- Both the cash corn market and corn futures completed bearish long-term technical reversal patterns this past spring and early summer, indicating their respective trends had turned down.

- However, long-term fundamentals were, are, and should continue to be bullish for the foreseeable future, according to basis and futures spreads.

- While these two components of the market's structure don't seem to fit together, in reality they still do.

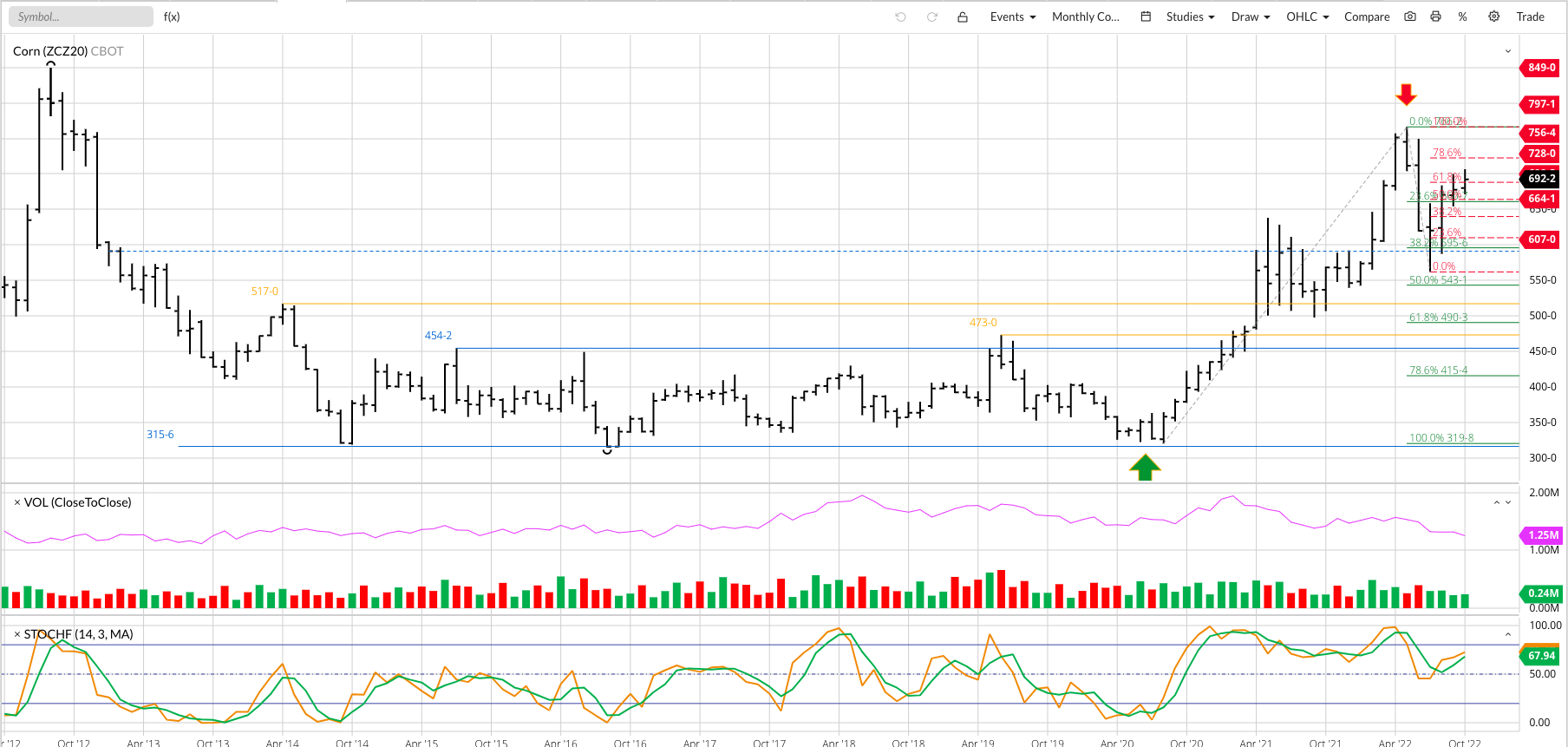

Those of you following along with my commentary on Barchart (or Monthly Analysis on my website) will recall I talked about how both the Barchart National Corn Price Index (ZCPAUS.CM) (weighted national average cash price), what I consider the intrinsic value of the market, and the December corn (ZCZ22) contract both posted technical topping patterns on their long-term monthly charts this past spring and early summer. Given this, long-term investors in the market may turned bearish, looking for opportunities to be short the market.

And rightfully so, according to Newsom’s Market Rule #1: Don’t get crossways with the trend. Long-term investors likely rode the corn market higher from August 2020 when the NCPI posted a new 4-month high beyond $3.30. The investment avenue chosen likely varied by individual with some holding cash corn, others buying corn futures, others buying into and ETF like Teucrium Corn (CORN), or buying stocks related to the US corn industry (e.g. Deere (DE), Mosaic (MOS), etc.). There may have been some concern in the spring/summer of 2021 as the NCPI posted a Wave 3 peak of $7.49 (May 2021) before falling to a low of $4.86 (October 2021), but support near the 50% retracement level held and the move proved to be nothing more than a Wave 4. Wave 5 crested with the high of $8.05 (April 2022), and a new long-term downtrend confirmed with a new 4-month low below $6.87 during July 2022.

I can hear you out there, though. “What about all your talk of corn’s long-term bullish fundamentals?” What about your statement, “Corn’s 2022-2023 futures spreads are more bullish in October 2022 than it was at the end of October 2021.” What about Newsom’s Market Rule #6 that says, “Fundamentals win in the end.”

All of those still hold true, and still fit with what I see on corn’s long-term monthly charts. I’ve also said I’m concerned about all three legs of US corn demand the second half of 2022-2023:

- Feed demand could start to slow due to fewer cattle on feed, the result of cows being slaughtered during 2022.

- Ethanol demand should stay stable, though the threat is demand from driving could start to slow in 2023.

- Export demand is off to a slow start this marketing year, partly due to near record tight available stocks-to-use at the end of 2021-2022. Newly harvested bushels are being used to meet domestic demand at this time, particularly feed.

The fact futures spreads remain bullish long-term indicates the commercial side of the market is concerned about supply and demand and given all three categories of demand have question marks, the conclusion is the US could see a supply problem again this marketing year.

Going back to the NCPI’s monthly chart, then, shows us a possible move to Wave B (second wave) of the ongoing 3-wave downtrend pattern. Given fundamentals remain bullish, both national average basis and futures spreads, Wave B could retrace from 61.8% to 80% of Wave A putting the upside target area between $7.40 and $7.70. As for a timeframe, Wave B could last through next February, again the midpoint of the 2022-2023 marketing year.

The continuous monthly chart for December futures only shows us a similar picture, though the December 2022 contract is already closing in on its 80% retracement target near $7.20. At some point, traders who sold December 2022 will be looking to roll those short positions to the 2023 issue, with the spread testing its own resistance near the 64.5-cent inverse level.

More Grain News from Barchart

- Coffee Under Pressure on Improving Prospects for Brazil's Coffee Crop

- Coffee Falls Sharply on Robust Brazil Exports and Demand Concerns

- Sugar Prices Recover Early Losses and Post Moderate Gains

- Cocoa Prices Push Higher on a Weaker Dollar

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)