/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

According to recent media reports, Intel (INTC) is on track to acquire AI chip startup SambaNova. SambaNova offers a full-stack AI platform that helps run AI applications both on private clouds and in data centers. Rumors around the deal started in October, but they seem to be getting more credible as time passes, especially with the two companies already having an existing relationship.

Lip Bu-Tan, who is the CEO of Intel, is also the executive chairman of SambaNova. Intel Capital has already made an investment in the company, and Japanese tech company SoftBank (SFTBY), which took a stake in Intel in August, is also a stakeholder in SambaNova. This brings back the AI circular economy debate, but the relationship raises the probability of an eventual acquisition of SambaNova by Intel.

The deal will help Intel penetrate a market segment it has been lacking in. As things stand, Intel does not offer AI appliances like the Nvidia (NVDA) DGX racks or GroqRack. SambaNova sells similar racks and, therefore, allows Intel to enter the enterprise AI market to snatch market share from other AI companies. The fact that SambaNova already has some traction in finance, healthcare, defense, and the government is a positive sign for Intel if the acquisition goes through. Investors would need to wait for regulatory approval and initial feasibility studies before a deal is finalized.

About Intel Stock

Intel is a famous CPU maker, with many consumers familiar with the “Intel Inside” sticker on their laptops, referring to the Intel processors that still power the majority of the world’s PCs today. The company employs over 88,000 people and is based in Santa Clara, California.

INTC stock has nearly doubled over the past year, significantly outperforming the S&P 500 Index’s ($SPX) 13.19% returns during the same period. These returns were mainly driven by the interest shown by President Donald Trump in taking a U.S. government stake in the company and ensuring its turnaround, sparking renewed investor confidence.

After doubling in the span of a year, Intel’s valuation is high when compared to its own five-year average. For example, the forward price/sales ratio of 3.7x is 46% above the five-year average of 2.52x. The forward price/cash flow ratio of 18.34x is also high compared to the five-year average of 11.57x.

There are various ways to look at the above data. Intel’s management had done such a poor job of running the company over the last five years that its valuation had dropped to ridiculous levels. Nobody wanted a piece of the dying giant. The company itself brought back a veteran in Pat Gelsinger to save the sinking ship, then fired him for not executing fast enough.

Another opinion is that with the government’s backing and its own unique position in the chip industry, the company is a gem and a buy at any valuation. Investors would hope that this is the case right now and the SambaNova acquisition unlocks further value, as is planned. Intel may not be like one of those flashy AI investments that people have become used to, but it certainly is a turnaround story, now with the U.S. government’s backing!

Intel Posts a Surprise Earnings Beat

On Oct 23, Intel announced its Q3 earnings report, surprising investors with its profitability. It reported $13.65 billion in revenue versus consensus estimates of $13.15 billion. The EPS of $0.11 came as a real surprise, as analysts were expecting the company to post a loss in the quarter.

Going forward, Intel expects a revenue of $13.3 billion at the midpoint in the fourth quarter, translating to an expected EPS of $0.08. This excludes the financial impact of the Altera sale, a subsidiary of Intel.

On the earnings call, CEO Lip Bu-Tan reiterated the company’s resolve to advance Donald Trump’s vision for the company, showing how integral the U.S. government has now become to the company’s future plans. On joining forces with Nvidia (NVDA), the CEO said the focus is on creating a new class of products that will increase the pace of AI adoption. The company ended Q3 with over $30 billion in cash and short-term investments.

What Analysts Are Saying About INTC Stock

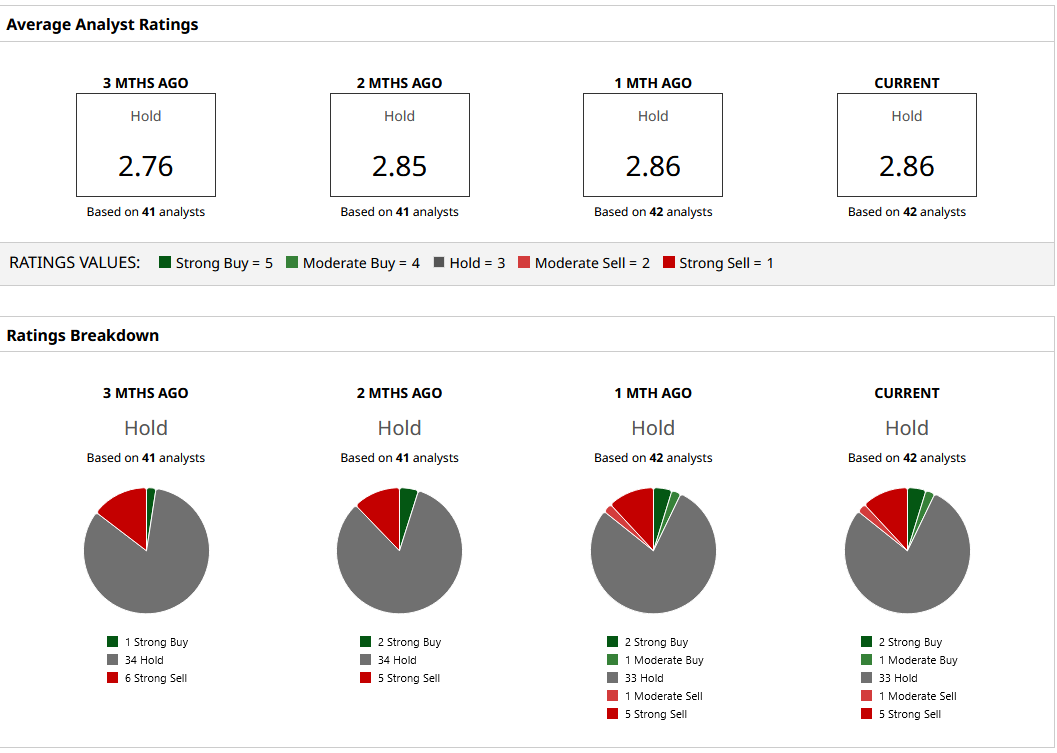

42 analysts cover INTC on Wall Street, with 33 of them maintaining a “Hold” rating on the stock. Five analysts have a “Strong Sell” rating. Consensus suggests analysts are not as confident in the company’s prospects despite its unique position in the semiconductor industry. However, this is precisely what Intel is trying to change through acquisitions like that of SambaNova.

The stock price’s one-year rally has meant that it now trades above the mean target price of $35.98. However, the highest target price of $52 still offers 32% upside from current levels.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)