- From a technical point of view the 3 major US stock markets indexes established long-term bearish reversal patterns at the end of January, before momentum took them to bearish closes at the end of February.

- Stock indexes are not the economy (I can't stress that enough, regardless of what some think), and economists will continue to argue about all the factors that do or don't point to a recession.

- Investors looking to reallocate money will be closely studying fundamentals of not only stocks, growth and/or value, but also commodities.

As some of you might recall from previous stories, I have a dictionary that has been on my desk since high school graduation, a book that has been invaluable to me and a great source of bewilderment for my kids growing up. “Why don’t you just look it up on the internet?” Over the years I’ve heard that question nearly as many times as, “It’s not good, but it’s the best statistics we have, and they are free, so we might as well use them…” But that’s a subject for another day. Or not, because I’m tired of talking about it. But back to the dictionary: I still use the book every time I write something. Every time. I don’t know why. Maybe it’s a security blanket. Goodness knows there are words used to today that aren’t in my dictionary (e.g. covfefe). Nevertheless, here we are, and the first thing I did was look up another word.

‘Recess’ is defined as “A temporary cessation of the customary activities of an engagement, occupation, or pursuit.” As we think about US stock market indexes, there is a lot to keep in mind, starting with Newsom’s Market Rules:

- Rule #1: Don’t get crossways with the trend.

- My version of Newton’s First Rule of Motion applied to Markets: A trending market will stay in that trend until acted upon by an outside force, with that outside force usually investment money.

- Rule #7: Stock markets go up over time.

- This coming from someone who started in this industry trading during October 1987, also known as the Black Monday stock market crash.

This past January saw all three major US stock market indexes post bearish technical reversal patterns on their respective long-term monthly charts, telling us major trends had turned down. Given this technical reading, and applying previously mentioned Market Rules, has this selloff seen since the end of January been a buying opportunity (Rule #7) or a chance to reallocate money out of stocks and into something more fundamentally sound (Newsom’s Rule #6: Fundamentals win in the end) like any in a long list of commodities with inverted forward curves?

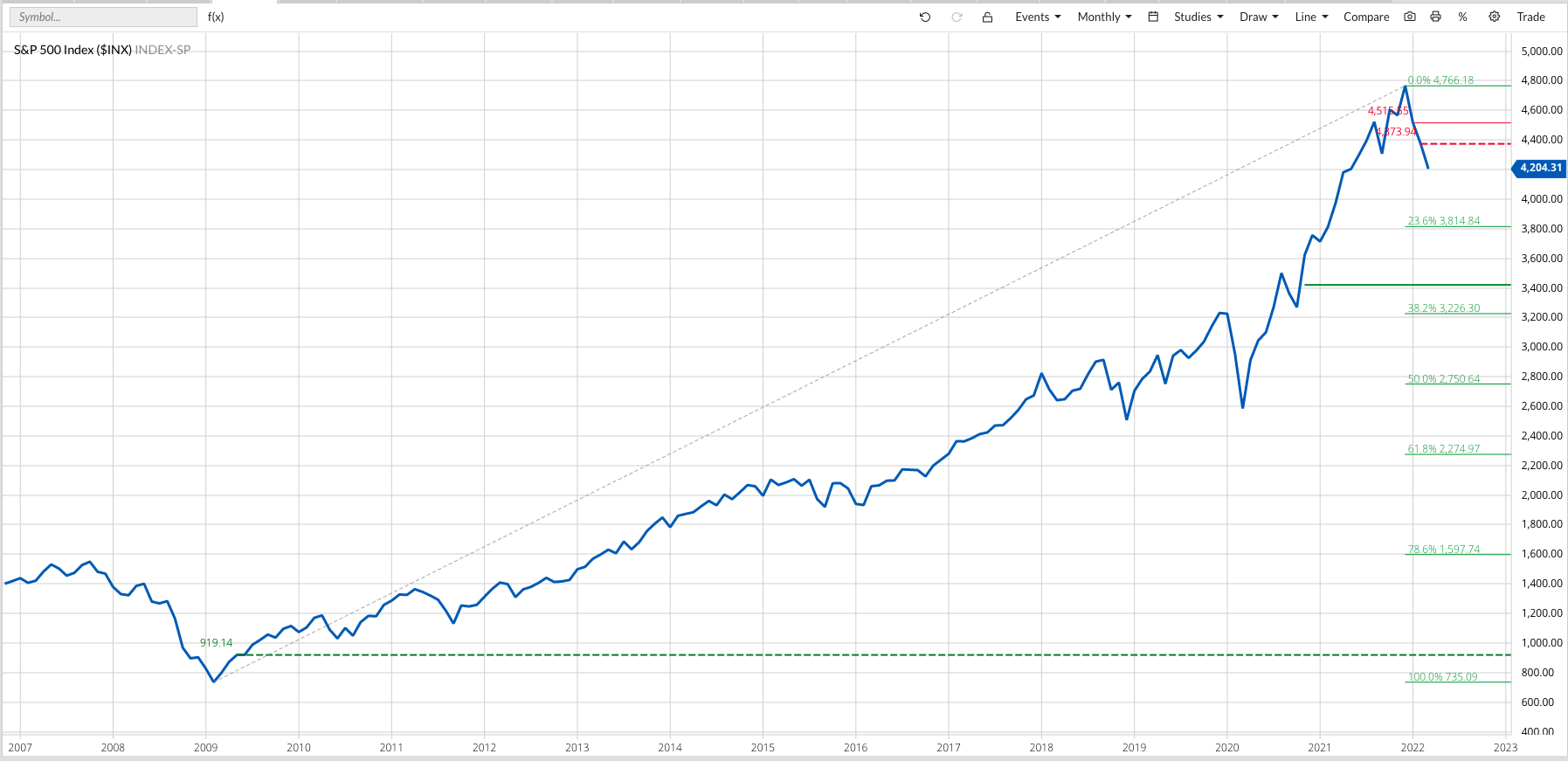

The subject came up again recently as I visited with a gentleman in the financial planning industry. To him the downturn is a buying opportunity, a standard line of thought from what I know about the business in general, viewing the ongoing selloff as nothing more than ess of the never-ending bullish times. He was quickly flipping through standard slides as we talked, flashing by one that looked familiar to me, a price chart for the S&P 500 ($INX). I asked him to set aside the corporate pitch, take a look at the chart, and tell me what he saw. Yes, the S&P 500 still had room to go down. Maybe substantially. We agreed.

‘Recession’ is defined as “A moderate and temporary decline in economic activity.” Since that meeting, I’ve heard a lot of chatter about double-digit interest rate increases (times, not the actual interest rates) by the US Federal Reserve and a coming recession. If we apply Dow Theory, looking at monthly closes only, and the 4-Month Rule (my interpretation of the Four-Week Rule), then a major downtrend was confirmed by the February close of the S&P 500 taking out its previous 4-month low monthly close of 4,373.94. This ended the previous uptrend that began with a new 4-month high monthly close of 919.14 at the end of May 2009. Therefore, the S&P seems destined for continued pressure, with a 33% retracement target (based on monthly closes only) down near 3,422.00.

From a fundamental point of view (again, Rule #6), other than commodities, what would I be looking at if reallocating investments? Given most stocks are overvalued, it’s hard to find the undervalued needle in the haystack of value stocks, so I’d look at growth. Sure, these stocks are likely too high-priced as well, but some of the industries look to have staying power. A few that come to mind are:

- Electric vehicles (The world has again shown its vulnerability to petroleum energy)

- Construction (Infrastructure everywhere, except maybe China, seems to be crumbling)

- and Poultry companies (Inflation is leading to increased demand for lower priced protein, though this could be a short-term or ‘transitory’ play).

‘Transitory’ is defined as “Existing only briefly, short-lived.”