With markets looking increasingly volatile, investors might be more interested in generating income rather than capital gains.

Financial stocks have typical paid reasonable dividends, but in this era of low interest rates (maybe not for much longer), yields are quite low.

Thankfully, as sophisticated investors, we can generate an additional income from holding banks stocks by using options. The strategy is a known as a covered call which involves selling call options against a stock position.

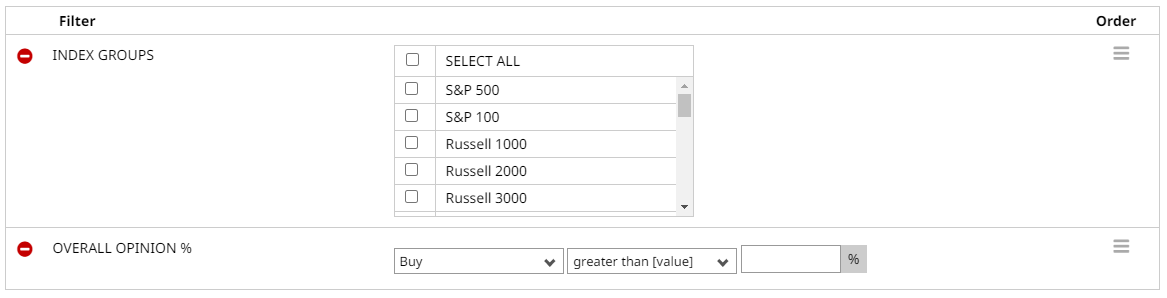

Let’s firstly check which bank stocks have a Buy or Hold Rating. To do this go to the Stock Screener and use these Parameters:

Looking at the table below, Raymond James Financial (RJF) is one name that stands out, so let’s use that in our Covered Call Screener.

RJF Covered Call Example

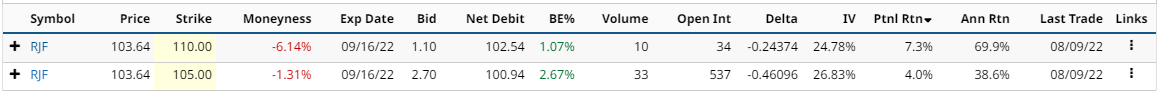

When running the Covered Call Screener for RJF, we find the following results:

Let’s evaluate the second RJF covered call example. Buying 100 shares of RJF would cost $10,364. The September 16, 105 strike call option was trading yesterday around $2.70, generating $270 in premium per contract for covered call sellers. Selling the call option generates an income of 2.67% in 37 days, equalling around 26.39% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 105?

If RJF closes above 105 on the expiration date, the shares will be called away at 105, leaving the trader with a total profit of $406 (gain on the shares plus the $270 option premium received). That equates to a 4.02% return, which is 38.6% on an annualized basis.

Barchart Technical Opinion

The Barchart Technical Opinion rating is an 8% Buy with an average short term outlook on maintaining the current direction. The market is in highly overbought territory. Beware of a trend reversal.

Long term indicators fully support a continuation of the trend.

Implied Volatility

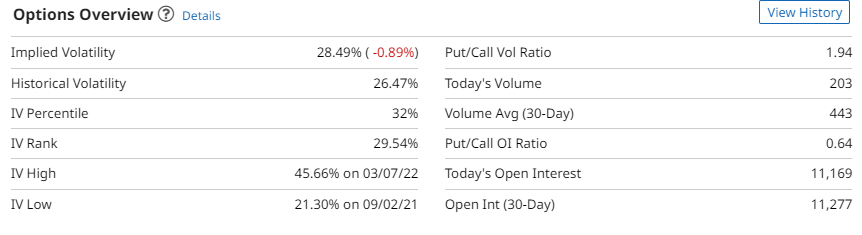

Implied volatility is at 28.49% compared to a 12-month low of 21.30% and a 12-month high of 45.66%. Some traders may prefer implied volatility to be higher before starting a covered call trade.

Company Profile

Raymond James Financial, Inc. (RJF) is a financial holding company whose broker-dealer subsidiaries are engaged in various financial services, including the underwriting, trading & brokerage of equity & debt securities & the sale of mutual funds & other investment products. In addition, other subsidiaries of RJF provide investment management services for retail and institutional clients, corporate and retail banking, and trust services. RJF's principal subsidiaries are Raymond James & Associates, Inc. (RJ&A), Raymond James Financial Services, Inc. (RJFS), Raymond James Financial Services Advisors, Inc. (RJFSA), Raymond James Ltd. (RJ Ltd.), Eagle Asset Management, Inc. (Eagle), and Raymond James Bank, N.A. (RJ Bank). All of these subsidiaries are wholly owned by RJF. RJF provide investment services for which charge sales commissions or asset-based fees based on established schedules. RJF provide custodial, trading, research and other back office support and services.

Financial stocks are a common component of most investment portfolio and now you know how to generate an income from your RJF position now.

Traders could look at other stocks from the initial screener such as Goldman Sachs (GS), CBOE Global Markets Inc (CBOE), First Republic Bank (FRC) and Progressive (PGR)

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Steven Baster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, August 9, 2022.

More Stock Market News from Barchart