changes between the U.S. and Brazilian foreign exchange instruments.

COVID-19 weighed on Brazil’s growth and cost the departing President the election

COVID-19 took a significant toll on Brazil as South America’s most populous country with the leading economy has been in the top five in the number of infections and second in fatalities.

The pandemic weighed heavily on Brazil’s economy and likely cost business-friendly President Jair Bolsonaro the late October runoff election against incoming President Lula. COVID-19 made it impossible for the outgoing leader to deliver on his promises for Brazil’s economy.

The real has been consolidating against the dollar with an upside bias

Brazil is a leading producer of many commodities, making it a global supermarket. The Brazilian currency, the real, reached a high of $0.6517 against the U.S. dollar in 2011, as many commodity prices reached peaks.

The long-term chart highlights the steady decline that created lower highs and lower lows in the real versus the U.S. dollar that took Brazil’s currency to a $0.16756 low in May 2020 as the pandemic gripped worldwide markets. Since then, the real has moved sideways with a slightly bullish bias.

The shorter-term chart illustrates the pattern of higher lows and highs in the foreign currency relationship since the May 2020 bottom. In 2022, the exchange rate was between $0.1747 and $0.21773. At just over the $0.1900 level on December 29, the real was below the midpoint of the 2022 trading range. However, the currency has been consolidating in a sideways pattern.

A rising real is bullish for soft commodity prices

Brazil is a significant factor for four of the five soft commodities on the Intercontinental Exchange. Brazil is the world’s top producer and exporter of sugar, coffee, oranges, and a significant cotton producer. The ICE futures contracts use the U.S. dollar as the benchmark pricing mechanism for soft commodities, but local production costs are a function of the value of Brazil’s currency, the real.

Therefore, when the value of the real rises against the U.S. dollar, it puts upward pressure on soft commodity prices. When the real declines against the U.S. currency, production costs decline, and soft commodity prices tend to fall.

The trends in sugar, coffee, OJ futures, and cotton are mostly higher

Soft commodity prices reached multi-year highs in 2022 even though the real remained within a trading range. The currency’s slightly bullish bias was another supportive factor for agricultural products.

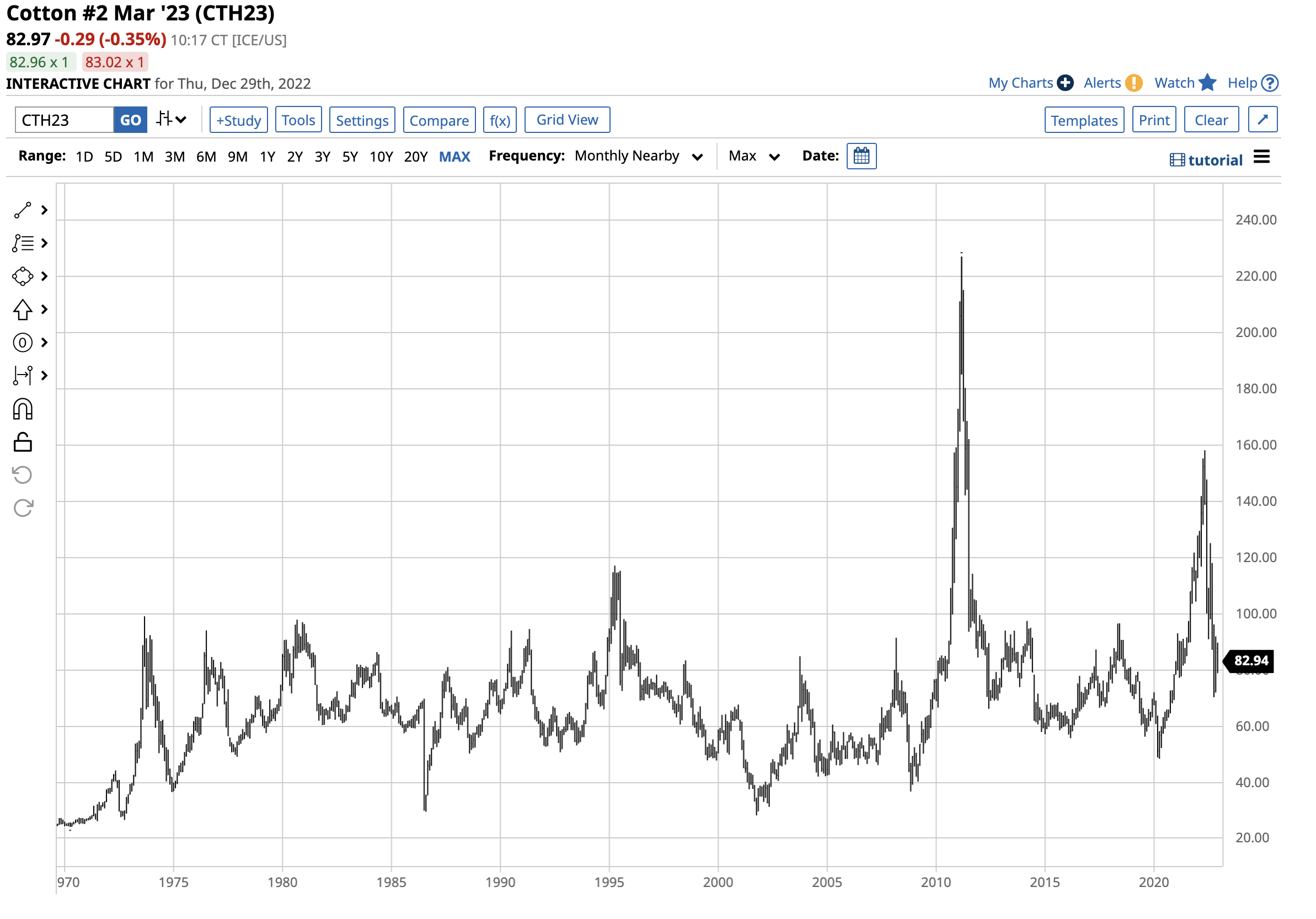

Brazil is the fourth-leading cotton-producing country.

Nearby cotton futures reached $1.5802 per pound in May 2022, the highest price since 2011, when cotton traded at a record $2.27 per pound peak.

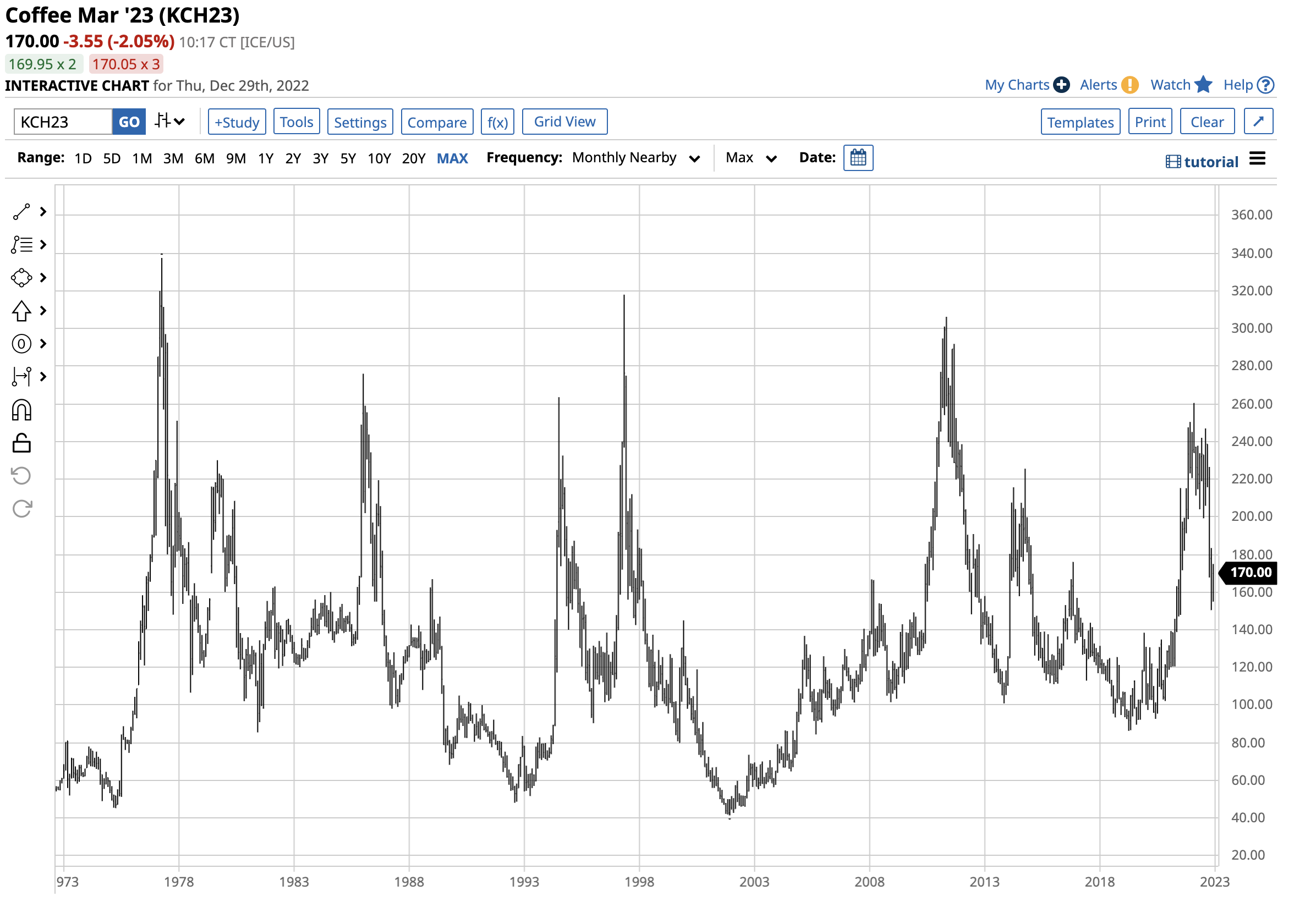

Nearby Arabica coffee futures rose to $2.6045 per pound in February 2022, the highest price since 2011, when coffee futures last traded above the $3 per pound level.

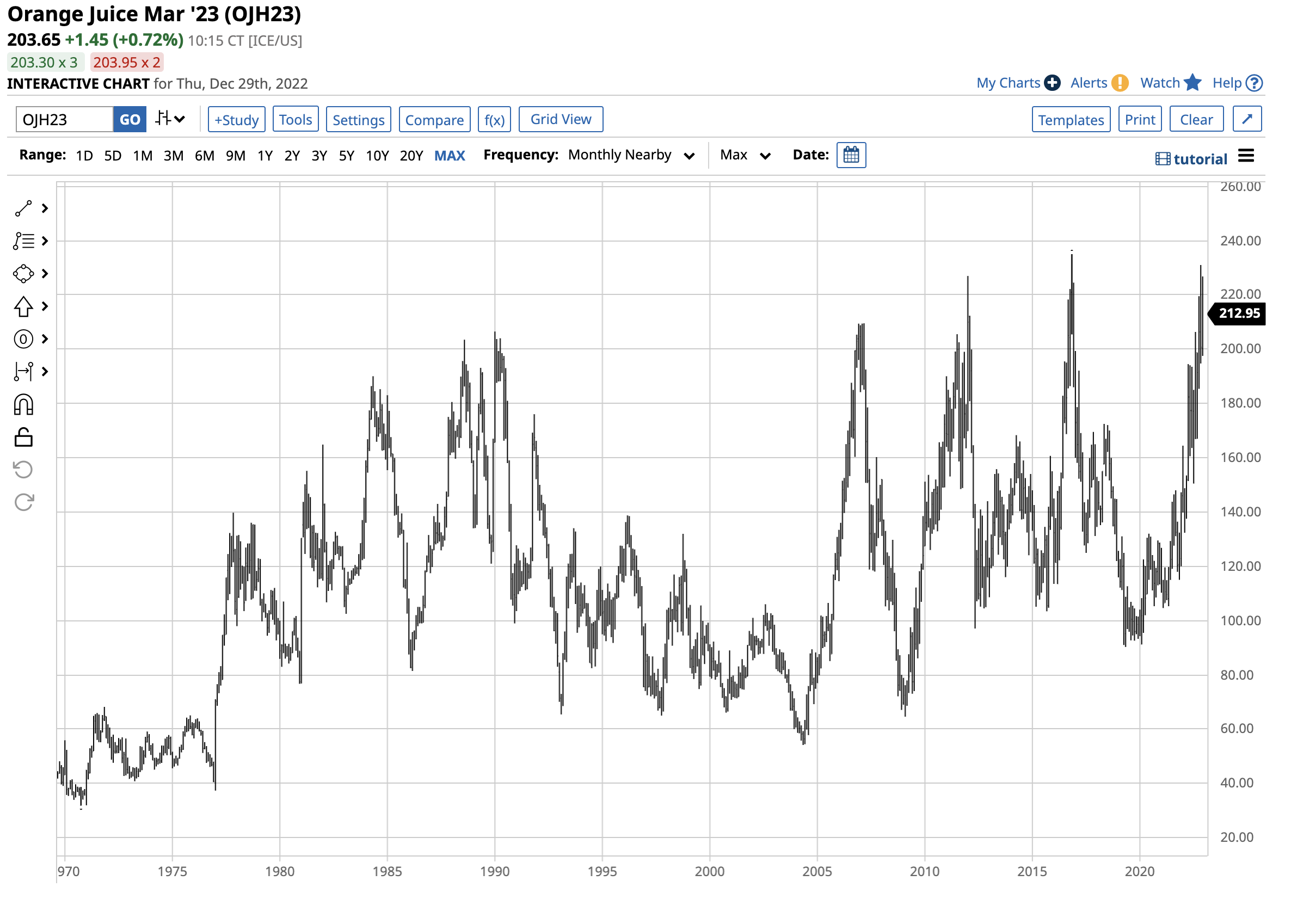

Frozen concentrated orange juice futures hit a $2.31 per pound high in November 2022, the highest price since November 2016 when FCOJ traded to its record $2.35 high.

The latest soft commodity to reach a multi-year peak was free-market sugar.

The chart shows the December 2022 21.18 cents per pound high was the highest sugar price since February 2017.

Soft commodities rallied for many reasons, but the weather in Brazil, crop diseases, and other specific crop factors are the primary driver of prices.

Levels to watch in the Brazilian real- An indicator for soft commodity prices in 2023

As we move into 2023, the Brazilian real’s level against the U.S. dollar could take the center of the stage if it moves out of the current trading range and breaks above the $0.21 level or below the $0.17 level.

Many issues face the Brazilian currency in the coming year. President Lula’s Democratic-Socialist ideology will impact the economy, but the government and populace remain divided as the election was close. However, rising worker wages could put upward pressure on commodity production costs. Moreover, the U.S. dollar has been trending lower since reaching a two-decade high in 2022. The fall in the dollar supports higher soft commodity prices. The highest inflation in decades continues to erode fiat currency values, leading to higher raw material prices.

Meanwhile, the weather is always the primary driving force for agricultural products. Soft commodities had a bullish year in 2022, and the medium-term trends remain mostly bullish as we head into the New Year. The softs have long histories of explosive and implosive price action. Fasten your seatbelts for what could be a wild year of price variance in the soft commodity sector.

More Softs News from Barchart

- Red Start for Wednesday Cotton

- Cotton Closes Off Lows on Wednesday

- NY Cocoa Erases Early Gains on Robust Ivory Coast Cocoa Supplies

- Sugar Prices Fall on Improved Global Sugar Supply Outlook

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)