Specifications, Statistics, and Uses

Soybean Meal is a by-product of soybeans. Just like gasoline and heating oil are by-products of crude oil. After their fall harvest, soybeans are crushed to remove the oils from the soybean. The majority of that soybean oil is used in food but also has uses in industrial oils, soaps, and biodiesel. After the crushing and extraction of soybean oil, the soybean hulls are left, and then the soybean meal production begins. Typically 1 bushel (60 lbs.) of soybeans will yield 48 lbs. of soybean meal.

98% of Soybean meal is used mainly for animal feeds as a protein supplement. It has been estimated that, of soybean meal provided to animals in the US, 48 percent will be fed to poultry, 26 percent to swine, 12 percent to beef cattle, 9 percent to dairy cattle, 3 percent to fish feed and about 2 percent to pet food.

Soybean meal has consistent seasonal demand each year. During the summer months, livestock is grass-fed in open pastures. The livestock has gained weight as the summer ends, but not enough for processing. During the fall season, many ranchers sell their herds to feedlots, where they will stay until a heavier weight. Part of the reason for selling the herd in the fall is the shortage of grass during winter. While livestock is in feedlots during the winter, soybean meal is consumed to gain weight faster due to the protein content. Another benefit of the soybean meal is that the feedlots are usually cold due to winter weather. This cold can cause livestock to shiver, resulting in weight loss as the body tries to stay warm. Once livestock reaches a certain weight, it is then sent off to be processed for human consumption.

Because of the annual sale of livestock to feedlots every fall season, a seasonal pattern of demand is created for soybean meal that we will discuss.

The front-month December soybean meal contract currently trades at $438.00 per ton. Creating a futures contract notional value is $43,800. The amount of margin required to trade soybean meal futures is $2,650, creating leverage of 17:1.

Recent Performance

Soybean meal has had a solid 9% performance over the past month. Year-to-date performance is 16%, and we haven't experienced the feedlot's seasonal demand. The question will now be, did the July lows put in an early seasonal low for soybean meal?

Fundamentals

Some markets don't get much attention, and soybean meal is one of them. With the fall season approaching, traders will give more attention because of the feedlot demand. And, if China's demand for soybean meal to feed their massive swine population comes back, it will add additional demand this year.

Unlike other commodities that can be stored for years, soybean meal with proper storage can only be kept for up to three weeks after processing. After three weeks, the risk of mold increases beyond healthy levels. Due to this storage issue, sufficient soybean meal must be produced each fall season to carry through until spring when the grasses return.

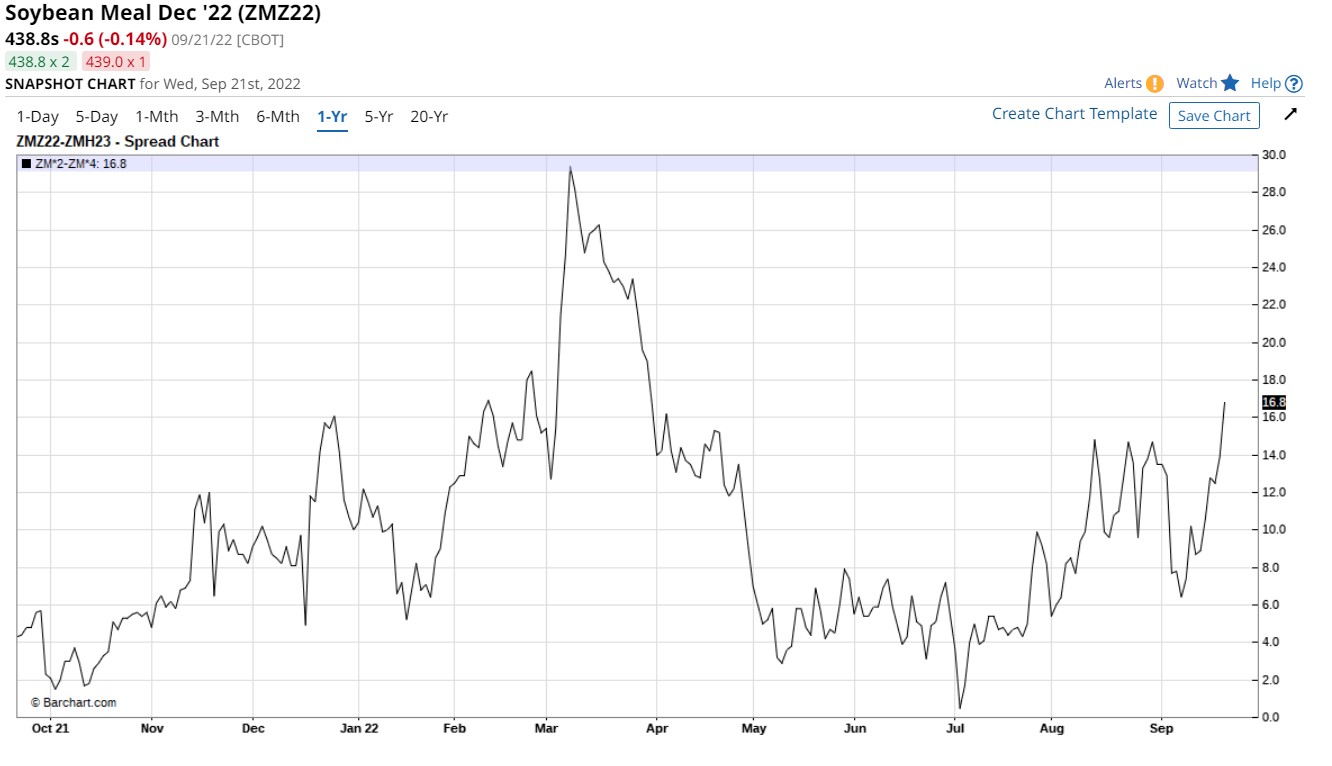

Soybean Meal Spreads

The December 2022/March 2023 intra-market spread is showing bullish tendencies. The spread put in a July low, much like the outright soybean meal futures contract, and is now trading above the July recovery high.

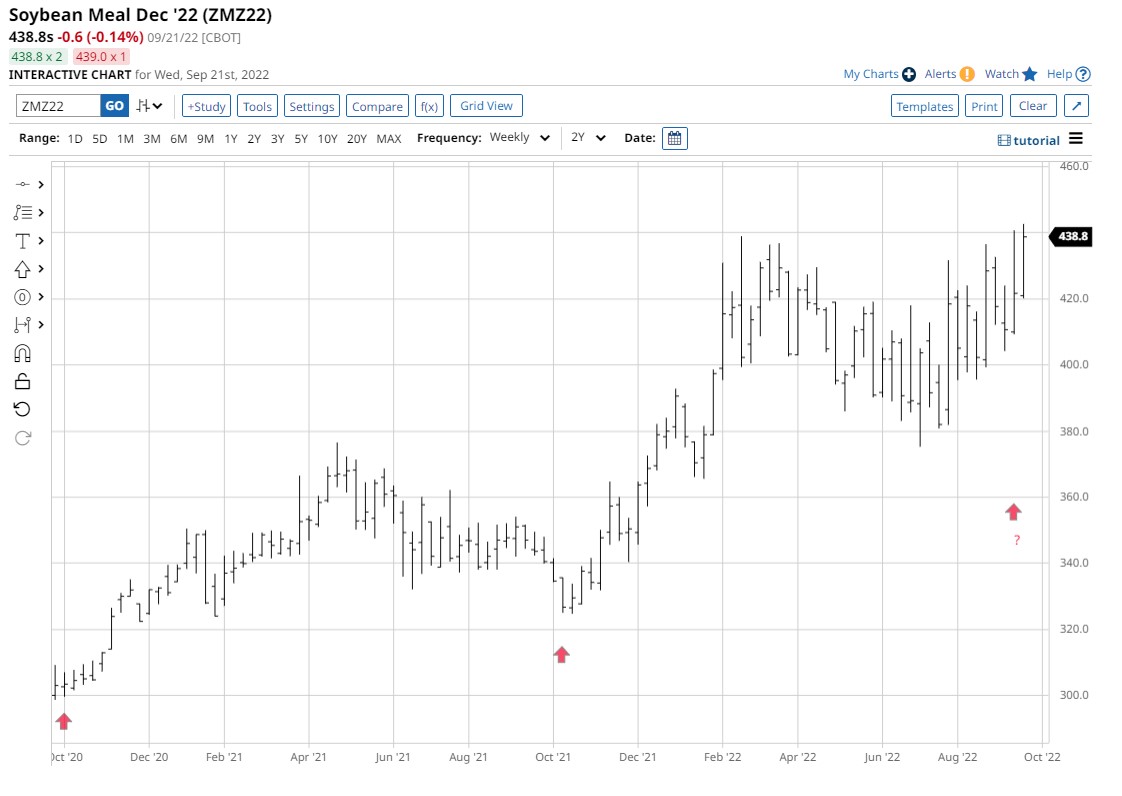

Soybean Meal Technicals

The weekly December soybean meal chart shows a major weekly uptrend since 2020. Since July 2022, there have been progressive higher highs and higher lows.

I included red arrows under the past two October lows to illustrate this strong seasonal pattern that occurs annually. This year soybean meal may have put in its seasonal low early, which can lead to a more robust than average market move.

The highs created during the early part of 2022 may offer some resistance to price temporarily. Still, with the upcoming seasonal demand, there may be enough buyers to push through the resistance.

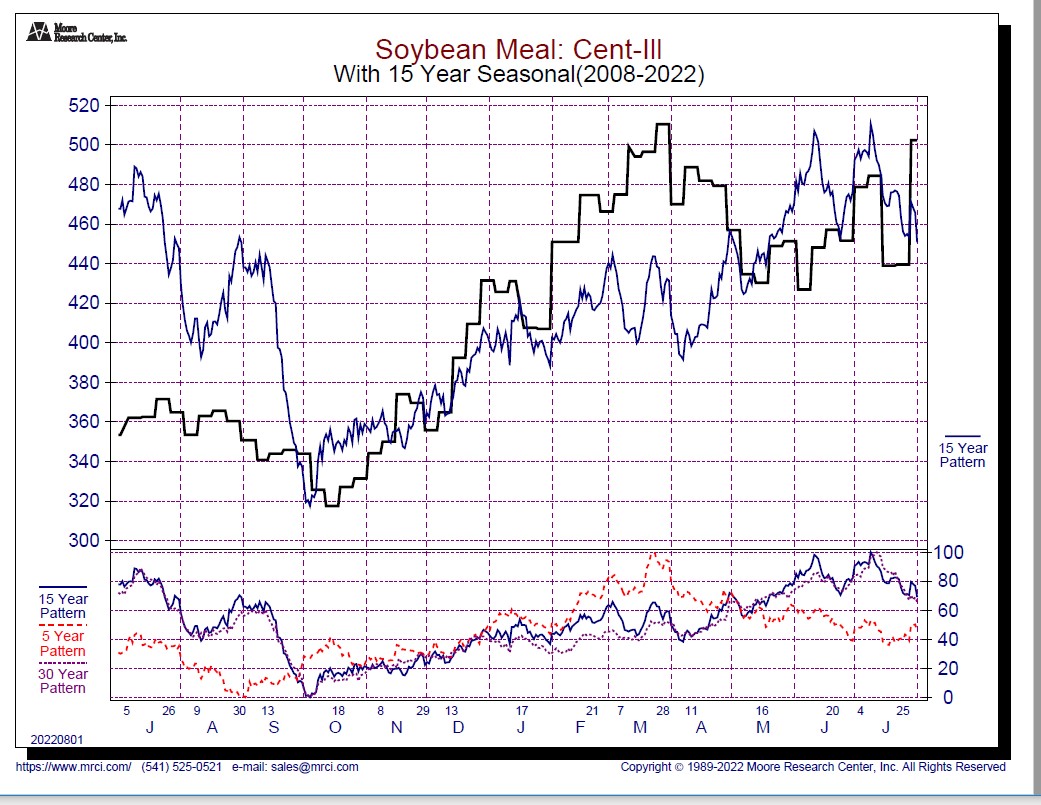

Seasonality

Due to the short storage period of this commodity and the need to feed livestock annually, the seasonal lows in the cash soybean meal market are consistent. Moore Research Center, Inc. (MRCI) research shows this pattern for the past 15 and 30 years. The 5-year pattern has shown signs of an earlier low. There is no specific date to enter your trade, but the research shows a strong tendency for prices to rise after October. There are never any guarantees in seasonality; it is just research of the past and then projected forward.

Source: MRCI

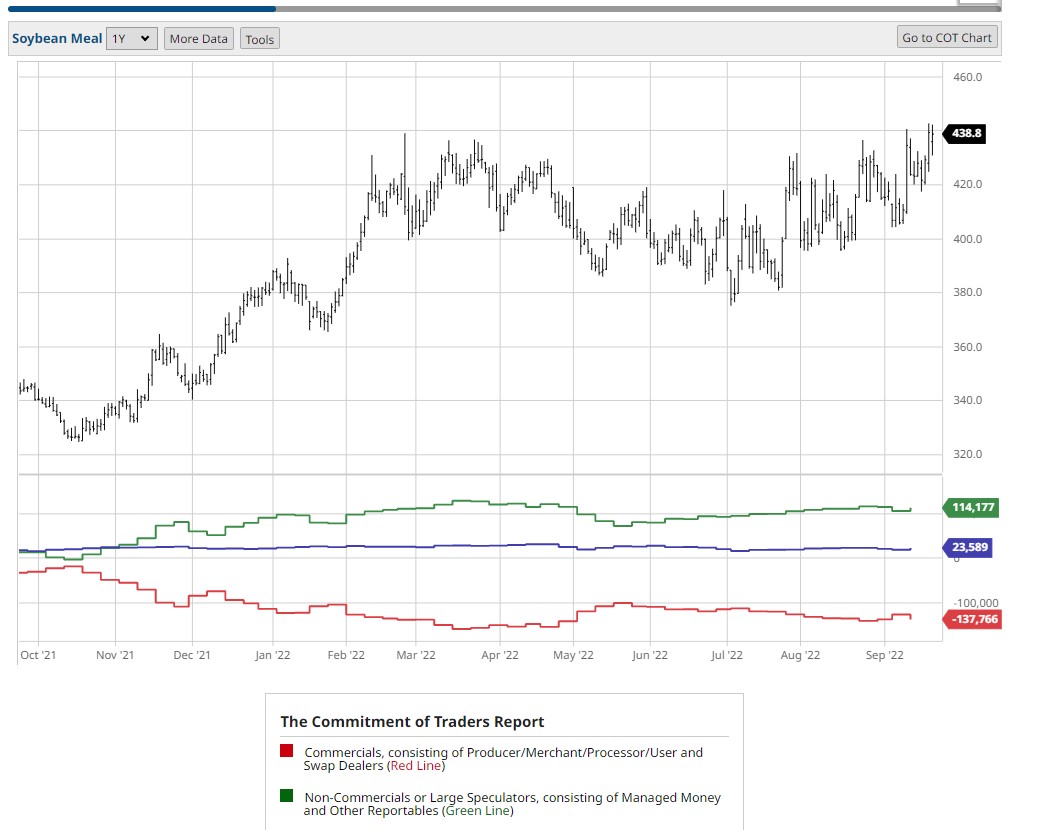

The Commitment of Traders (COT) Report

The COT report shows that non-commercials (large speculators/hedge funds) have been net long soybean meal since November 2021. Their long position is now more bullish than at any time in the past year. The green line (non-commercial traders) is rising each week prices increase. Non-Commercial traders tend to be trend followers, and with their bullish position, it looks like the trend is still intact.

A concern is that commercial traders currently have a significant short position. We need to observe upcoming COT reports and see if the commercials add to their extensive short positions, which could be bearish for prices.

Assets to Trade Soybean Meal

The primary asset is the futures contract that trades on the CMEGroup exchange. The symbol for the soybean meal contract is ZM. Currently, there are no mini or micro futures contracts to trade. There are no soybean meal ETFs with good liquidity for trading. The soybean ETF is the closest, and the symbol is SOYB.

Disclaimer

"Always perform your due diligence when trading new or unfamiliar products."

My intent in this report was not to give trading advice but simply some research to support your trading strategy.

I did not have a position in the soybean meal market as of this writing.

Summary

Soybean meal is one of the commodity products forced to be produced annually due to its short shelf life—creating a relatively consistent seasonal low near October. If the market can trade through the high prices we saw in early 2022, the uptrend will have some momentum.

Depending on how fast the next recession comes, keep in mind that there will be less demand for steak dinners as expendable income might become tighter, reducing demand for cattle and the amount of soybean meal feed needed.

If demand does drop for soybean meal, then I think the stock market bull would be an excellent choice to bulk up with the extra soybean meal that will be available.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)