Dollar General Corporation (DG) is a leading discount retailer that operates thousands of stores offering a wide array of everyday consumer products, including groceries, cleaning supplies, health and beauty items, apparel, housewares, and seasonal merchandise at value-oriented prices. The company has grown into one of the largest retail chains in the United States, with headquarters in Goodlettsville, Tennessee. Its market cap is around $32.4 billion.

Shares of the company have outperformed the broader market over the past 52 weeks. The stock has increased 103.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.6%. Moreover, shares of the company have soared 11% on a YTD basis, compared to SPX’s 1.7% increase.

Narrowing the focus, shares of the discount retailer have surpassed the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 10.2% increase over the past 52 weeks and 12.6% rise on a YTD basis.

Dollar General’s stock rose, driven by a successful turnaround strategy that focused on inventory optimization, improved supply chain efficiency, and enhanced store-level execution. The company benefited from increased consumer traffic as budget-conscious shoppers sought value amidst inflationary pressures, alongside strengthened operating margins resulting from reduced store-level shrink and strategic pricing initiatives.

Furthermore, investments in digital capabilities and the expansion of higher-margin product categories boosted overall profitability and investor confidence in the retailer’s growth trajectory. In Dollar General’s last reported quarter (Q3 2025), EPS came in at $1.28, up significantly from $0.89 in Q3 2024, and beating expectations.

For the fiscal year ended in January 2026, analysts expect Dollar General’s EPS to grow 9.8% year-over-year to $6.50. The company’s earnings surprise history is impressive. It beat the consensus estimates in each of the last four quarters.

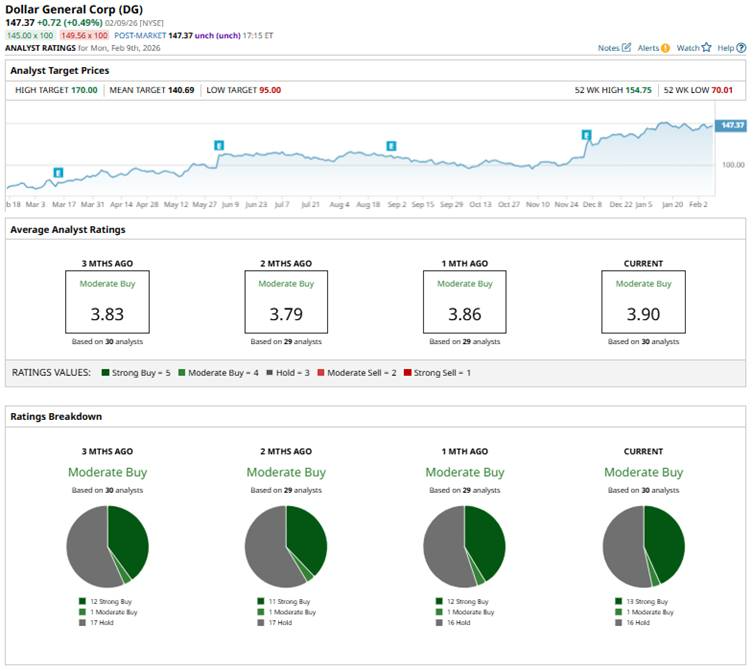

Among the 30 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” and 16 “Holds.”

The configuration is slightly more bullish compared to one month ago, when there were 12 “Strong Buy” ratings.

Last month, Jefferies raised its price target on Dollar General to $165 from $145 while maintaining a “Buy” rating, amid growing confidence in the retailer’s long-term execution.

The stock has already surged past the mean price target of $140.69, while the Street-high price target of $170 suggests a 15.4% potential upside.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)