Throughout history, wheat has been a highly political commodity as it is the agricultural product that feeds the world. Most market participants would point to crude oil if asked which raw material impacts domestic and geopolitical trends. While the energy commodity continues to power the globe, wheat powers individuals, providing the nutrition that sustains life.

In 2022, crude oil and wheat have been in the crosshairs of the first major war in Europe since WW II. In 2021, Russia and Ukraine accounted for 27% of the world’s wheat exports. The war in Ukraine caused the price of the grain to explode to a new record peak on the nearby CBOT wheat futures market.

Over the past week, Russia suspended its participation in the Back Sea corridor agreement. The Black Sea Ports are a critical and crucial logistical hub for Russian and Ukrainian wheat exports. After the suspension, Moscow reconsidered, reversing the suspension. Wheat volatility increased over the past sessions. Meanwhile, wheat prices are trending higher after correcting from the record peak. The spread between KCBT hard red and CBOT soft red winter wheat provided a clue that the grain’s price was heading higher. The current level of the spread remains bullish for the agricultural commodity that feeds the world.

CBOT wheat corrects, consolidates, and becomes volatile

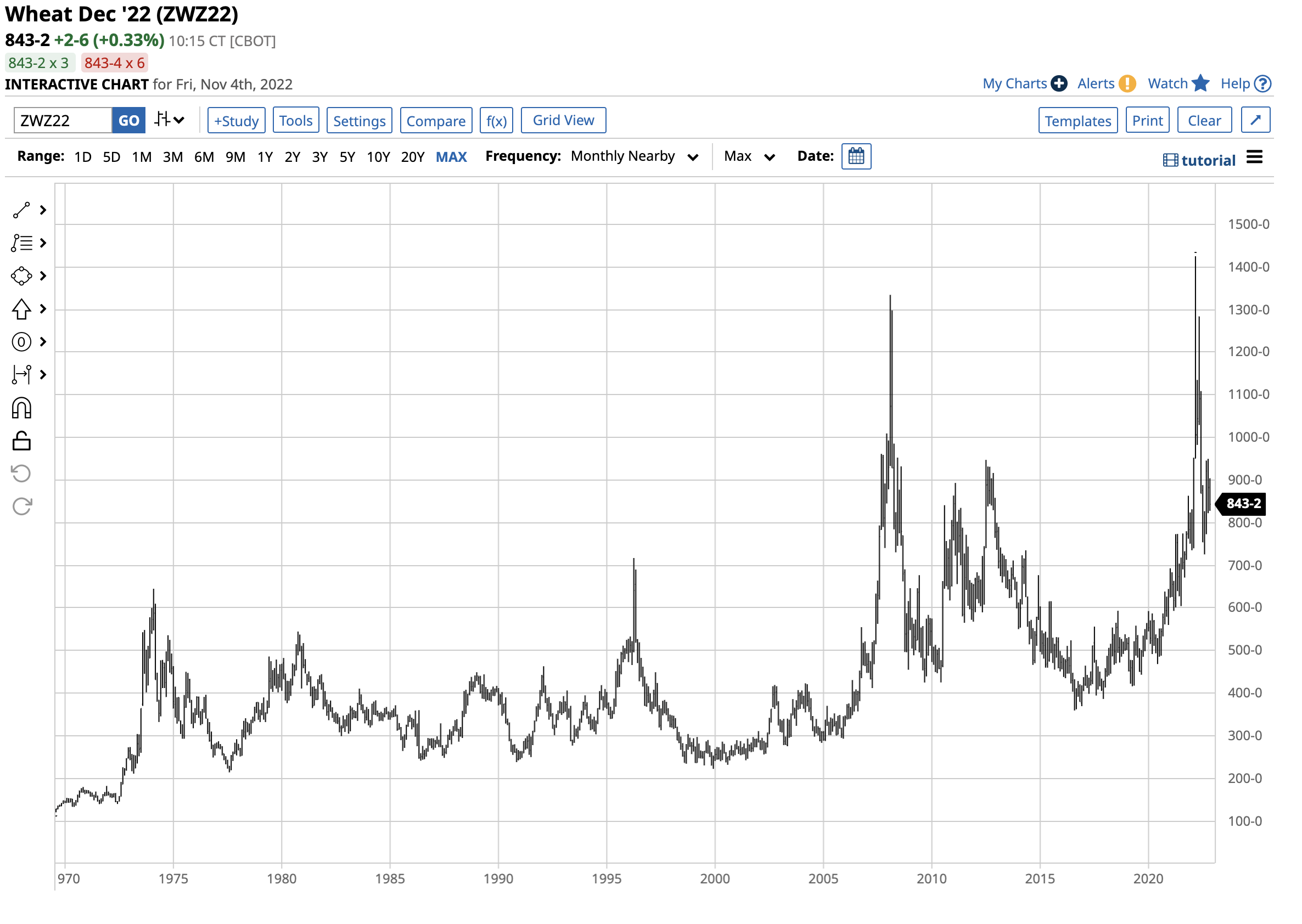

Nearby CBOT wheat futures rose to a record high of $14.2525 per bushel in March 2022. As Russia and Ukraine are leading world wheat-producing and exporting countries, the war launched the price of the grain that is the primary ingredient in bread production.

The long-term chart highlights that CBOT wheat futures eclipsed the previous 2008 $13.3450 high before correcting lower to under the $8.50 per bushel level on November 4. December wheat futures fell to a low of $7.4325 on August 18, a 47.9% decline from the March high.

The short-term chart illustrates wheat’s slight upside bias since the August 18 low, but the price has remained below the $9.50 per bushel level.

CBOT wheat is a global benchmark

Three wheat futures trade on the US futures market. The MGE spring wheat contract, the KCBT hard red winter wheat contract, and the CBOT soft red winter wheat contract. The contract specifications for each wheat futures market call for a different grade of the agricultural product.

The CBOT contract for soft red winter wheat is the global benchmark as it attracts the most hedging and speculative activity. While other wheat contracts trade in Europe and worldwide, the CBOT soft red winter wheat product is the most liquid, with the highest volume and open interest levels. Open interest is the total number of open long and short positions in a futures market, which reflects. Liquidity or the ease of executing buy and sell orders.

KCBT wheat is a pricing mechanism for many US consumers

While the CBOT contract is the most liquid, the KCBT hard red winter wheat contract is the one that many US bread manufacturers use to price supply requirements. Many pricing contracts for wholesale companies that produce burger buns and other wheat-based products depend on the KCBT and not the CBOT price.

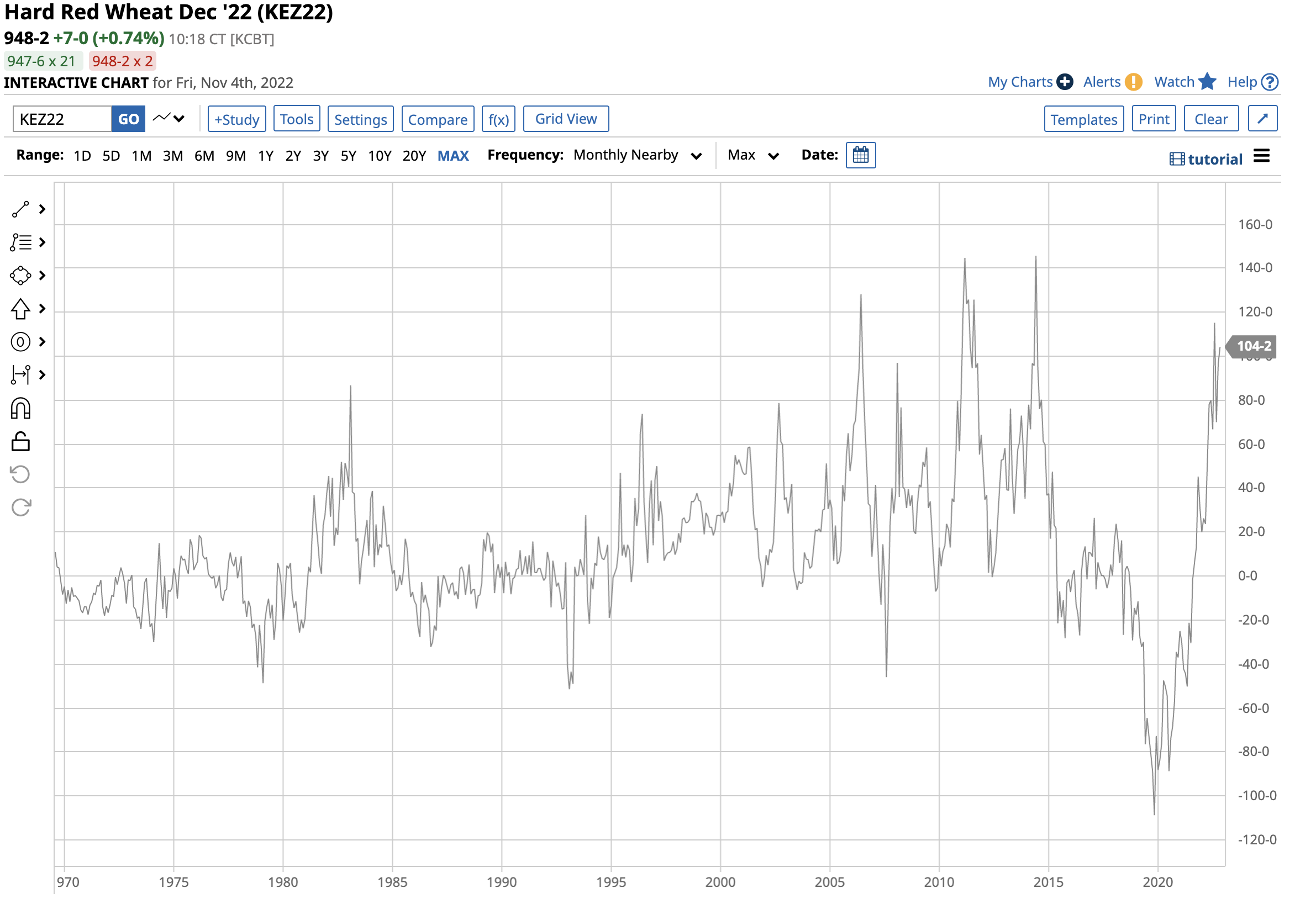

I watch the spread between the KCBT-CBOT wheat contracts for clues about consumer hedging activity in the wheat market. Over the past decades, the average level of the spread has been a twenty to thirty cents premium for KCBT wheat. The spread tends to rise to a higher premium for KCBT wheat when consumer hedging activity increases. Over the past years, a bearish trend in wheat that caused the price to make lower highs and lower lows sent the KCBT wheat price to a discount to the CBOT futures. Consumers purchased requirements hand-to-mouth as the price declined as a bear market provided no need to lock in prices that were trending lower. The situation changed dramatically in 2022.

The KCBT-CBOT spread rose above the $1 level

After mainly trading at a discount to CBOT wheat from 2015 through 2021, the KCBT wheat returned to a premium in 2022, soaring to the highest level since 2014.

The chart ({KEZ22}-{ZWZ22}) shows the KCBT premium rose to above $1 per bushel in August 2022 and remained above the $1 level on November 4. The highest premium for KCBT wheat in eight years tells us that US consumers who manufacture bread products and price on the KCBT futures contract are hedging as they fear higher wheat prices and scarce availabilities over the coming months. The spread level and price action are fundamental bullish factors for the overall wheat price and the global benchmark, the CBOT contract.

WEAT is the wheat ETF product that follows CBOT wheat

Trading the spread between KCBT and CBOT wheat requires a futures account. The most direct and liquid route for a risk position in wheat is via the futures and futures option on the CME’s CBOT division. The Teucrium Wheat ETF product (WEAT) tracks a portfolio of three actively traded CBOT wheat futures.

At the $8.71 per share level on November 4, WEAT had over $345 million in assets under management and trades an average of over 1.8 million shares daily. WEAT charges a 1.14% management fee.

December CBOT wheat futures rose from $7.4325 on August 18 to a high of $9.4975 on October 10, a 27.8% price increase. The price corrected to the $8.44 level on November 4, 11.1% below the October 10 high.

Over the same period, WEAT rose from $7.63 to $9.50 per share or 24.5%. At the $8.71 level on November 4, WEAT corrected 8.3% from the October 10 high.

WEAT holds three active CBOT wheat futures contracts to reduce the roll risk. The most volatility tends to occur in the nearby contract as it attracts the lion’s share of speculative activity. Therefore, WEAT tends to underperform the nearby wheat futures on the upside and outperform during price corrections, as we have seen since the mid-August low.

At over a $1 per bushel premium for KCBT wheat over the CBOT wheat futures, the bullish case for the grain remains compelling. If the war in Ukraine continues, wheat will be in the crosshairs of the battle, consumers will remain nervous, and supplies could be scarce. I am a buyer of wheat and the WEAT ETF product on price weakness, leaving plenty of room to add at lower levels over the coming weeks and months.

More Grain News from Barchart

- Wheats Trading Higher into Friday’s Day Start

- Morning Soy Futures Strong into Friday

- 4 Cent Gains for Morning Corn

- Red Thursday for Wheat Market

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)