- Friday saw the release of the Bureau of Labor Statistics January jobs data, and hilarity ensued.

- Not only did those making guesses on this silliness miss badly, again, previous months saw ridiculously large revisions while the Secretary of Labor defiantly stated, “I stand by these numbers…”

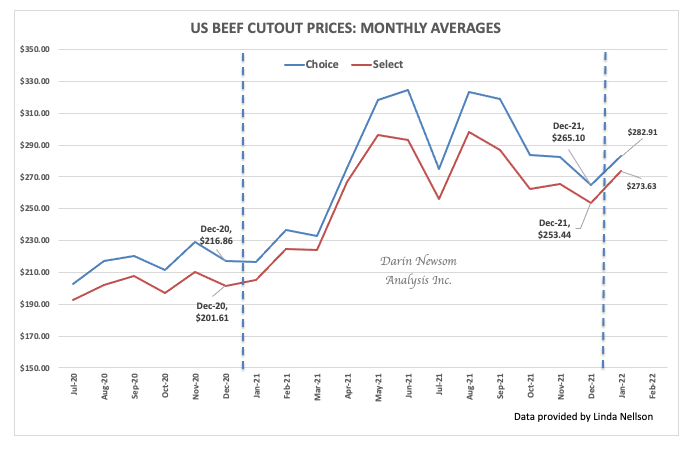

- If we want a more reliable read on the US economy, we can track the beef cutout market.

Researching today’s piece, I was reminded that “Brown Cow” was an 18th century description for a barrel of beer. Given that, someone who just polished off one before slurring, “Let’s have another Brown Cow!” was likely understood to say, “How now brown cow…” This is all quite fitting for how I imagine Friday morning has gone for those silly enough to play pin-the-tail-on-the-cow (or donkey) by making guesses on the US Bureau of Labor Statistics monthly nonfarm payroll numbers. One average pre-release guess I saw was a gain of 150,000. When the envelope was unsealed and the number read to the waiting throng, it came in at 467,000. I was laughing so hard I almost spit coffee on my computer again.

But as the saying goes in the world of infomercials, “But wait…There’s more!”, for the dismal December figure of 199,000 was revised to 510,000 while the neutral November number of 249,000 was raised to 647,000. I said it the last couple months, and I’ll say it again, somewhere along the line I missed the memo the Bureau of Labor Statistics had been put under control of USDA. The whole situation became even more humorous when the Secretary of Labor made an appearance on CNBC to say, “I stand by these numbers.” My question would be which set? The numbers we see today or the revisions we will see tomorrow?

Of course markets reacted, why I don’t know, with the chatter quickly turning to a much stronger than expected economy setting the stage for the US Federal Reserve to be more aggressive with its interest rate hikes. As I type this out, the US dollar index ($DXY) has eased back from its spike high of 95.70 to sit at 95.45, up 0.10 for the day. Meanwhile, the yield on the US 10-year Treasury note climbed to about 1.94% and was holding near that level at midday. US stock market indexes had quieted, settling into a mixed pattern waiting for the last half-hour of the day.

The interesting thing is these silly games are completely unnecessary. If we want a better read on the US economy, look for markets that perform that function without all the chaos. One I track is the beef cutout markets, on the idea when the US economy is improving and consumers have more disposable income, they are more willing to spend money on higher cuts of beef. On the other hand, when times get tight, so do the purse strings and beef cutout markets start to come down. As this chart of average monthly prices shows (data provided by my friend Linda Nellson), cutout prices have been in decline since August 2021, though did tick up during January. This tells us things were a bit better to start 2022, but there is a possibility we could see the economy start to slow further due to inflation. Hourly earnings were reportedly 5.7% higher for the year, while consumer prices reportedly increased 7.0% for the year ending December 31, 2021. This again is reflected in the decreasing beef market over the last quarter of the year.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)