Copper is the leader of the base metals that trade on the London Metals Exchange, the world’s leading nonferrous forward exchange. Copper prices tend to rise during worldwide economic expansion and fall during contractions. China is the world’s leading copper consumer, while Chile is the top producer. However, copper is a metal with growing applications. In 2021, when copper was on its way to a record high at just below the $4.90 per pound level, Goldman Sachs said that decarbonization is impossible without copper as it is a critical ingredient in electric vehicles, wind turbines, and other green energy initiatives. Aside from being an industrial metal, copper is an energy commodity of the future.

Copper futures trade on the CME’s COMEX division, but the LME forward contracts experience the most volume and open interest as they provide flexibility for producers and consumers that hedge their price risk. After falling $1.50 per pound over the past six months, it may be the optimal time to consider building a long position in the copper arena.

Copper corrected, and the price is consolidating

After reaching a record high of $5.01 per pound in March 2022, COMEX copper futures have made lower highs and lower lows.

The chart highlights the decline to a low of $3.15 per pound in mid-July 2022. At over the $3.40 per pound level on September 2, copper was closer to the recent low and consolidating. The short-term trend was bearish, while the medium-term trend from the 2020 $2.0595 low remained bullish.

Inventories are low, and new production takes almost a decade to develop

LME copper inventories have made lower highs and lower lows over the past five years.

Source: LME/Kitco

Inventories on the most liquid worldwide copper exchange stood below the 111,000 metric ton level at the end of last week.

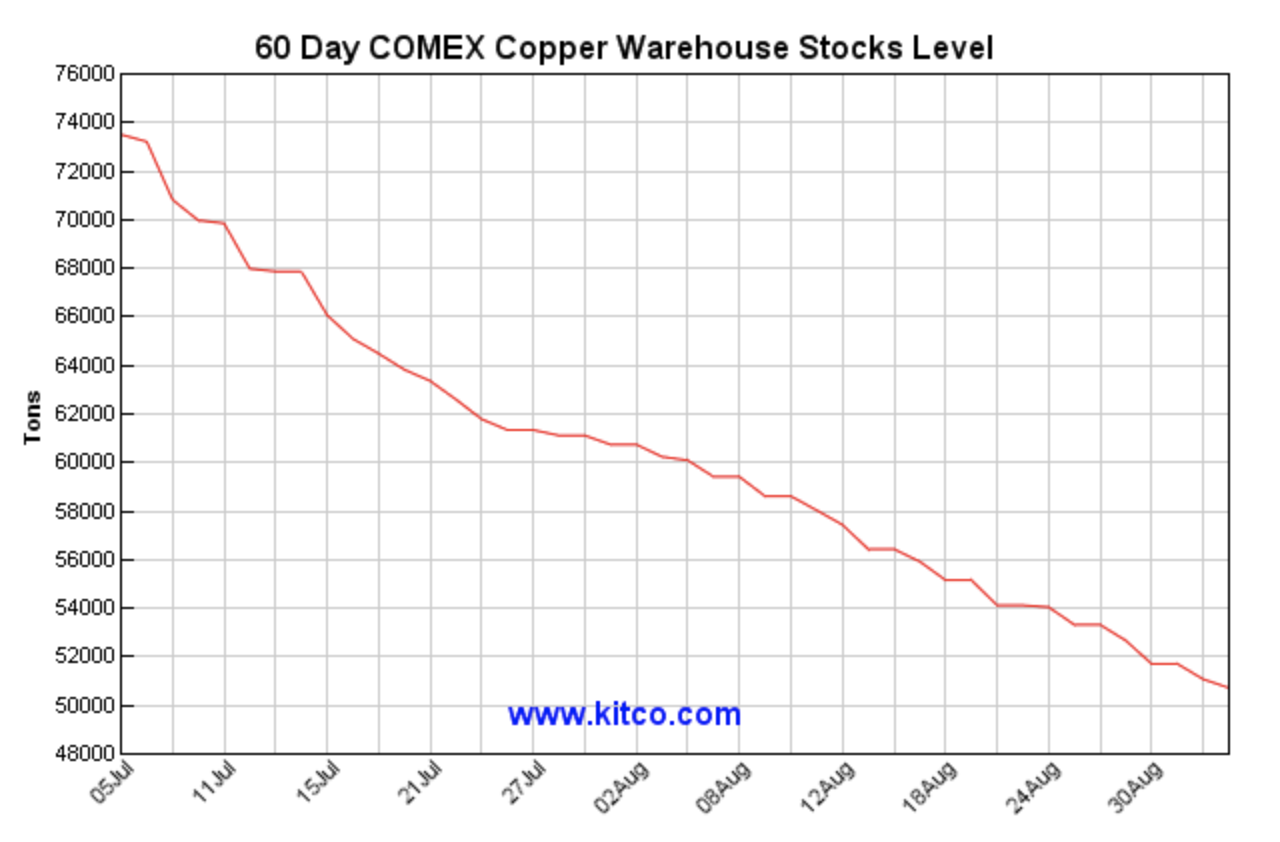

Source: COMEX/Kitco

Copper stocks on the COMEX futures exchange have been steadily declining over the past two months, falling from nearly 74,000 tons to under 52,000 metric tons at the end of last week. Declining inventories tend to be a bullish sign for a commodity.

Meanwhile, it takes nearly a decade to develop new copper production. As the demand for EVs, wind turbines, and other green initiatives increases copper requirements, it will put pressure on the fundamental supply and demand equation, supporting the copper price.

China owns the LME for a good reason- They are the leading base metal consumer

In 2013, a Chinese entity purchased the London Metals Exchange after a competitive bidding process that included the leading US exchanges, the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE). China’s purchase of the UK exchange was no surprise as China is a significant nonferrous metals producer and the world’s leading consumer of metals that are infrastructure building blocks. The LME provides contracts for base and ferrous metals that the industry favors for hedging because of the flexibility of settlements on each business day.

Over the past months, COVID-19 lockdowns have weighed on metal prices as it has caused a slowdown in Chinese business activity. Moreover, rising interest rates to battle inflationary pressures have increased the cost of carrying metal inventories. Increasing US rates have pushed the US dollar higher. The dollar index, which measures the US dollar against other world reserve currencies, rose to a new two-decade high last week at 109.980. Since the US dollar is the world’s reserve currency, it is the pricing mechanism for many commodities, including base metals and copper. A rising dollar tends to weigh on raw material prices. The Chinese economic slowdown, higher interest rates, and a strong US currency create a potent bearish cocktail for copper and other base metals.

An end to COVID-19 concerns in China could turbocharge a copper rally

In the short term, the critical issue facing the copper market is the economic malaise in the leading consuming country, China. An end to COVID-19 lockdowns and economic growth in the country with 1.4 billion people and the second-leading economy will likely cause copper demand to increase. Low stockpiles, addressing climate change, and the return of Chinese demand will likely cause copper prices to resume the upward trajectory. In 2021, Goldman Sachs analysts forecast that LME copper prices will rise to the $15,000 per ton level by 2025. As of September 2, the LME three-month copper forwards were just below $7,600 per ton. With Goldman Sachs projecting a nearly 100% increase in the price, we could see nearby COMEX futures rising to almost the $7 per pound level. A return of Chinese demand could ignite another rally that leads to a higher high above the early 2022 peak when copper probed over the $5 per pound level.

CPER and JJC track the copper price

The most direct route for a risk position in copper is via the LME forwards for the futures and futures options on the CME’s COMEX division. Two products track copper for those looking to participate in the copper market without venturing into the forward or futures markets:

- At $17.02 per share, the iPath Series B Subindex TR ETN product (JJC) had $55.826 million in assets under management. The ETN trades an average of 30,105 shares daily and charges a 0.45% management fee.

- At $20.45 per share, the US Copper ETF product (CPER) had $143.616 million in assets under management. The ETF trades an average of 94,610 shares daily and charges a 1.08% management fee.

The last rally in nearby COMEX copper futures took the price from $3.1500 in mid-July to a high of $3.7850 in late August, a 20.2% increase.

Over the same period, the JJC ETN rose from $15.86 to $18.84 per share, or 21.2%.

Over the same period, the CPER ETF moved from $19.11 to $22.94 per share, a 20% rise.

While CPER offers more liquidity, it charges a higher fee and underperformed the JJC product. However, both did an excellent job tracking the copper price during the most recent rally. At below the $3.50 per pound level, copper is an attractive asset to add to portfolios. However, picking bottoms in any market is impossible, so purchases should leave plenty of room to add to long risk positions on further declines.

More Metals News from Barchart

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)