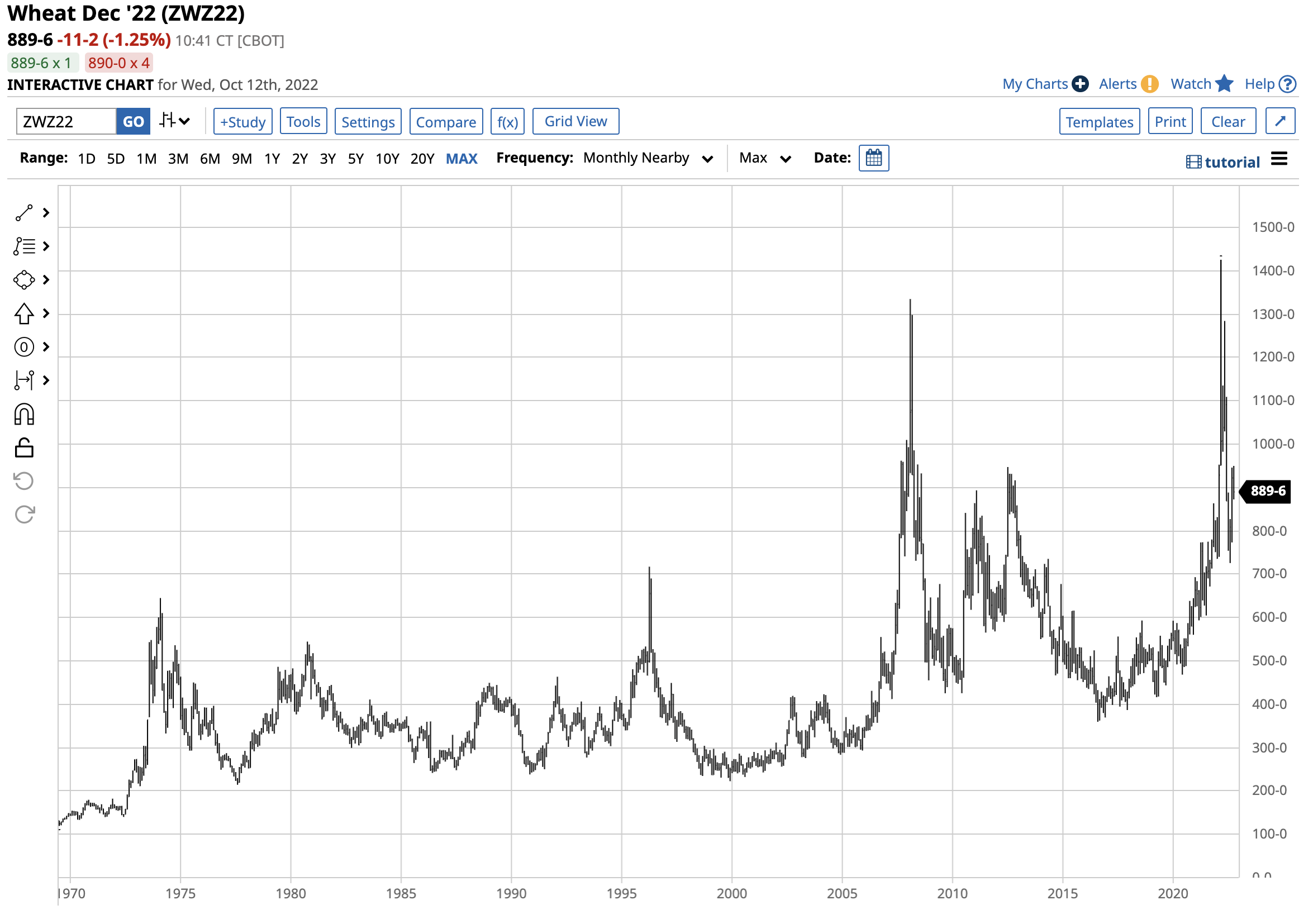

The CME CBOT division’s soft red winter wheat is the most liquid worldwide wheat futures market, making it a global benchmark for the grain. In Q3, the CBOT wheat futures rose 6.07%, bucking the corrective trend in other grains and across the commodities asset class. Over the first nine months of 2022, CBOT moved 19.56% higher after a 20.34% gain in 2021. The nearby futures settled at $9.215 per bushel on September 30 and were higher on October 12.

Wheat is the agricultural product in the crosshairs of the war in Ukraine. After rising to a record peak in March 2022, CBOT wheat futures corrected but remains at multi-year highs after the 2022 Northern Hemisphere harvest season. The odds favor continuing elevated wheat prices over the coming months and into 2023, stoking significant worldwide political ramifications.

Wheat remains near $9 per bushel

Nearby CME wheat futures settled at $9.2150 on September 30, 2022, and were 6.07% higher for the quarter and 19.56% above the 2021 closing level at the end of the third quarter.

The chart highlights that the soft red winter wheat futures reached a short-term bottom of $743.25 per bushel on the December contract on August 18, 2022, and have made higher lows and higher highs.

At $8.90 per bushel, CBOT wheat sits at the highest level in a decade since 2012.

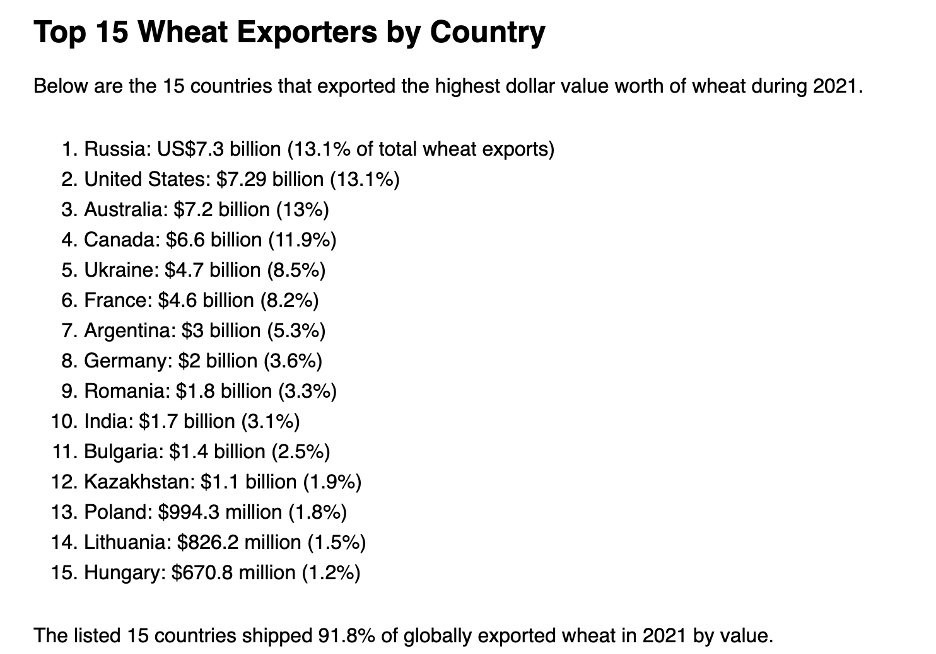

Russia and Ukraine are significant wheat exporters

In 2021, the combined exports of Russia and Ukraine led the world.

Source: worldstopexports.com

The chart shows that Russia and Ukraine accounted for 21.6% of the world’s wheat exports, with Russia leading the way and Ukraine the fifth top exporter of the grain. The combined supplies were 8.5% above the second-leading wheat exporter, the United States.

The war in Ukraine continues to rage with increasing concerns over a nuclear attack

In February 2022, Russia’s invasion of Ukraine caused the war to break out in Europe’s breadbasket. CBOT wheat futures, the worldwide benchmark, rose to a record high in May when they eclipsed the 2008 $13.3450 previous all-time peak and rose to $14.2525 per bushel.

While CBOT wheat futures ran out of upside steam, they remain at the highest price since 2012 as the war in Ukraine continues to rage.

Meanwhile, aside from wheat production issues, as a significant part of Europe’s breadbasket is a battlefield, the Black Sea ports, a critical logistical hub, are a warzone. The war threatens worldwide wheat supplies, leading to rising prices and famine in countries that depend on Russian and Ukrainian supplies as the battle continues.

Meanwhile, if Russia decides to use nuclear weapons in Ukraine, even a tactical atomic explosion could cause wheat supplies to disappear for years or decades, causing prolonged shortages.

US consumers are worried about prices and supplies

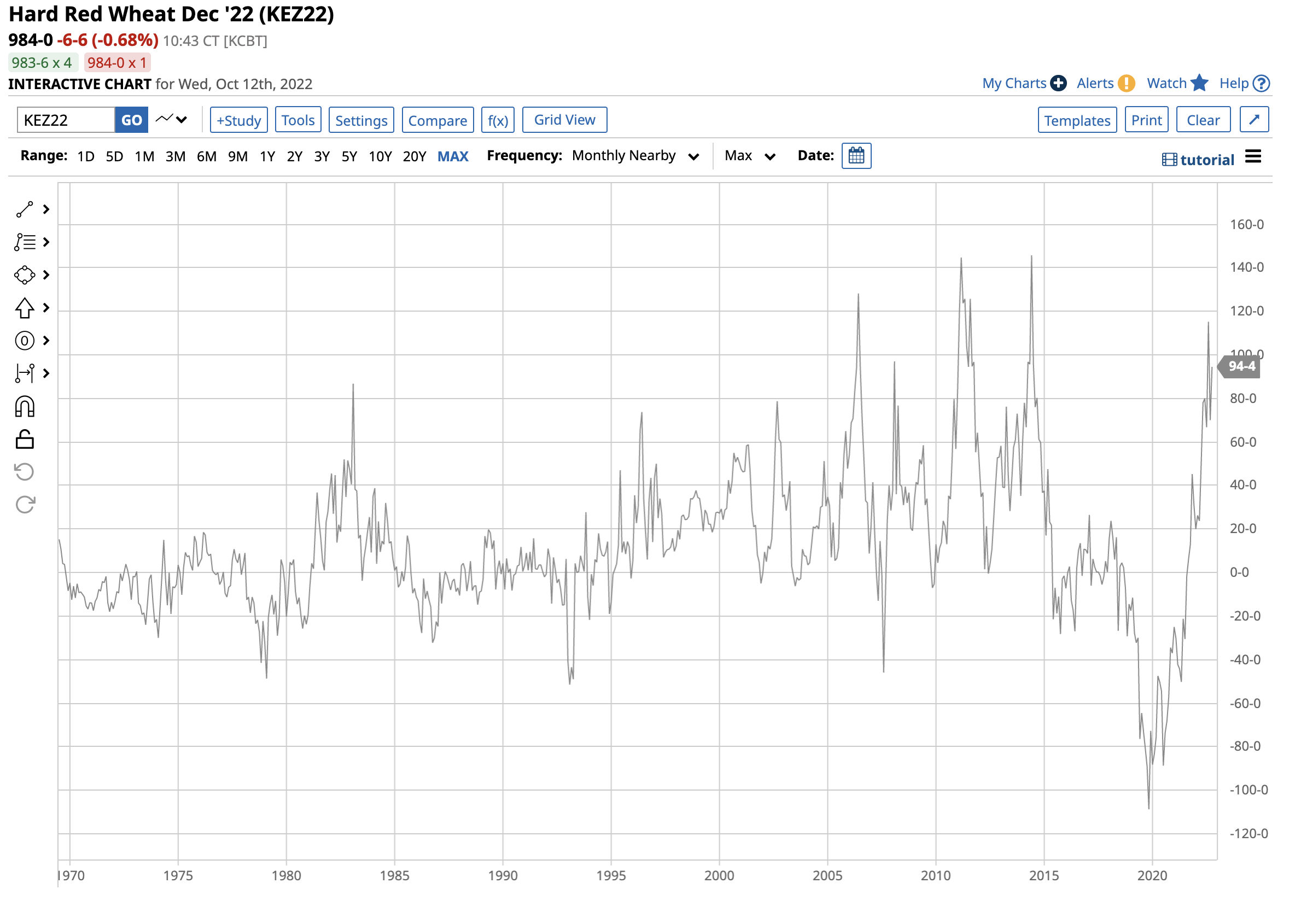

The metric I watch for clues about US wholesale US wheat consumer behavior is the spread between KCBT hard red winter and CBOT soft red winter wheat. Many US bread manufacturers price their requirements from the KCBT contract. When the premium for KCBT wheat against CBOT wheat rises, it signifies supply and price concerns. The spread tends to rise when wholesale consumers increase their hedging activity, locking in price levels and assuring supplies.

The long-term spread chart ({KEZ22}-{ZWZ22}) shows that the average is around a 20-30 cents premium for KCBT over CBOT wheat futures.

Meanwhile, the bearish price action in the wheat markets pushed the spread to an over $1 premium for CBOT wheat in late 2019 as consumers did little hedging. However, the war in Ukraine caused the spread to rise to a high of over a $1 per bushel premium for KCBT wheat in August 2022. At over the 94 cents per bushel level on October 12, the KCBT premium remains far above the long-term average and close to record territory.

The spread tells us consumers are aggressively hedging and worried about future wheat supplies and prices, a bullish sign for the grain that feeds the world.

Wheat remains a buy on price corrections until the war ends

While the war in Ukraine continues, the prospects for wheat futures remain highly bullish. Bull markets rarely move in straight lines, and pullbacks, as we witnessed from the May high to the August low, are bound to occur and often shake the confidence of even the most committed bulls. However, in the currency environment, the corrections will likely be buying opportunities as production and logistics in the warzone will limit global supplies and support prices.

I am bullish on wheat so long as the battle for Ukraine’s sovereignty continues.

More Grain News from Barchart

- Morning Weakness in Corn Market

- Soy Prices Off Lows, now Near Break Even

- Wheats Are Fading through Morning

- USDA, Sara Bareilles, and Paul McCartney

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)