Traders rotate out of silver and into gold as the Gold–Silver ratio rebounds to 51:1. Phil Streible breaks down what’s driving the shift and the key levels traders are watching in today’s Metals...

Gold is in an uptrend and is now printing new highs, supported by rising geopolitical tensions between the US and Iran, as well as growing political pressure around the Fed’s independence

The dollar index (DXY00 ) dropped to a 2-week low on Tuesday and finished down by -0.79%. The dollar retreated on Tuesday as President Trump's push to take over Greenland is reviving fears of trade confrontations...

Base metals were the second-best-performing sector of the commodities asset class in Q4 2025 and the third-best over the entire year. As the sector is now in 2026, the trends for base metals remain bullish...

This could actually happen. Silver could temporarily rally based on all this. I’ll get back to this shortly. Meanwhile, let’s take a look at context.

The dollar index (DXY00 ) dropped to a 2-week low today and is down by -0.84%. The dollar is falling today as President Trump's push to take over Greenland is reviving fears of trade confrontations between...

The first year of Trump's second term brought strong stock market gains, but the underlying fundamentals have not improved much, which could become a problem.

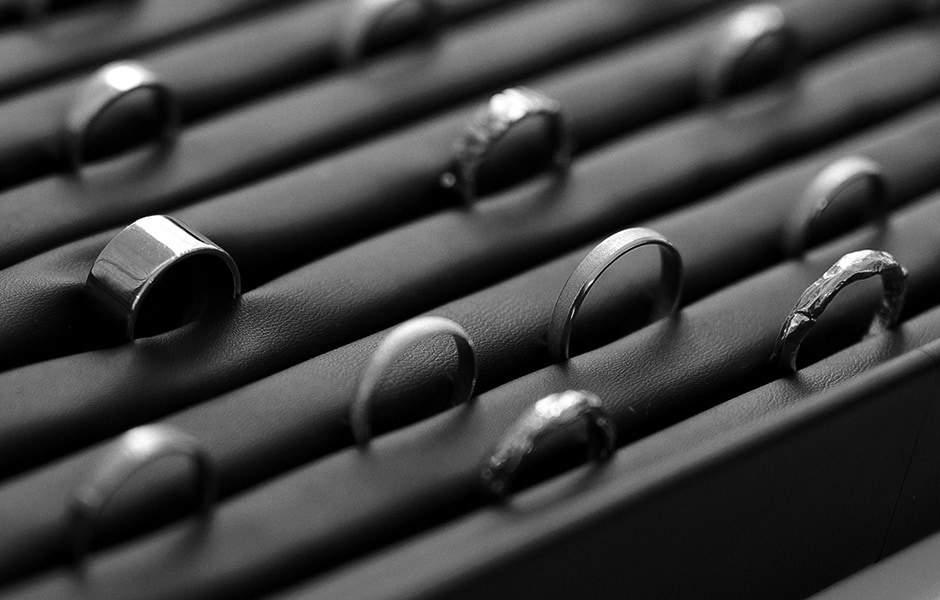

Review the latest platinum jewelry demand forecast, highlighting growth driven by the metals’ price discount to gold and a newly diversified global market.

As the financial elite gather in Davos, Switzerland, the war of words between the US president and - well - everyone else continues to grow louder.

With gold near record highs and policy, currency, and geopolitical risks pushing investors toward hard assets, GLD offers a simple way to ride or hedge the bull market.