On Friday, December 9, the USDA released its December World Agricultural Supply and Demand Estimates Report. In 2022, corn and soybean futures rose to the highest level since 2012, when the coarse grain and oilseed futures reached record peaks. CBOT soft red winter wheat rose to a record high this year as the war in Europe’s breadbasket, and critical logistical hub at the Black Sea Ports created significant supply concerns. Meanwhile, sugar and animal protein prices were elevated, and cotton and orange prices rose to multi-year peaks. The full text of the December 2022 WASDE report is available via this link.

While agricultural commodity prices have come down from the 2022 highs, they remain elevated as we move into 2023. The Teucrium CORN, SOYB, and WEAT ETF products follow portfolios of corn, soybean, and CBOT soft red winter wheat futures higher and lower.

Sal Gilberte’s view of the final WASDE

Sal Gilberte is the founder of the Teucrium family of grain and oilseed ETFs. On December 9, I reached out to Sal for his view of the December 9 report, and Sal told me:

As for today’s WASDE, it was really a non-event. The only thing of note is that the US will use more corn, soybeans, and wheat next year than it uses, which means all three big grain balance sheets are tightening. Because grain balance sheets are relatively tight due to supply demand imbalances over the past two years, the entire world needs farmers to have record crops in the coming year so that we finally begin to rebuild excess crop supplies. Globally, grain inventories should – and need to – begin to trend higher beginning next season. If not, there is a danger of extended food inflation until grain supplies approach the excess inventory levels we had three years ago.

The bottom line is the world needs to produce more grains and oilseeds in 2023 to loosen the tight balance sheets and improve the supply and demand fundamentals in the agricultural products that feed the world.

Soybeans- Crush Spreads remain bullish

The December WASDE report told the soybean market:

Total U.S. oilseed production for 2022/23 is forecast at 127.9 million tons, up slightly due to an increase for cottonseed. Soybean supply and use projections for 2022/23 are unchanged from last month. Based on a review of EPA's recent proposed rule for renewable fuel obligation targets, soybean oil used for biofuel for 2022/23 is reduced 200 million pounds to 11.6 billion. Soybean oil exports are also reduced on historically low export sales through November. With reduced use of soybean oil for biofuel and exports, food use and ending stocks are raised. The U.S. season-average soybean price forecast is unchanged at $14.00 per bushel. The soybean oil price is reduced 1 cent per pound to 68 cents. The soybean meal price forecast is increased $10.00 to $410.00 per short ton. Global oilseed production for 2022/23 is projected at 644.4 million tons, down 1.2 million from last month. Lower sunflower, rapeseed, palm kernel, and cottonseed production forecasts are partly offset by higher soybean output. Global sunflowerseed production is reduced for Russia and Ukraine based on harvest results. Canola production for Canada is lowered 0.5 million tons to 19.0 million based on government reports. Palm kernel and palm oil production is lowered for Indonesia for 2021/22, reflecting crop losses during periods of export restrictions and poor harvest weather. Indonesian palm oil production for 2022/23 is also lowered 1.0 million tons to 45.5 million. The global soybean outlook includes higher production, exports, and ending stocks. Production is raised on higher output for India and Ukraine. Exports are raised slightly as higher shipments for Argentina are partly offset by lower exports for Canada and Paraguay. With global crush relatively unchanged, ending stocks are raised 0.5 million tons to 102.7 million.

Source: USDA December 2023 WASDE report

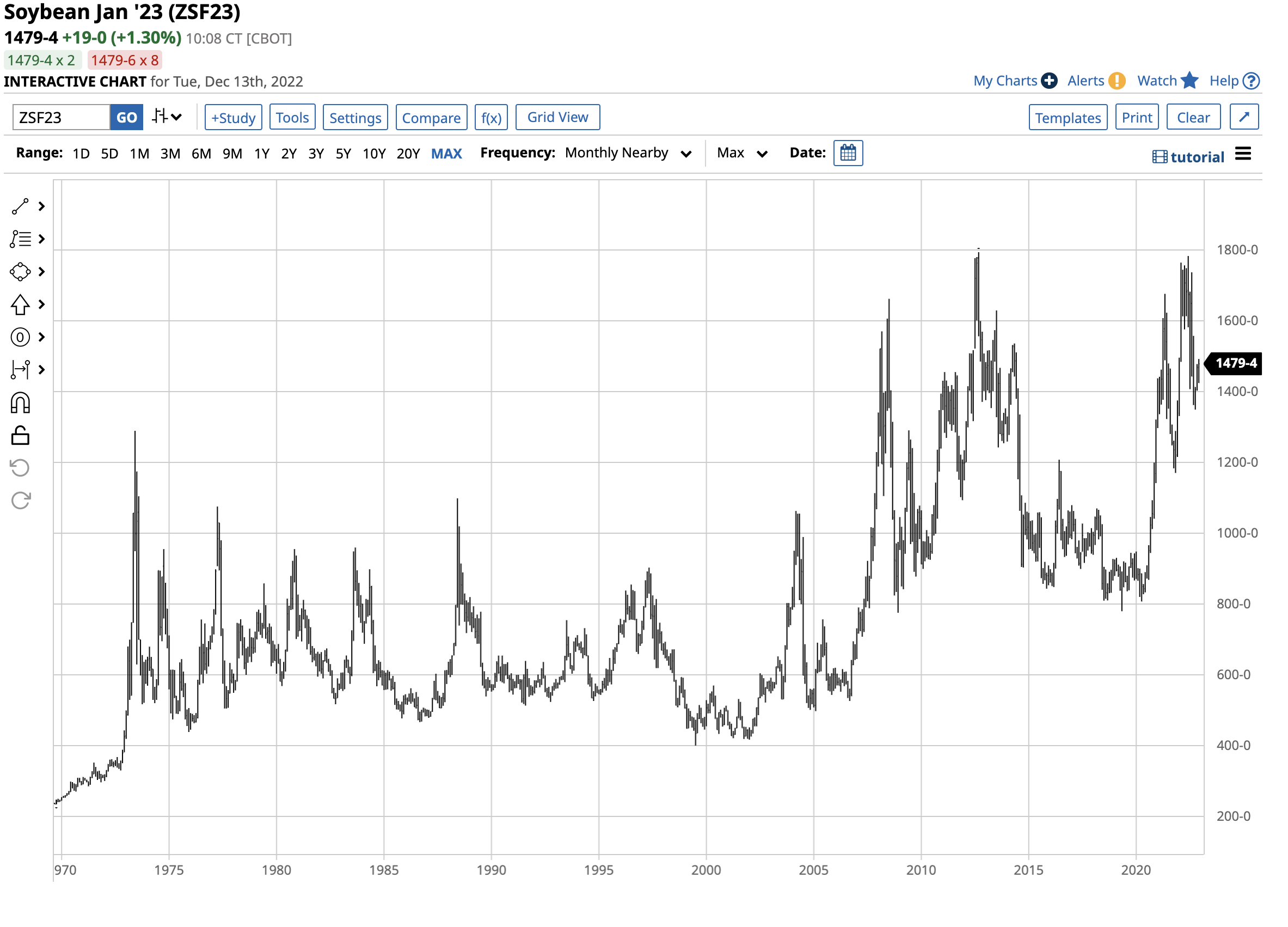

While the December WASDE said that U.S. and global production and ending stocks increased from the November WASDE report, soybean prices remain at multi-year highs in December 2022.

At nearly $14.80 per bushel, the soybean futures price for January delivery remains at the highest price in December since 2013.

One real-time indicator of soybean demand is the crush spread that reflects the margin for processing the raw oilseeds into soybean products: oil and meal. The meal is a primary ingredient in animal feed, while oil has many uses, including cooking oils, food additives, and as an input in biodiesel fuel. On December 13, the soybean crush spread was sitting at over $2 per bushel after reaching a record high of $3.4025 per bushel in late October/early November. Even at the $2 level, the crush spread is sitting at a multi-year high, indicating robust demand for soybean products, translating to demand for raw oilseeds.

The crush spread level is a fundamental barometer for soybean prices, which remain bullish during the final month of 2022.

Corn- Follow the energy aspect in 2023

The December USDA report told the corn market:

This month’s 2022/23 U.S. corn outlook is for lower exports and greater ending stocks. Exports are lowered 75 million bushels as competition from other exporters and relatively high U.S. prices have resulted in slow sales and shipments through early December. With no other use changes, corn ending stocks are raised 75 million bushels. The season-average corn price received by producers is lowered 10 cents to $6.70 per bushel based on observed prices to date. For 2022/23 sorghum, a substantial decline in demand from China supports greater domestic use expectations. Exports are lowered 20 million bushels, with offsetting increases to food, seed, and industrial and feed and residual use. Global coarse grain production for 2022/23 is forecast down 5.9 million tons to 1,453.6 million. The 2022/23 foreign coarse grain outlook is for lower production, greater trade, and smaller stocks relative to last month. Foreign corn production is reduced with forecast declines for Ukraine, Russia, the EU, and Vietnam. Ukraine corn production is sharply lower with reductions to both area and yield as the ongoing conflict and record-setting autumn rainfall have delayed the harvest in key producing oblasts of Poltava, Sumy, and Cherkasy. Russia corn production is lowered as harvest delays in the country reduce area expectations. Barley production is raised for Australia based on the most recent crop report from ABARES. Argentina barley production is cut on continued dry conditions. Corn exports are raised for Ukraine but lowered for the United States, Russia, and the EU. Barley exports are raised for Australia but lowered for Argentina. For 2021/22, sorghum exports for Argentina are lowered for the local marketing year beginning March 2022, based on shipments through the month of November. For 2022/23, corn imports are raised for the EU, but lowered for Canada, Iran, South Korea, Mexico, Vietnam, Philippines, and Turkey. Sorghum imports are reduced for China. Foreign corn ending stocks are down, reflecting reductions for Ukraine, Paraguay, Vietnam, and Mexico. Global corn stocks, at 298.4 million tons, are down 2.4 million.

Source: USDA December 2023 WASDE report

While the December WASDE increased the U.S. ending stock level from the November report, foreign inventories and overall global stocks declined.

The long-term corn futures chart illustrates at over $6.50 per bushel for March delivery; corn is sitting at its highest price since 2013 in late 2022.

In the U.S., corn is the primary ingredient in RBOB gasoline. The U.S. government mandates that refiners blend petroleum-based gasoline with ethanol. The war in Ukraine and U.S. energy policy under the Biden administration have caused oil and oil product prices to rise to multi-year highs in 2022. Upward pressure on gasoline prices has translated into more demand for corn-based ethanol. Moreover, since Russia and Ukraine are leading corn-producing and exporting countries, the war in Europe’s breadbasket and hostilities in the Black Sea Ports, a critical logistical export hub, have put additional upward pressure on worldwide corn prices. If the war continues, the world will need to produce more corn in 2023 to replace output from the war-torn region.

Wheat- The KCBT-CBOT spread warns against getting too bearish

The USDA told the wheat market:

This month’s 2022/23 U.S. wheat supply and use outlook is unchanged from last month. There are offsetting changes for exports by-class with Hard Red Spring and White higher and Soft Red Winter lower. The 2022/23 season-average farm price is forecast $0.10 per bushel lower at $9.10, based on prices received to date and expectations for futures and cash prices for the remainder of 2022/23. The global wheat outlook for 2022/23 wheat is for reduced supplies, lower consumption, increased trade, and reduced stocks. Supplies are lowered 2.1 million tons to 1,056.9 million on reduced production for Argentina and Canada that is only partly offset by higher Australia production. Argentina is lowered 3.0 million tons to 12.5 million with reductions in both area harvested and yield on continued widespread dry conditions. This would be the lowest production since 2015/16. Canada’s production is reduced 1.2 million tons to 33.8 million, based on the latest Statistics Canada estimate and is the third largest crop on record. Australia’s production is raised 2.1 million tons to a record 36.6 million, based on the latest Australian Bureau of Agricultural and Resource Economics (ABARES) forecast. Global consumption is reduced 1.6 million tons to 789.5 million, mainly on lower feed and residual use by the EU and Ukraine. World trade is raised 2.2 million tons to 210.9 million on higher exports by Australia, Ukraine, the EU, and Russia more than offsetting reduced exports by Argentina. Australia exports are raised 1.5 million tons to a near-record 27.5 million. Because of excessive rains in New South Wales at harvest, Australia’s feed wheat supplies are expected to be greater for 2022/23 and competitively priced against feed grains for East Asian importers. This resulted in higher imports for South Korea and several Southeast Asian countries this month. Ukraine exports are increased 1.5 million tons to 12.5 million. Argentina’s exports are reduced 2.5 million tons to 7.5 million with lower exportable supplies. This would be Argentina’s lowest exports since 2014/15. Projected 2022/23 ending stocks are decreased 0.5 million tons to 267.3 million as reductions for Russia, Canada, Argentina, and Ukraine more than offset increases for the EU and Australia.

Source: USDA December 2023 WASDE report

The USDA lowered global ending wheat stocks and lowered its 2023 production forecast to its lowest level since 2015/2016.

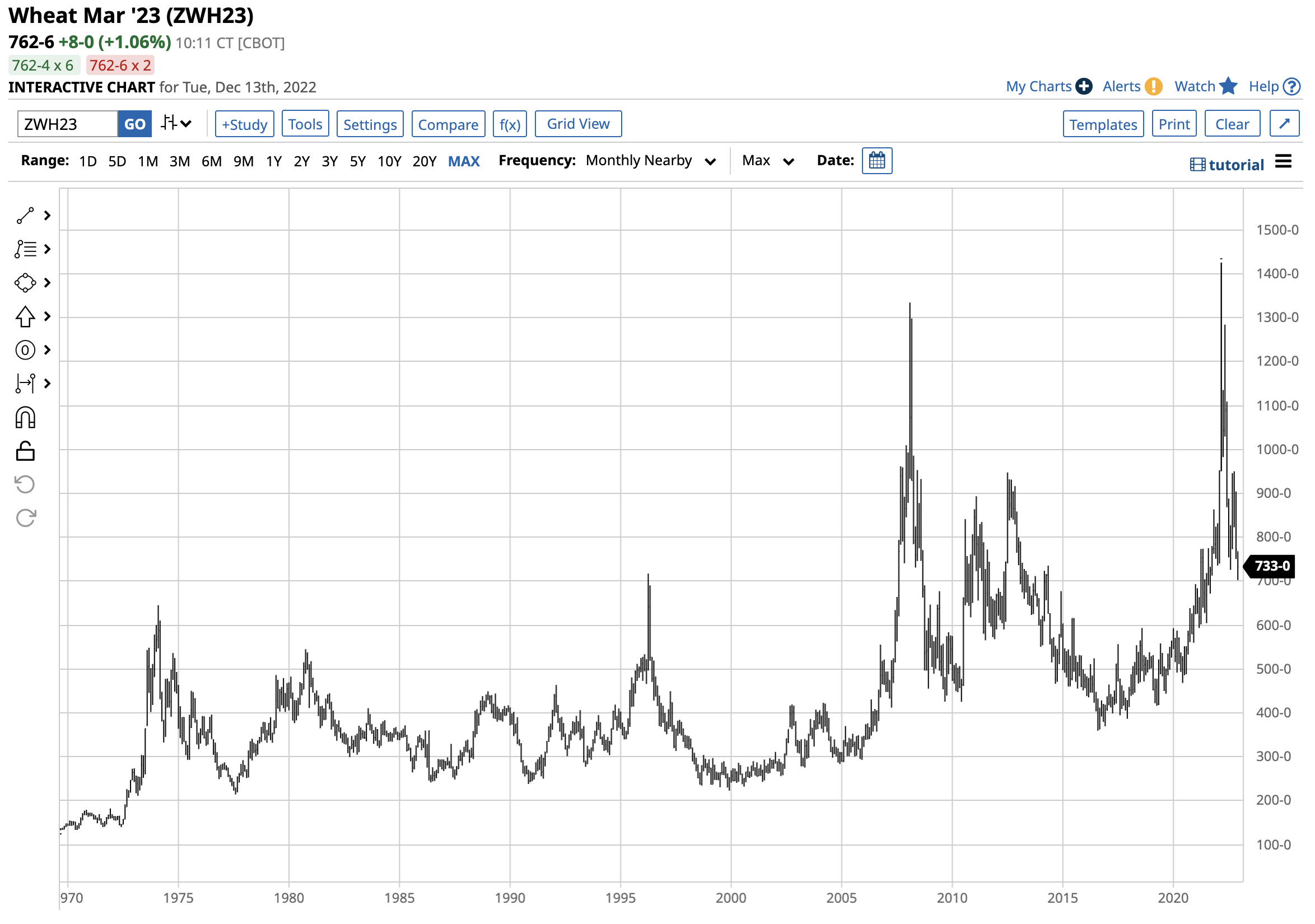

The long-term CBOT soft red winter wheat chart shows that the primary ingredient in bread is trading at the highest price in November since 2012 at over $7.60 per bushel.

Many U.S. wholesale bread manufacturers price their requirements using the Kansas City hard red winter wheat futures contract. The spread between the KCBT and CBOT wheat contracts provides clues about their sentiment and hedging activity. When the premium for KCBT wheat over CBOT wheat increases, it signals consumer supply and price concerns.

The chart ({KEH23}-{ZWH23}) highlights at the $1.38 per bushel level, the premium for KCBT wheat over CBOT wheat is at a record high on December 13. The spread is a bullish sign for wheat prices as we head into 2023.

Russia and Ukraine are significant wheat producers and exporters. If the war continues, wheat shortages could appear. In March 2022, CBOT wheat futures rose to a record high of $14.2525 per bushel when Russian troops invaded Ukraine. While CBOT wheat futures have corrected by around $7.60 per bushel, the spread between the KCBT and CBOT wheat futures warns that we should not be too bearish for wheat prices for the coming year.

The Teucrium products do an excellent job tracking the grains and oilseed futures

Soybean and corn futures rose to the highest prices since 2012 and came close to all-time peaks from that drought-ridden year. CBOT wheat futures reached record prices in 2022.

Tight balance sheets for agricultural products and the war in Europe’s breadbasket will likely cause a continuation of high prices in 2023, and we could see higher highs. The current price levels could be at bargain levels if the 2023 crop is anything but at bumper levels.

The most direct route for a risk position in the grain and oilseed markets is via the futures and futures options on the CME’s CBOT division. The Teucrium family of grain and oilseed ETFs offer alternatives to the futures. The Teucrium ETFs do an excellent job tracking soybean, corn, and wheat futures prices but tend to underperform on the upside and outperform during price corrections. The ETFs hold portfolios of three actively traded months in each futures market to reduce risks when one nearby month rolls to the next.

The nearby futures tend to experience the most price volatility, leading to the upside underperformance and downside outperformance of the Teucrium ETFs.

- At $27.90 per share on December 13, the Teucrium Soybean ETF (SOYB) had $64.659 million in assets under management. The ETF traded an average of 39,132 shares daily and charges a 1.16% management fee.

- At $26.20 per share, the Teucrium Corn ETF (CORN) had $203.110 million in assets under management. CORN trades an average of 105,756 shares daily and charges a 1.14% expense ratio.

- At $7.72 per share, the Teucrium Wheat ETF (WEAT) had $303.242 million in assets under management. WEAT trades an average of over 1.17 million shares daily and charges a 1.14% management fee.

SOYB and CORN do an excellent job tracking the CBOT futures contracts, while WEAT follows the CBOT soft red winter wheat, the most liquid U.S. wheat futures market that is a worldwide benchmark for the grain.

The correction in the grain and oilseed futures markets could be an excellent time to consider long positions for 2023. However, since picking bottoms in any market is always dangerous, leave plenty of room to add on further price weakness. The tight balance sheets could cause another significant rally for the grain and oilseed futures markets in 2023.

More Grain News from Barchart

- Tuesday Follow Through for the Wheat Market

- Entire Soy Complex Gaining

- Overnight Corn Trade Mostly Higher

- Wheat Bounced Double Digits

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)