Johnson and Johnson (JNJ) stock is rising ahead of the spinoff of its consumer health division next year. Its consistent dividend, buybacks, and free cash flow make JNF stock attractive to value buyers.

So far this year, the stock is up 4.3% to $178.88 as of Friday, Dec. 2, most of which has occurred in the last month. Moreover, the stock is still reasonably cheap with a 17.8x forward price-to-earnings (P/E) multiple and a 2.53% dividend yield.

Sparkling Fundamentals and Free Cash Flow

One reason could be that the company produces large amounts of free cash flow (FCF). For example, in Q3 alone its 3 major divisions produced $6.284 billion in operating cash flow. After deducting $952 million in capex spending, its FCF was $5.33 billion. That works out to an amazing 22.4% of its $23.79 billion in quarterly sales during Q3. That also implies that FCF could hit also $22 billion next year based on analysts' forecasts of $97.57 billion in sales in 2023.

That means its FCF yield is about 4.68% annually, which makes the stock very valuable. Most companies generating FCF margin will trade at an FCF yield that is at 3.0% or better. This FCF also allows the company to consistently raise its dividend, as it has done for the past 60 years. Moreover, in the last year, JNJ has bought back over $11 billion of its shares this year, including $2.1 billion in Q3 as well, and another $5 billion planned.

Spinoff Planed for its Consumer Division

Johnson and Johnson's management plans to spin off, either as a dividend or a split-off, its consumer division as an independent company and stock, to be renamed Kenvue. That won't happen until sometime in mid-to-late 2023, based on the company's recent guidance during its Q3 conference call. Kenvue will include its iconic brands, such as Band-Aid, Listerine, and Tylenol.

This can act as a chance to buy the stock cheaply, just as the recent spin-off by AT&T of its Time Warner division pushed T stock down earlier this year. JNJ stock could take a similar hit leading up to the separation, depending on the details of the separation, which still have not been clarified.

As a result, JNJ stock could look interesting to value buyers over the next year. One way to play this is to short out-of-the-money put options, assuming the stock could become more attractive.

Shorting JNJ Put Options for Income

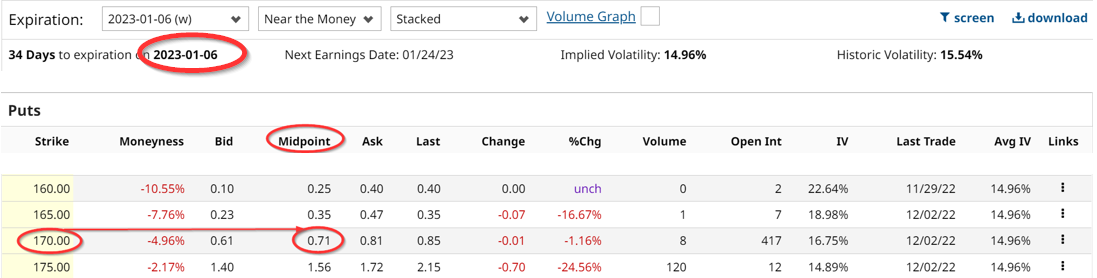

One way to play this potential event is to start shorting out-of-the-money (OTM) put options each month for income, leading up to the spin-off event. For example, if you look at the Jan. 6, 2023, put premiums, the $170.00 strike price puts trade for 71 cents at the midpoint price.

That means that the investor who puts $16,000 worth of cash or margin or both with his brokerage firm, can sell the $170 put and immediately receive $71.00. That is an attractive yield of 0.417% earning immediately.

Moreover, unless JNJ stock falls by over $8.71 (i.e., $178.88-$170+0.71), by Jan. 3, to $169.29, the investor will have a profit. Even if it does fall to $170.00 or lower, the investor automatically buys JNJ stock at a 5% discount from today's price.

In addition, if the investor does this monthly for the next year without any exercise he makes an annual return of 5%. That is even better than owning the stock which has an annual yield of 2.53%.

More Stock Market News from Barchart

- Friday's Last Call, Lots of Markets to Talk About

- Stocks Recover Most of Their Losses as Bond Yields Erase an Early Surge

- Chinese Tech Stock Sentiment Improves with Fewer Covid Restrictions

- Stocks Fall as Labor Market Strength Keeps an Aggressive Fed in Play