/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

The pioneering aerospace firm SpaceX, led by Elon Musk, is gearing up for what could be the largest initial public offering in history. Set for 2026, the IPO aims to raise an unprecedented $30 billion, positioning the company’s valuation at approximately $1.5 trillion. The potential offering reflects SpaceX’s ambitious expansion in satellite internet, human spaceflight, and Mars colonization efforts, drawing intense investor interest.

However, details will remain speculative until the filing, leaving questions about whether the stock justifies such a lofty price tag amid regulatory and market risks. While investors await that opportunity to evaluate Elon Musk’s space venture, Rocket Lab (RKLB) stands out as a space stock worth buying today, offering actual growth in the burgeoning commercial space industry.

About Rocket Lab Stock

Rocket Lab is an end-to-end space company specializing in small satellite launches via its Electron rocket, while also building spacecraft and components for various missions. As of the end of 2025, it has conducted over 79 successful launches since its debut in 2017 – 21 this year alone -- establishing a track record of reliability in deploying payloads for clients like NASA and private firms.

The company is also advancing its Neutron rocket, a reusable medium-lift vehicle slated for debut in mid-2026, which will expand its capabilities into larger payloads and more frequent operations. Headquartered in Long Beach, California, Rocket Lab operates globally with three launch pads in New Zealand and Wallops Island, Virginia.

RKLB stock has gained over 190% in the past 52 weeks, significantly outperforming the S&P 500’s ($SPX) 17% gain, driven by record launches and contract wins. Valuation-wise, its forward price-to-sales ratio stands at around 65x, far exceeding the aerospace and defense industry average of 2.8x. Compared to its own historical averages, which hovered in the 30x to 40x range earlier in 2025, the current metric reflects heightened investor optimism.

This elevated P/S suggests the stock appears overvalued relative to broader industry benchmarks, where mature firms trade at lower multiples due to stable revenues. However, for a high-growth player like Rocket Lab, it may be fairly valued, as the ratio accounts for projected revenue acceleration from Neutron and backlog expansion, implying strong future sales potential without immediate profitability pressures.

Why RKLB Is 2026’s Top Space Stock to Buy

Rocket Lab positions itself as a leading force in the rapidly expanding space economy, driven by surging demand for satellite constellations and data services. Through its vertically integrated model— encompassing rocket design, manufacturing, satellite production, and mission operations — the company minimizes risks and costs associated with external dependencies, thereby achieving greater efficiency and superior margins compared to many specialized competitors.

Recent performance highlights this momentum, as third-quarter revenue hit a record $155 million, reflecting 48% year-over-year growth supported by a contract backlog surpassing $1 billion. The Electron rocket, which holds approximately half the small-launch market, secured 17 additional missions in the quarter alongside successful hypersonic testing, setting the stage for an accelerated launch cadence in the coming year.

Further diversification comes from spacecraft development for NASA’s Mars missions and large-scale satellite builds for defense agencies, diminishing reliance on launch revenue alone. The forthcoming Neutron rocket will enable entry into the medium-lift category, dominated by SpaceX’s Falcon 9, opening doors to larger payloads and more complex endeavors.

Bolstered by cash reserves exceeding $1 billion, Rocket Lab funds Neutron development and targeted acquisitions, such as those advancing laser communications, while maintaining financial flexibility. Leadership prioritizes measured advancement and reliability to foster enduring customer confidence.

In an industry increasingly focused on global connectivity and Earth observation constellations, Rocket Lab’s agile, comprehensive capabilities position it to seize emerging opportunities and generate significant value. Its established dominance in small payloads, paired with broadening horizons, underscores considerable growth potential, establishing RKLB as a compelling opportunity in the 2026 space sector.

What Do Analysts Expect for Rocket Lab Stock?

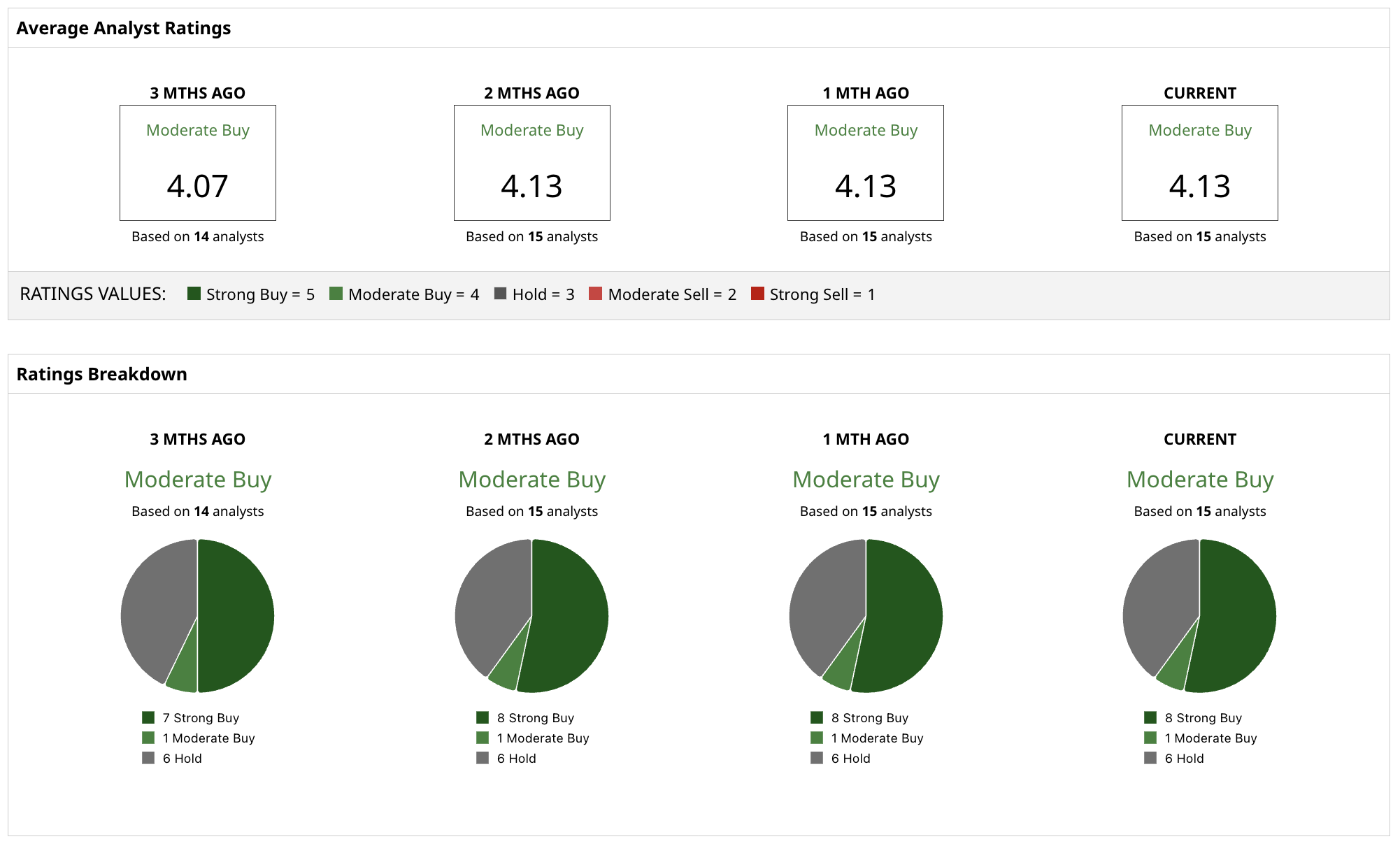

Analysts maintain a positive outlook on Rocket Lab stock, with a consensus rating of “Moderate Buy” based on coverage from 15 analysts, breaking down to eight “Strong Buy” recommendations, 1 “Moderate Buy,” and six “Holds,” with no “Sells.” This reflects confidence in the company’s execution during the space sector’s expansion. In recent months, there have been no major shifts in consensus, though some upgrades followed strong quarterly results and backlog growth, signaling steady sentiment without volatility.

The mean price target stands at $68.83 per share, which represents potential downside of only 5.6% from the current share price of around $73 per share. While this implies modest caution on near-term valuation, higher targets from optimistic firms reach up to $90 per share, suggesting room for upside if Neutron milestones are met ahead of schedule or market conditions improve.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)