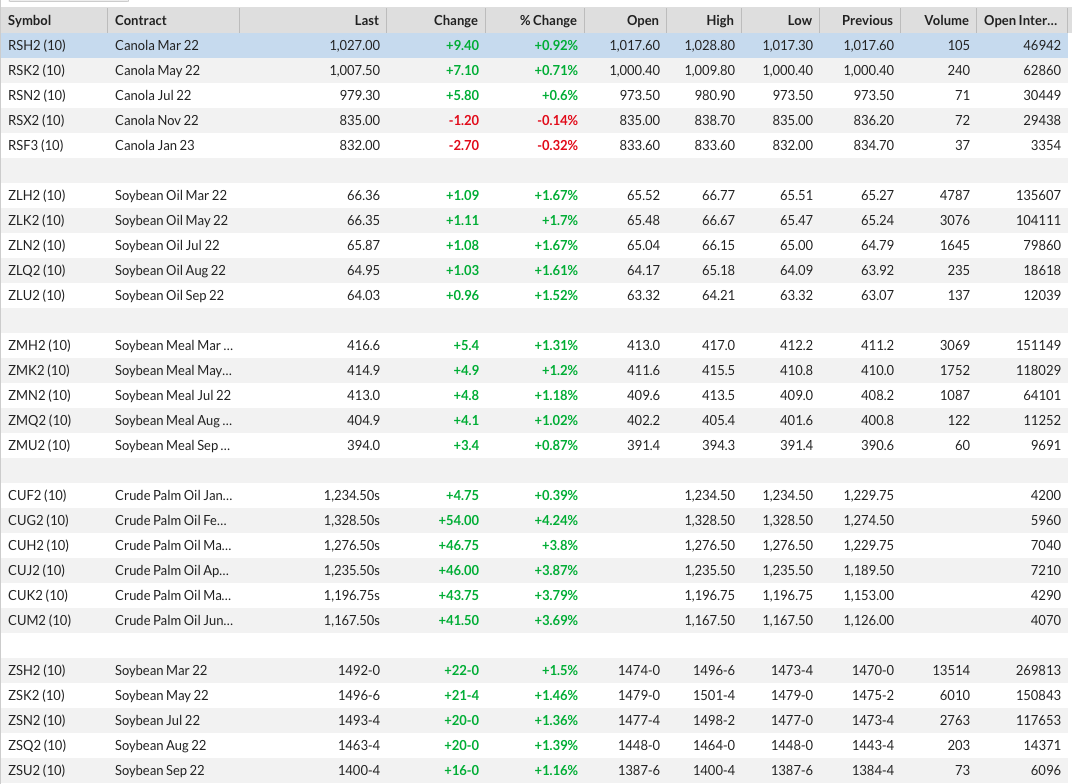

- The oilseed sector is showing consistent bullish supply and demand, across the board, with market's inverted forward curves.

- This continues to tell us the story the commercial side of the various markets are concerned about real global supply and demand, with weather the key factor in a number of situations.

- Both commercial and noncommercial traders continue to buy, the latter seen in recent weekly CFTC Commitments of Traders reports.

We’ve reached midnight (ET) here in North America, so the title of this piece is accurate in that respect. Also, the oilseed sector is on fire to start the new week so we can safely say it’s burning. A quick look at Sunday night/Monday morning market activity shows a consistent rally, led by 1.5% gains posted by both soybeans and soybean oil (I’m not seeing quotes from Malaysian palm oil, with the 4.0% rally registered last Friday). Those who are watching the various markets closely should not be surprised all markets remain red hot.

A week ago today (Monday), I was in Atlanta speaking at a US Soybean Export Council (USSEC) meeting with the honored guests a contingent of dignitaries and industry leaders from Nigeria. My part of the program was simple: Talk about the US soy complex supply and demand situation. I showed them my slides of US available stocks of soybeans continuing to tighten (something I will update again when January ends), with my end of December calculation coming in at 0.3% (as compared to USDA’s guesses equating to ending stocks-to-use of 8%). My message was as it always is: We can read the story of real supply and demand by simply looking at futures spreads, and that story is bullish as far out as one wants to look.

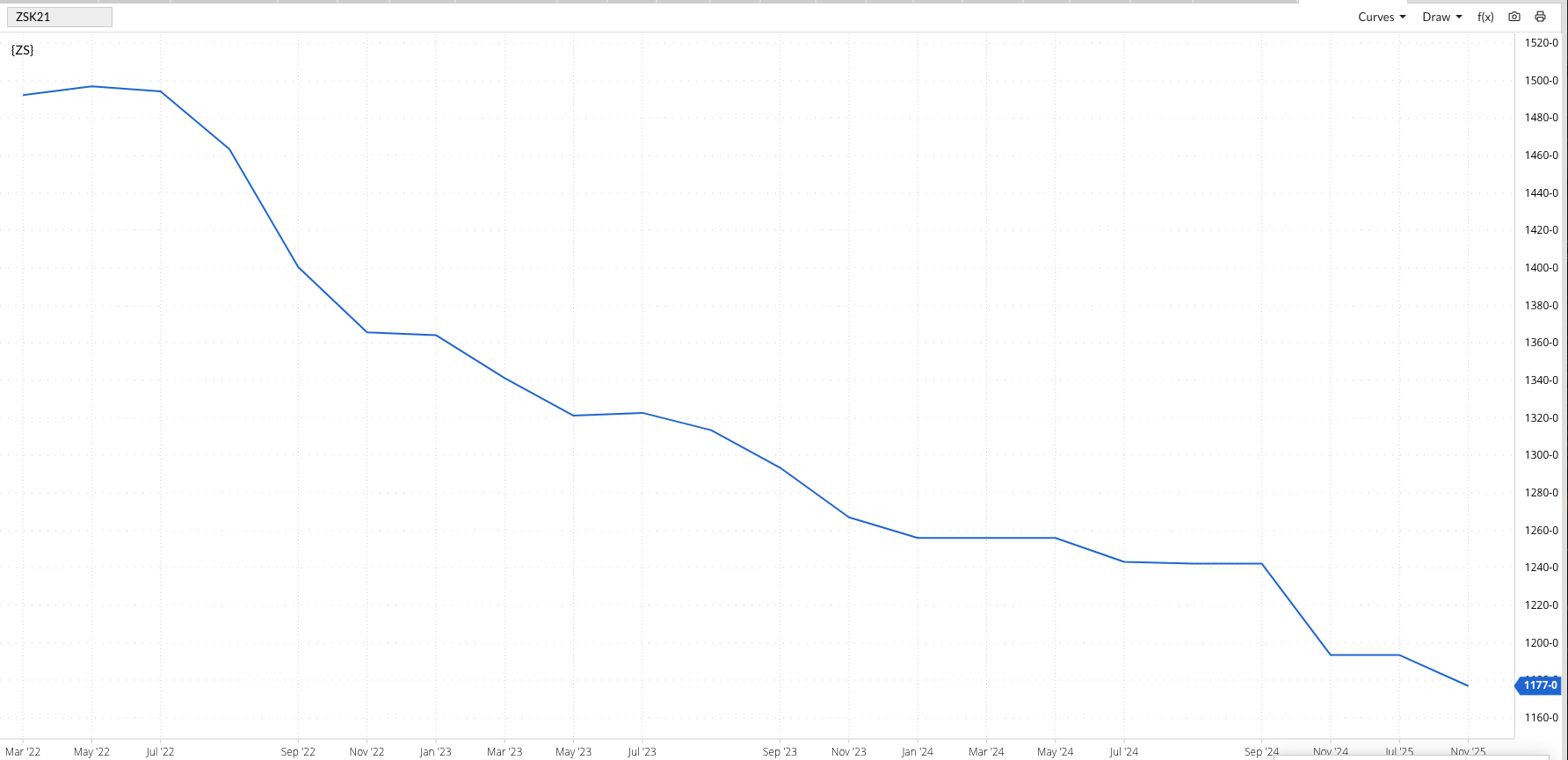

In the soybean market, we see a small carry in the March-May futures spread due to South American harvest. However, the more telling spread is May-July going inverted, a timeframe that covers South American production basically being completed. This tells us the commercial side is growing increasingly concerned over the global supply and demand situation. Additionally, the market’s forward curve is inverted from the May 2022 issue through at least the January 2024 contract, meaning the initial 2023-2024 November-January spread is showing an inverse. We can actually take this out through the November 2025 contract. Impressive.

We see a similar price relationship in soybean meal where the forward curve is generally inverted from March 2022 through December 2024. Given Argentina is the world’s largest soybean meal exporter, this speaks volumes about the commercial side’s opinion of Argentine production this year due to drought. Not to be outdone, soybean oil’s forward curve is also inverted from March 2022 through December 2024. At last week’s meeting I was also part of a panel discussion regarding renewable diesel in the US, a program expected to create a demand market (new demand pulling on steady to growing supplies, resulting in a long-term price change) in soybean oil. Canola is also fundamentally bullish long-term, again indicated by the market’s inverted forward curve from March 2022 through March 2024. Here we see my idea oilseed futures at their core are weather derivatives, with continued drought over the Canadian Plains the key factor.

My message to the USSEC and industry leaders from Nigeria was buy cash oilseed supplies when one can, because supplies are going to be tough to come by. As we start another week, and soon another month, that still looks to be the case. One last note from the meeting: My friend who invited me to speak, one of the Regional Directors of USSEC, introduced me by saying he had never heard me be so bullish. He’s probably right. But then again, all I’m doing is looking at a market sector that is as red-hot bullish as anything I’ve seen in a long, long while.

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)