- In its October round of supply and demand estimates, USDA is expected to be creative in revising its previous numbers to fit the September 1 quarterly stocks figure of 1.375 bb.

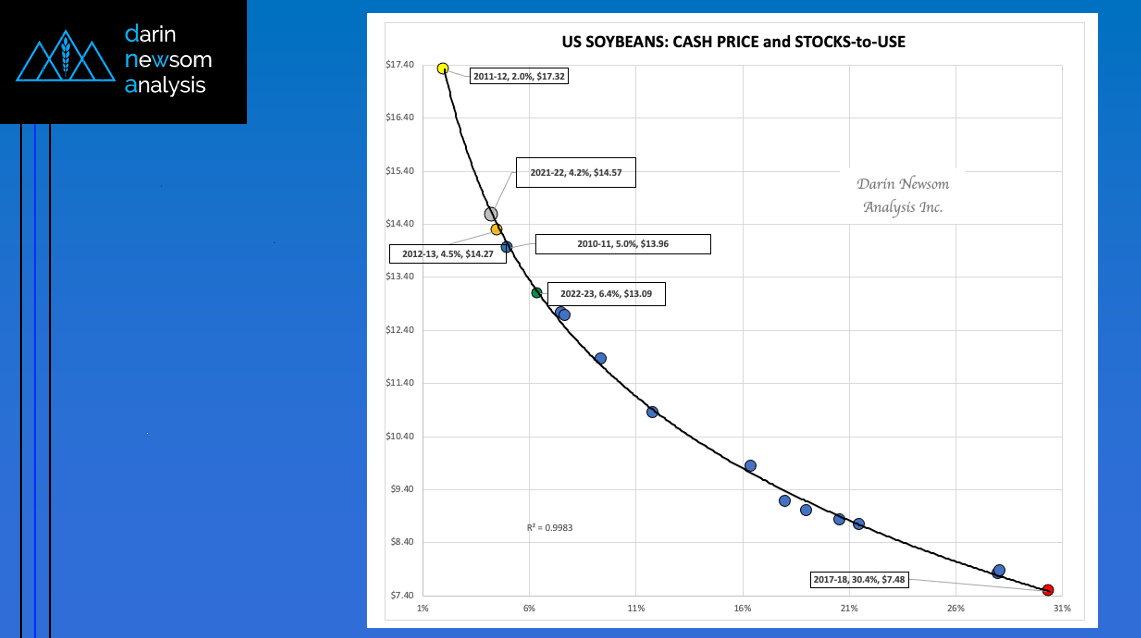

- Similarly, it will be interesting to see what changes are made to previous marketing year soybean tables to reach its quarterly stocks number of 275 mb, with the most likely candidate residual use going negative once again.

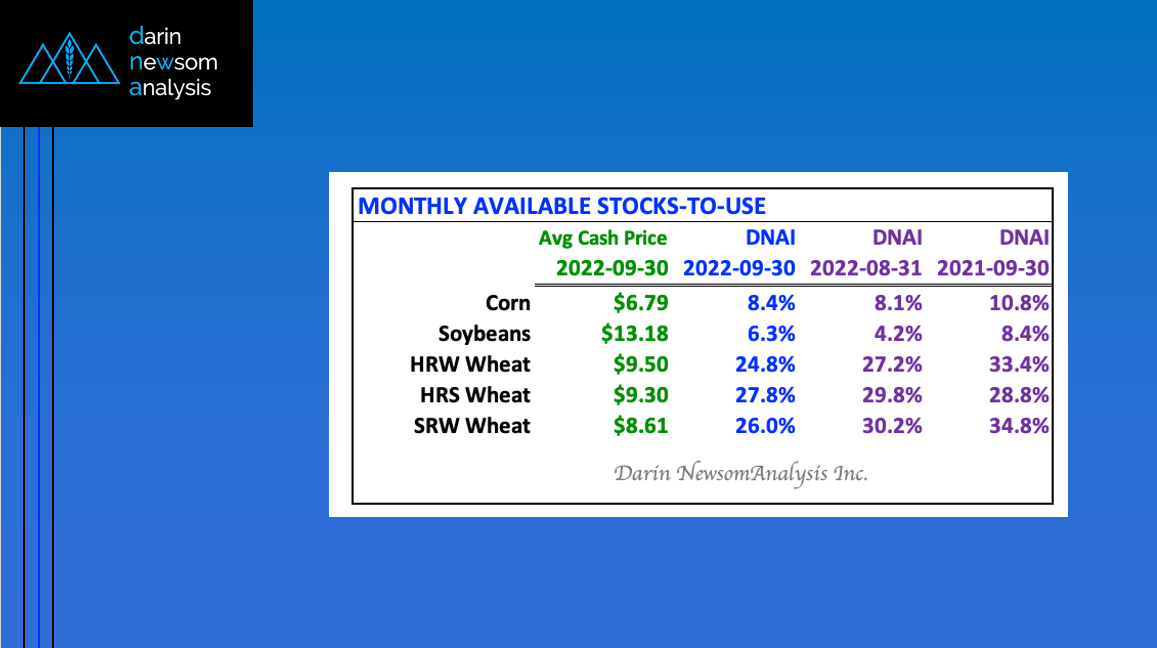

- In the wheat sector, most of the internet will be on the global table, Ukraine and Russia in particular.

I was recently asked if I would write a USDA Report Preview for Barchart, and you can guess my initial reaction. In all fairness, my new friend who had done the asking wasn’t as familiar with my stance on government reports as many of you are, and my initial reaction brought to mind the Sara Bareilles song “Love Song” with the chorus, “I’m not gonna write you a love song, ‘cause you asked for it, ‘cause you need one…” After my rant died down, my new friend broke into laughter. Then today rolled around, and as I was writing this Morning Commentary the playlist always going on in my mind jumped to Paul McCartney’s “Silly Love Songs” that states, “You’d think that people would’ve had enough of silly love songs. I look around me and I see it isn’t so.”

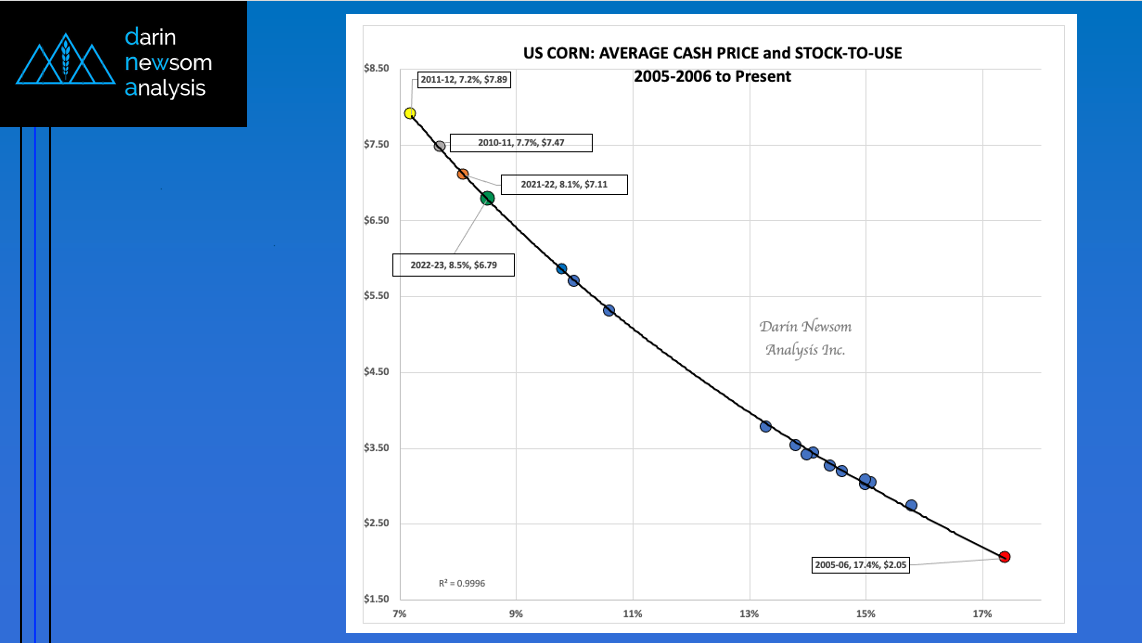

Corn: The corn market again traded both sides of unchanged overnight, with December registering light trade volume of 12,800 contracts. As everyone is likely aware, Wednesday brings with it the next round of monthly USDA supply and demand silliness, despite the fact we already know corn’s fundamentals remain bullish both long-term and short-term. Still, we have to play this same infernal game each month, and this time around I’ll take a look at what was changed in either the 2021-2022 or 2020-2021 tables that brought USDA’s September 1 quarterly stocks figure in at 1.377 bb. Recall this was down nearly 150 mb from the September ending stocks estimate of 1.525 bb. The ripple effects of this will be a solid change to USDA’s ending stocks-to-use calculation for 2021-2022 as compared to my end of August available stocks-to-use figure of 8.1%, the latter the lowest since August 2011 at 7.7%. USDA’s new 2021-2022 ending stocks figure, if it sticks with it, is also the adjusted beginning stocks number for 2022-2023 meaning that table could see changes as well. Recall USDA’s September guess on ending stocks came in at 1.219 bb, and if we subtract 150 mb off the top, well…

Soybeans: The soybean market was also showing a small loss early Wednesday morning with November down about 2.0 cents pre-dawn. This after November posted a trading range of 15.0 cents, from up 6.25 cents to down 8.75 cents, on moderate-to-light trade volume of 14,500 contracts. Also like corn, we know the US soybean supply and demand situation is bullish heading into USDA’s monthly madness given what we see in both futures spreads and basis. Regarding the latter, my Tuesday evening calculation came in at 49.6 cents under November futures as compared to Monday’s 49.2 cents under November. What should we be looking for in USDA’s numbers Wednesday? Recall the September 1 quarterly stocks figure came in at 274 mb, well above USDA’s September ending stocks guess for 2021-2022 of 240 mb. I’ll be looking for the adjustments that make this pencil out, with smart money riding on residual use going negative once again. There is also a strong possibility some of the 2022 crop was added into the September 1 number, not as unusual an occurrence as one would think. It will also be interesting to see what revisions are made to exports, not only this market year but the previous two as well.

Wheat: The wheat sector was under pressure to start the day with all three markets showing losses on moderate-to-light overnight trade volume. Given Russia’s war on Ukraine, all eyes remain on the Chicago (SRW) market as we make our way through what should have been winter wheat planting season. The December Chicago issue was down 7.0 cents at this writing after posting a trading range of 13.75 cents, from up 2.75 cents to down 11.0 cents, on lighter trade volume of 4,500 contracts. December Kansas City (HRW) was down 5.0 cents with only 800 contracts changing hands through early Wednesday morning. December Minneapolis (HRS) was showing a loss of 2.0 cents on overnight trade volume of 120 contracts. What might USDA have in store for wheat Wednesday? Honestly, USDA views wheat as an afterthought and usually doesn’t make many changes this time of year. However, it will be interesting to see what, if any, changes are made on the global table, particularly Ukraine and Russia. Then there’s the weather situation going on in Australia that will likely fly under USDA’s radar this time around. At the end of the day, traders’ attention should return to the dry situation across the US Southern Plains HRW growing area. We’ll see.

More Grain News from Barchart

- Is it Time to Stock Up on Flour Products?

- Corn Closed Red on Tuesday

- Mixed Soy Market on Tuesday

- Wheats Pullback on Turnaround Tuesday

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)