The Dogs of the Dow is a long standing wall street strategy for investing in the stock market that involves purchasing the 10 highest yielding Dow Jones Industrial Average ($DOWI) (DIA) stocks. The DJIA is a stock market index that consists of 30 large publicly traded companies listed on the New York Stock Exchange and the NASDAQ 100 Index ($IUXX) (QQQ).

The Dogs of the Dow strategy is based on the idea that the high dividend yield of these stocks indicates that they may be undervalued by the market and are likely to outperform in the future. The strategy involves rebalancing the portfolio at the end of each year to ensure that it still includes the 10 highest yielding DJIA stocks.

The Dogs of the Dow strategy has been popular with investors as a way to potentially generate income and outperform the market. However, like all investment strategies, it carries risks and may not always be successful.

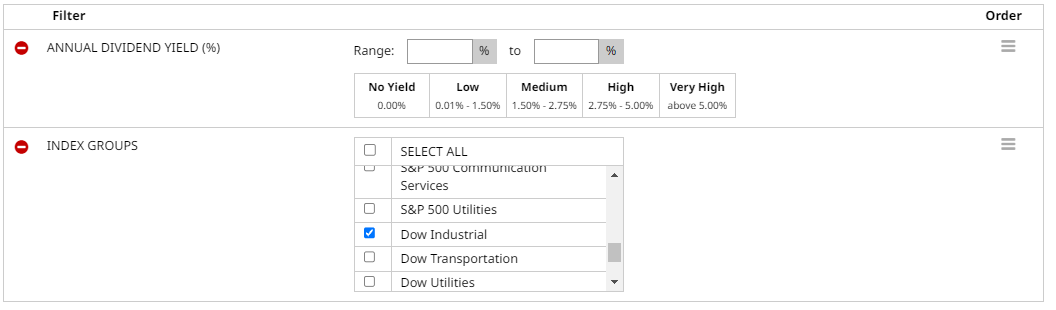

So, what are the 10 highest yielding stocks in the Dow right now? We can use the Stock Screener to find all the Dow stocks and include a column for Annual dividend yield.

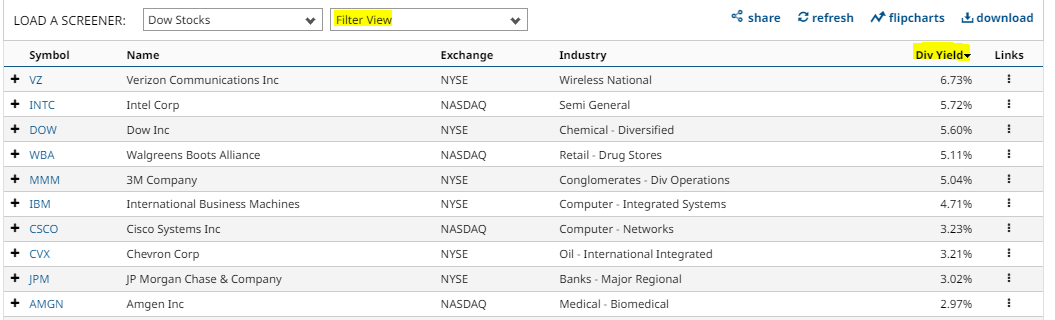

Then for the results, we select Filter View and sort by Dividend Yield.

So our 10 Dogs of the Dow for 2023 are:

Verizon (VZ)

Intel (INTC)

Dow (DOW)

Walgreens (WBA)

3M Company (MMM)

International Business Machines (IBM)

Cisco (CSCO)

Chevron (CVX)

JP Morgan (JPM)

Amgen (AMGN)

As shown in the above table, there are some very healthy dividend yields on offer. One way to further enhance this yield is by selling covered calls.

Some people like to sell monthly covered calls, but that can require ongoing maintenance and monitoring. Today, we’re going to look at a yearly covered call for those that like a more set and forget approach.

Verizon Yearly Covered Call Example

Let’s use the first stock on the list, Verizon, and look at an example.

Buying 100 shares of VZ would cost around $3,920. The January 19, 2024, call option with a strike price of 40 was trading yesterday for around $3.15, generating $315 in premium per contract for covered call sellers.

Selling the call option generates an income of 8.74% in 385 days, equalling around 8.26% annualized.

That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 40?

If VZ closes above 40 on the expiration date, the shares will be called away at 40, leaving the trader with a total profit of $395 (gain on the shares plus the $315 option premium received). That equates to a 10.96% return, which is 10.36% on an annualized basis.

That doesn’t include dividends. VZ is estimate to pay around $2.61 in dividends over the next 12 months which would increase the income potential by 6.73% per annum.

Let’s look at another example using Intel.

Intel Yearly Covered Call Example

Buying 100 shares of INTC would cost around $2,620. The January 19, 2024, call option with a strike price of 27.50 was trading yesterday for around $3.50, generating $350 in premium per contract for covered call sellers.

Selling the call option generates an income of 15.42% in 385 days, equalling around 14.58% annualized.

That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 27.50?

If INTC closes above 27.50 on the expiration date, the shares will be called away at 27.50, leaving the trader with a total profit of $480 (gain on the shares plus the $350 option premium received). That equates to a 21.15% return, which is 19.99% on an annualized basis.

That doesn’t include dividends. INTC is estimate to pay around $1.46 in dividends over the next 12 months which would increase the income potential by 5.72% per annum.

Selling covered calls in 2023 on the Dogs of the Dow stocks, could be a great strategy for generating income and building long term wealth.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Rally Broadly as Bond Yields Fall

- TSMC Ramps Up Chip Production Despite Fears of a Global Slowdown

- Strength in Tech Stocks Leads the Overall Market Higher

- Markets Today: Stocks Climb as Bond Yields Fall on U.S. Labor Market Weakness

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Meta%20by%20creativeneko%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)