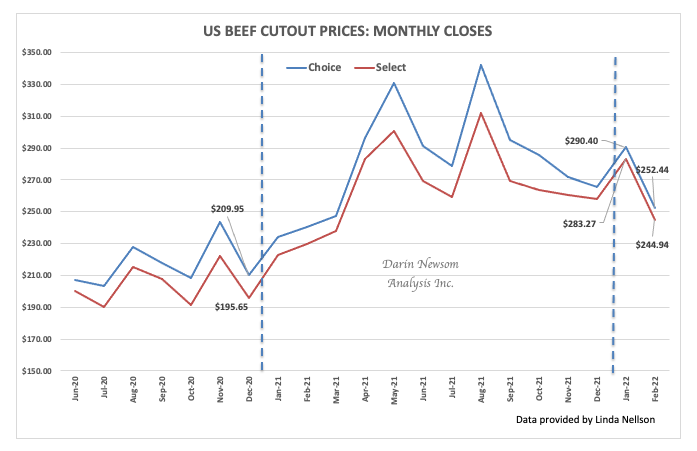

- Beef cutout markets showed a sizable drop Tuesday afternoon, extending the selloff in the market that has been in place since August 2021.

- Based on what the cutout markets did during February, I'm looking for the monthly consumer price index to be higher than expected Thursday morning.

- Additionally, the weakening beef cutout markets add to the bearish supply and demand picture for live cattle in general.

One of the markets that jumped out at me early Wednesday morning was beef cutouts. Tuesday afternoon reportedly saw choice come in at $252.44, down $2.27 from Monday while select was quoted at $244.94, $5.28 lower than the previous day. Those are some solid hits, not only adding to the break seen since the end of August highs of $342.11 and $312.03 respectively but dropping to levels not seen in nearly a year. The last time the cutout markets were this low was back on April 1, 2021 – no fooling. During February alone both cutout markets lost roughly $38 from the end of January.

Recall from previous discussions my view is the beef cutout market is as good an economic indicator as any other used. Keep this in mind with the February consumer price index (CPI) numbers set for release Thursday morning, with the CPI (including energy and food) expected to be 0.7% as compared to last month’s 0.6%, while the Core CPI (excluding energy and food) has a median forecast of 0.6%, unchanged from last month. Given what was seen in markets during February, and based on the drop in beef cutouts markets, I’m expecting the CPI to come in higher than 0.7%. How does all this fit together? As the CPI continues to move higher, which it should, US discretionary income gets less. And when that happens, spending on high dollar items tends to decrease, items like, as a good friend of mine asked, “$18.99 ribeyes?”.

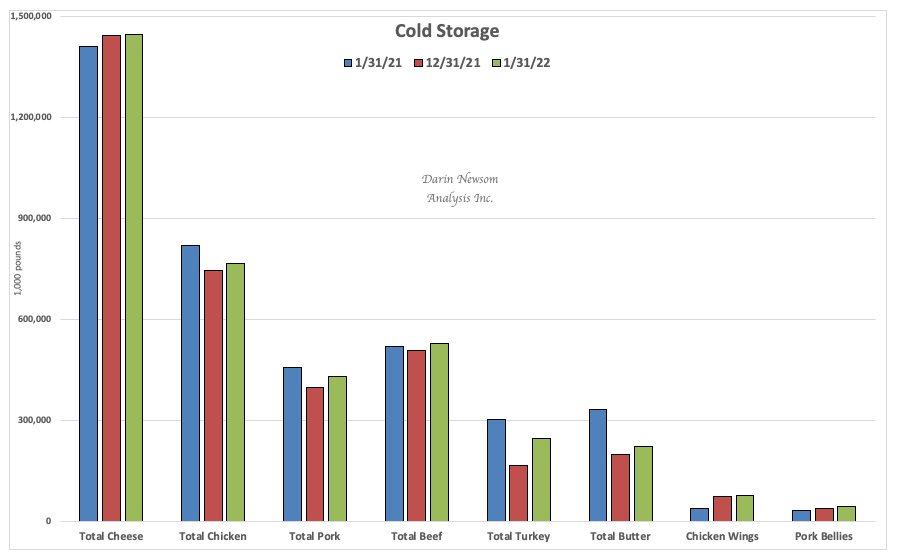

Yes. I think the higher cuts of meat will be trimmed from the budget. Where might the dollars go instead? Will folks be buying impossible burgers and other imitation meat products? Well, if the stock price of Beyond Meat (BYND) is any indication, my answer is still “no”. It’s interesting to go back to my piece from late October 2021 and look at what BYND has done, overshooting my downside target on its monthly chart. This says market fundamentals are more bearish than earlier projected. On the other hand, talking to a chicken processor on the East Coast, one of the largest in the industry, I’ve learned they can’t kill chickens fast enough to meet demand. This tells us discretionary dollars in the US are going toward cheaper proteins, less expensive cuts of meat like real hamburger and chicken. We can also see signs of this in the latest Cold Storage report from USDA, as of February 1, 2022. On the beef side, despite a 5% decrease in marketings during January frozen stocks increased by 4% from the previous month and 1% from the previous year.

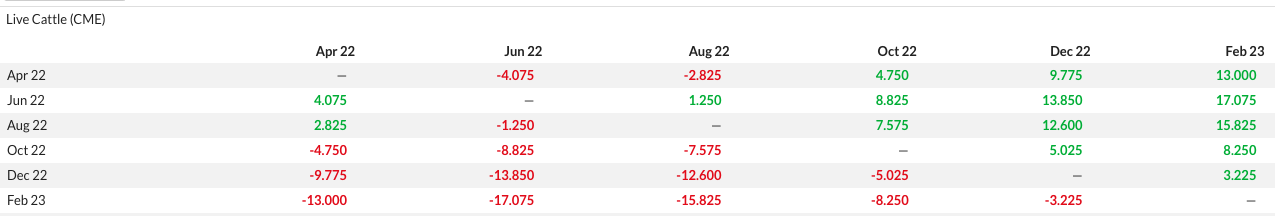

Everything is telling us demand for beef, particularly higher priced cuts, is coming down while supplies continue to go up. How do we know this about supplies? Futures spreads. They have been bearish for a year or more and are bearish at least out through the Dec22-Feb23 spread. As of Wednesday morning, the June live cattle futures contract is priced near $134.50, with the cash market reportedly near $137 or $138. Given all, we know about the market, it seem logical the cash market should continue to weaken over the weeks and months ahead.