While US energy policy continues to address climate change, fossil fuels power the world. Energy prices increased in Q2 and the first half of 2022, leading the commodities asset class. Natural gas declined in wild trading that saw the price explode to a fourteen-year high before plunging at the end of Q2. Oil, oil products, refining spreads, coal, and ethanol prices all moved to the upside in Q2, and all traditional energy prices posted gains over the first six months of 2022.

As we move forward into the second half of 2022, energy prices retreated from the highs but remained at the highest levels in years. The composite of the energy sector gained 6.77% in Q2 and was 43.86% higher over the first half of this year.

Nine consecutive quarterly gains in crude oil

Nearby NYMEX crude oil closed at $105.76 on June 30, 5.46% higher for the quarter and 40.62% above the price at the end of 2021. Brent futures were at the $109.02 level, up 5.07% in Q2 and 40.24% higher over the first half of 2022.

The chart highlights that crude oil moved higher over the past nine consecutive quarters since Q2 2020. US energy policy that handed pricing power back to OPEC, the war in Ukraine, sanctions on Russia and

Russian retaliation and increased demand in the post-pandemic era pushed the energy commodity to the highest price since 2008. In early July, the price of NYMEX August futures was above the $110 per barrel level despite an unprecedented release from the US strategic petroleum reserve.

Oil products and refining spreads reach record highs

Consumers require oil products. Most cars in the US and the world continue to run on gasoline. In Q2, NYMEX gasoline futures rose 12.23% and were 58.96% above the closing level on December 31, 2021. Gasoline futures settled at $3.5363 per gallon wholesale on June 30.

The chart shows that gasoline futures reached a new all-time high of $4.3260 per gallon in June. Heating oil futures are a proxy for other distillates, including jet and diesel fuels.

The chart of nearby NYMEX heating oil futures shows the move to a record $4.7072 high during Q2 in April. The price closed at the $3.8305 per gallon wholesale level on June 30, 13.97% higher for the quarter and 64.73% above the end of 2021 close.

Crack spreads reflect the refining margin for processing a barrel of crude oil into gasoline and distillate products. Crack spreads are a real-time indicator of the demand for oil products, and they reached record highs in Q2 2022. The gasoline crack spread rose to $61.95 per barrel, and closed Q2 at the $43.69 level, up 38.43% for the quarter and 140.05% in 2022.

The distillate crack spread reached a peak of $76.07 in Q2, closed at $55.99 on June 30, and was 38.25% higher in the second quarter. Distillate cracks moved 148.18% higher since the end of 2021.

Natural gas exploded and imploded

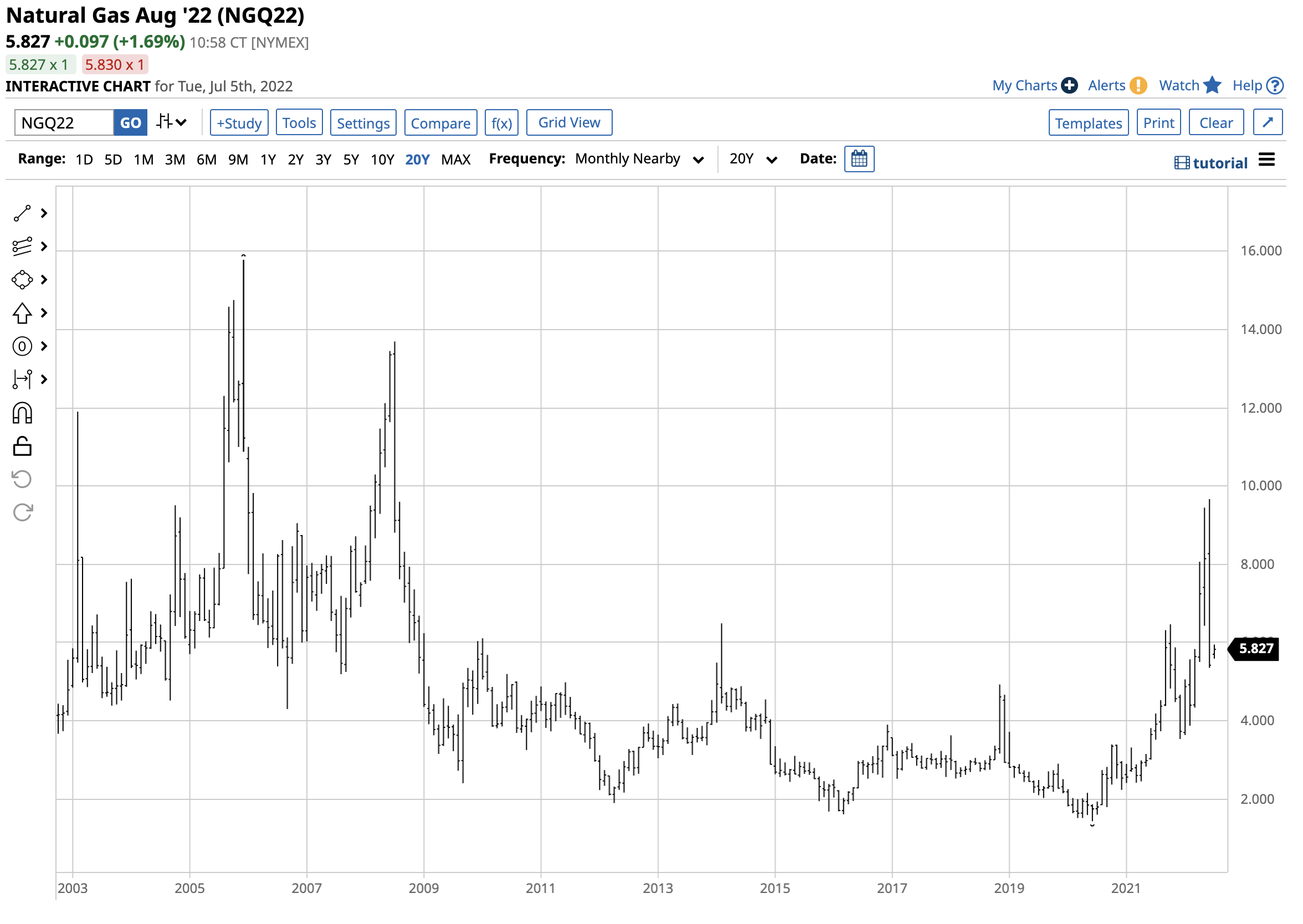

Natural gas is a highly volatile commodity. In June 2020, the nearby natural gas futures price reached a twenty-five-year low of $1.44 per MMBtu. In Q4, the range from low to high was $4.307 per MMBtu, with the high and the low coming in June.

The monthly chart shows natural gas futures rose to the highest level in fourteen years in June, exploding to a high of $9.664 before imploding and closing the quarter at $5.424, 3.86% lower in Q2 and 45.42% higher over the first half of 2022.

Natural gas has become a far more international commodity since US LNG now travels far beyond the North American pipeline network. Supply concerns in Europe because of the war in Ukraine and rising prices in Asia put upward pressure on US natural gas prices. On July 4, the August NYMEX futures price was above the $5.80 per MMBtu level.

Coal and ethanol move higher

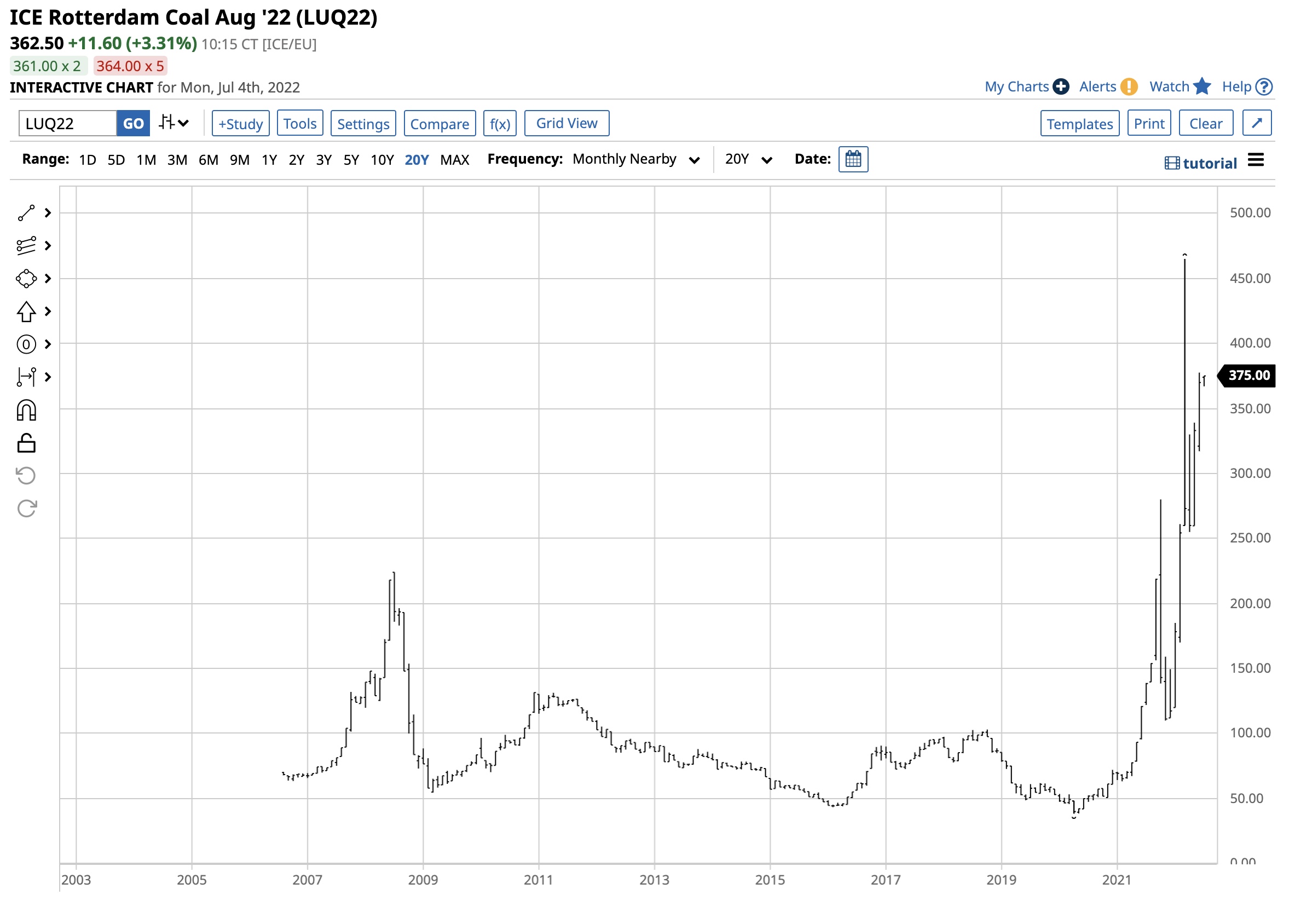

Coal continues to be a significant energy commodity for worldwide power generation.

The chart shows the ascent of coal prices in 2022. In Q2, thermal coal for delivery in Rotterdam, the Netherlands, moved 35.53% higher to the $370 per ton level. Over the first six months of this year, Rotterdam coal moved 215.16% higher.

Ethanol is corn-based biofuel blended with gasoline in the US. In Q2, Chicago ethanol swaps gained 7.76% to $2.57 per gallon wholesale and were 13.22% higher than at the end of 2021.

The outlook and issues for fossil fuels in Q3 and beyond

The war in Ukraine and tensions between NATO and Russia will continue to put upward pressure on hydrocarbon prices over the coming months. US energy policy addressing climate change has made the US and the world more dependent on OPEC and Russia for oil and gas supplies. High prices are causing China and India to burn more coal to generate electricity. Meanwhile, the highest grain and oilseed prices in years support the rising biofuel prices.

During Q3, the hurricane season could threaten natural gas and petroleum infrastructure along the US Gulf Coast. Later this year, a cold 2022/2023 winter season may cause Russia to tighten the supply noose around Western Europe’s neck, causing fuel shortages and higher prices. The US may be unable to fill the void as oil, oil product, and natural gas inventories remain significantly below the five-year average at the end of Q2.

While I am bullish on oil, gas, biofuel, and even coal prices at the end of the second quarter, bull markets rarely move in straight lines, and the potential for sudden and brutal corrections rises with the prices.

More Energy News from Barchart

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Seagate%20Technology%20Holdings%20Plc%20office-by%20JHVEPhoto%20via%20Shutterstock.jpg)