- It seems everyone is on the same side of the boat when it comes to a US recession in 2023.

- By definition, a recession needs to see two consecutive quarters of GDP decrease while employment and investment fall simultaneously.

- The sticking point throughout 2022 was employment, a factor acknowledged by the US Federal Open Market Committee often.

We are only two trading days into the new year and I’ve already come up with at least a half-dozen topics to discuss. The problem is as soon as I start typing away something new pops up and sends markets careening off in a different direction. Given this, I’m going to return to the original theme from this past Monday before all Hades broke loose in the markets. As I read through the news over this past weekend, one word popped up more than any other. In fact, one article send it was the only word on the mind of traders worldwide as 2023 got under way. That word, my friends, is “Recession”.

This afternoon, just before I started putting electronic to imaginary computer paper, an email came in asking the question point-blank, “So I’m clear, you don’t think there will be a recession?” Frankly, I don’t know. But nobody else does either, with the cacophony of voices squawking that lone word all just guessing at this point. In the past I’ve taken great pride to point out I am not an economist, nor do I play one on tv. But I know a lot of economists and the one defining trait is everything has to fit into a well-defined box. Therefore, let’s revisit with a definition of a recession is: In non-economist terms, a recession is “a significant decline in economic activity lasting more than a few months. It is generally considered to occur when gross domestic product (GDP), employment, and investment all fall simultaneously.”

Let’s take this apart step by step: Did the US see two consecutive quarters of negative GDP, an indicator of a recession? Yes, with both Q1 and Q2 showed decreases before the Q3 GDP increased at an annual rate of 3.2%. Did investments fall? Yes, as I’ve talked about for the last year all three major US stock indexes, as well as a number of global equity markets, all had a rough 2022. The S&P 500 ($INX) lost as much as 27% from its January 2022 high of 4,818.62 through the October low of 3,491.58. At the same time, the Dow Jones Industrial Average ($DOWI) dropped 22%, and the Nasdaq ($NASX) fell 38% from its November 2021 high.

The problem all those arguing for a recession face is the situation has changed. As I said, Q3 GDP showed an increase. Furthermore, all three US stock indexes posted bullish technical patterns on their respective monthly charts indicating long-term trends had turned up this past October. If so, investment won’t be falling buy climbing once again. It’s the third factor, though, that has not fit the clean definition of recession – Employment.

We’ll get our next round of employment numbers this coming Friday, with one set of industry estimates showing nonfarm payrolls increased during December by 200,000, leaving the US unemployment rate at 3.7%. Employment has been a thorn in the side of the US Fed as well, with a CNBC piece posted after the release of the December FOMC minutes stating, “…the labor market, a critical target of the rate increases, has been resilient. Nonfarm payroll has exceeded expectations for most of the past year, and data earlier Wednesday showed the number of job openings is still nearly twice the pool of available workers.” Without a drop in employment, can there technically be a recession? Particularly if the other two key factors are starting to change?

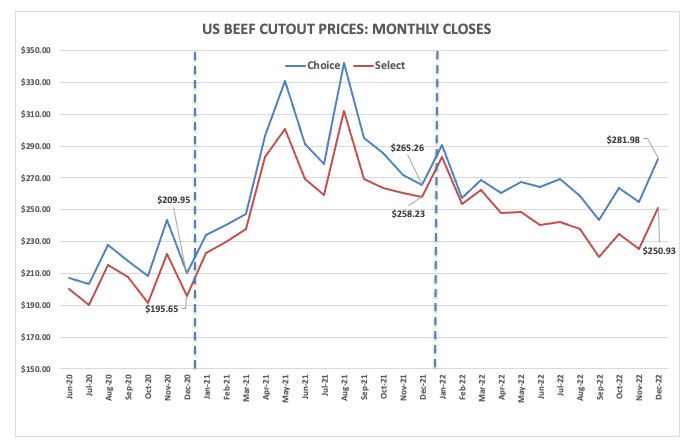

Again, I am not an economist, so I look at things differently. One of the key economic indicators I use is the boxed beef market. At the end of December, the choice market was reportedly priced at $281.98, up $27.10 for the month and $16.72 for the year. Similarly, select was reportedly priced at $250.93, up $25.92 for the month but down $7.30 for the year. My theory is boxed beef shows how willing US consumers are to allocate some of their discretionary income to high priced food items like beef. If the economy is tightening, it is unlikely boxed beef would be jumping higher to close out the year. Some will say the gains are due to increased exports, and the US was projected to export 120 million pounds (mp) more in 2022 than 2021, but domestic demand has also stayed strong given total supplies were estimated to be 459 mp larger this year than last.

To answer the question, then, no I do not think the US is moving into recession. I’m looking for employment to stay strong in 2023, investment to return to the equity markets, leaving the GDP to flop around as it likes to do. In my opinion the focus all along has been on the wrong “R” word in regard to global economics. The discussion since last February should’ve been about – Russia.

Next time.

More Stock Market News from Barchart

- Stocks Finish Higher on Positive Global News and Lower Bond Yields

- Unusual Options Activity With Archer-Daniels Midland Shows Income Play

- 3 Reasons Jeff Bezos Should NOT Return as Amazon CEO

- Apple Losing Some of its Safe-Haven Luster

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.