Johnson and Johnson (JNJ) stock was up 3.26% last year and closed the year at $176.65, up from $171.05 at the end of 2021. The pharmaceutical firm will spin off its consumer group in mid-2023, as I discussed in my article in early Dec. 2022. Now, it is attractive to investors who short its out-of-the-money (OTM) options.

I discussed shorting its put options for the period ending Jan. 6 in the article. At the time, the put premium was 71 cents for the $170 strike price puts. Since the stock is still well above that price, it looks like that was a profitable short, since there is still no intrinsic value. In fact, as of Friday, Dec. 30, the puts were trading for just 18 cents.

In other words, the option premium has fallen from $0.71 to $0.18, giving the investor an unrealized gain of about 75% of the full premium shorted on Dec. 4, when we published the Barchart article. At the time, the immediate yield was 0.418% or 5.0% on an annualized basis.

Roll Over the January Short Put Trade

As a result, investors can probably close that short trade out sometime this week. Since there is no intrinsic value the premium is likely to continue to degrade, providing further unrealized profits. At some point, the short put investor will put in a “buy to close” order. Then the investor can use the same cash or margin that supported the December short for a rollover into a Feb. 2023 short trade.

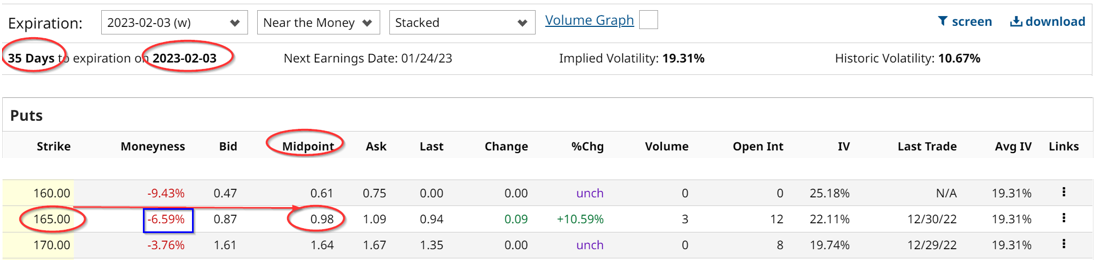

For example, the Feb. 3, puts at the $170 strike price now trade for $1.64. To be even more conservative, the investor might want to short the next lower OTM puts at $165.00. These are trading for 98 cents, providing an even higher yield of 0.594%or 7.12% annualized.

Moreover, the investor gains the advantage of having a short put that is 6.59% below today's price. That means the stock will have to fall further than the put trade last month. Moreover, the breakeven price is at $164.02 (i.e., $165.00-$0.98), or 7.15% below the $176.65 price from Dec. 30.

Keep in mind that the investor who shorts these puts cannot make an unrealized gain even though they have to put up $16,500 in cash or margin at the $165.00 put strike price. As a result, some investors, willing to take on more risk, short covered OTM covered calls.

For example, the $195.00 calls expiring Feb. 3, 2023, which is over 10% above today's price still have a premium of 15 cents. That represents an additional 8 basis points of income on top of the 59.4 basis points of income from shorting $170 strike price puts.

This shows why value investors are attracted to JNJ stock, given how stable the stock has shown itself to be over the past year.

More Stock Market News from Barchart

- Value Buyers are Watching Google Stock for a Rebound in January

- Fed Meeting Minutes, OPEC and Other Key Themes To Watch This Week

- Netflix Options Have High Implied Volatility Providing Income Plays

- Stocks End the Year on a Weak Note as Global Bond Yields Rise

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.