AT&T (T) stock now trades at a dividend yield of 6.1%. Moreover, the stock is cheap with its forward price-to-earnings (P/E) multiple of just over 7 times earnings. In addition, investors are now shorting out-of-the-money calls and shorting out-of-the-money puts to create extra income with this value stock.

At $18.14 on Aug. 8, AT&T's annual dividend of $1.11 gives T stock a 6.11% dividend yield. Moreover, analysts now project $2.54 in earnings per share (EPS) this year and $2.52 next year. So the dividend is well covered by the earnings projections from many analysts.

AT&T generated $1.4 billion in free cash flow (FCF) during Q2 and the company indicated that its 2022 FCF is forecast to be $14 billion. However, given that it will have lower interest costs, and lower capex requirements (now that it is focused only on telecom), FCF in 2023 could be higher.

As AT&T now has 7.126 billion shares outstanding, its $1.11 dividend will cost $$7.9 billion. That is only 56.5% of its projected 2022 $14 billion FCF. Moreover, assuming that the 2023 FCF rises at least 10% to $15.4 billion, the dividend costs will be just over half (51.3%) of its projected FCF in 2023.

This shows that the market fears about a dividend cut in T stock are overblown. That makes it a good value now. Moreover, some investors are shorting out-of-the-money (OTM) puts and OTM calls.

Creating Income Selling T Stock OTM Puts

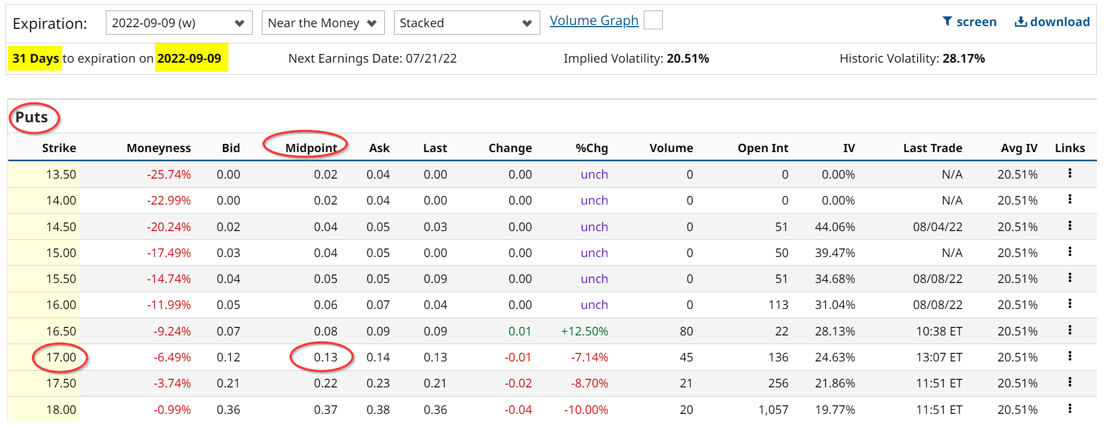

The Barchart put option chain below shows how investors can make money selling short-dated out-of-the-money (OTM) puts in AT&T.

This shows that an investor can sell 1 put contract for the $17.00 strike price and receive $13.00 immediately. Based on the potential $1,700 purchase price at this strike price, the one-month yield is therefore 0.765%. That works out to an annualized yield of 9.17%. The only risk here is that if the stock falls below $17.00 per share the investor has to purchase the shares at $17.00.

But think about that. At $17.00 AT&T stock will have a 6.53% dividend yield. That is very attractive. As a result, I suspect that this put contract has very little risk to most short sellers at this strike price.

Selling OTM Calls

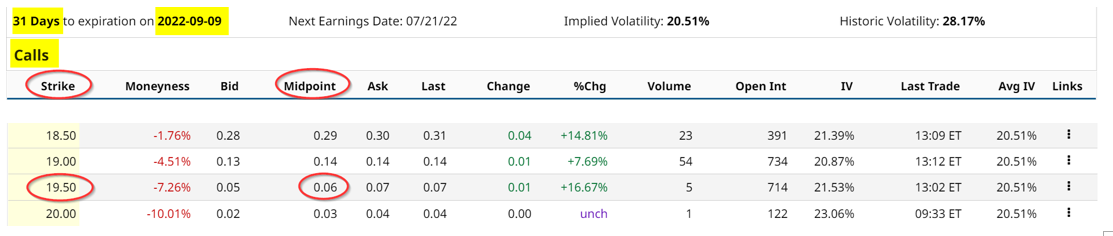

In addition, selling AT&T's out-of-the-money calls on a covered basis that are one month out is also attractive. Look at the Barchart table below.

This shows that the Sept. 9 $19.50 strike price calls provide a $6 per call contract for an investor who pays $1,814 for 100 shares today. That works out to a one-month yield of 0.33%, or 3.96% annually.

This has the risk that the stock could rise to $20.00 or more by Sept. 9, which is very possible. At that price, AT&T stock would have a 5.55% dividend yield, which is still very high. So there is a high risk the calls could be exercised.

As a result, I suspect that most investors will choose to sell out-of-the-money puts, rather than calls here. The balance of the risk seems to benefit shareholders who sell OTM puts in this stock.

More Stock Market News from Barchart