/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Artificial intelligence (AI) has certainly become a huge investment focus for Big Tech companies, and e-commerce giant Amazon (AMZN) is no different. AI is now woven into its retail platform, cloud business, devices, and advertising arm. In fact, since the launch of OpenAI’s ChatGPT in 2022, the company has poured billions into AI, using the technology both to enhance its own operations and to build new tools.

Amazon has developed AI chips and expanded its portfolio of AI products and services through its Amazon Web Services (AWS) segment, positioning itself as both a user and provider of advanced AI capabilities. And now things are getting even more interesting. Reports say Amazon is in talks to invest up to a massive $50 billion in OpenAI as the AI startup seeks funding to cover the substantial costs of training and operating its AI models.

Not many details are available yet, but discussions are reportedly being led by Amazon CEO Andy Jassy and OpenAI CEO Sam Altman. If finalized, this would make Amazon the biggest contributor to the ChatGPT maker’s current fundraising round. What really makes this deal stand out even more is that Amazon already has deep ties with Anthropic, one of OpenAI’s main competitors, showing that the company isn’t putting all its AI eggs in one basket.

So, with Amazon backing multiple major AI players while continuing to build out its own AI muscle, how should investors position themselves in AMZN stock now?

About Amazon Stock

Seattle-based Amazon might be famous for online shopping, but its journey into a full-scale tech powerhouse has been seriously impressive. What started as an e-commerce leader has grown into a company with its hands in cloud computing, artificial intelligence, data centers, and digital entertainment. Today, Amazon plays a role in how people shop, stream, work, and even develop new technology.

From Prime Video and Amazon Music to gaming and Twitch, Amazon has carved out a big space in the global entertainment world. Meanwhile, AWS sits right at the center of the cloud and AI boom, powering everything from small startups to giant corporations.

Amazon’s massive AI push has been dominating headlines, and the potential $50 billion OpenAI deal is just the latest example. Earlier this week, the company said it plans to cut around 16,000 corporate jobs, its second big wave of layoffs since last October. The goal is to free up cash to double down on AI and speed up the build-out of its global data center network. And the spending plans are eye-popping.

Amazon revealed last October that it expects capital expenditures to reach about $125 billion in 2026, the highest forecast among mega-cap companies at the time. Yet, despite that bold vision, the stock hasn’t exactly matched the company’s sky-high ambitions. With a market capitalization of roughly $2.6 trillion, Amazon shares are up just about 2% over the past year, lagging behind the broader S&P 500 Index’s ($SPX) 14.29% gain in 2025 as investors weigh the risks of massive AI spending and rising competition in the space.

Amazon’s Q3 Earnings Snapshot

Amazon’s fiscal 2025 third-quarter results proved the company is still operating from a position of strength. The tech giant topped Wall Street expectations on both revenue and earnings, with net sales rising 13% year-over-year (YOY) to $180.2 billion, beating forecasts of $177.9 billion. Amazon continues to lead in cloud infrastructure, and a large chunk of that growth came from its cloud powerhouse, AWS.

AWS sales climbed 20% from a year earlier to $33 billion. Cloud growth has been a closely watched area as Amazon faces intensifying competition from rivals such as Google (GOOGL) and Microsoft (MSFT), making this acceleration especially important. CEO Andy Jassy even commented, “AWS is growing at a pace we haven’t seen since 2022.”

Beyond AWS, Amazon’s core retail operations also delivered solid gains. North America segment sales rose 11% YOY to $106.3 billion, while international segment sales increased 14% to $40.9 billion, showing broad-based strength across regions. Profit growth was just as impressive.

Net income surged to $21.2 billion in the third quarter, or $1.95 per diluted share, up from $15.3 billion, or $1.43 per diluted share, in the third quarter of 2024. The bottom-line figure also topped Wall Street estimates of $1.57 per share. Now, investors are looking ahead to Amazon’s fiscal 2025 fourth-quarter results, set to be reported on Thursday, Feb. 5.

For the upcoming quarter, Amazon expects net sales between $206 billion and $213 billion, representing growth of 10% to 13% compared with the fourth quarter of 2024. Operating income is projected to be in the range of $21 billion to $26 billion, versus $21.2 billion in the year-ago period.

How Are Analysts Viewing Amazon Stock?

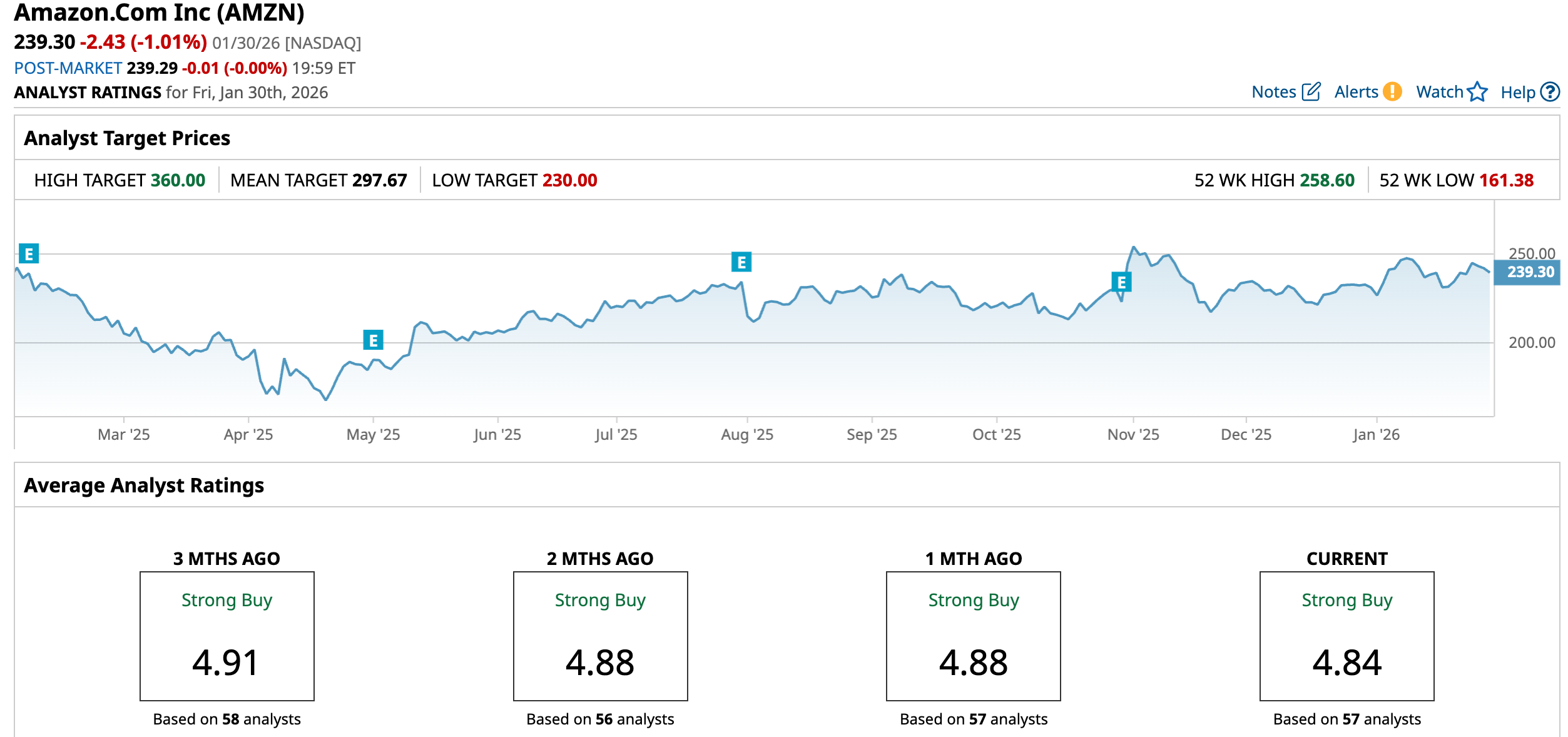

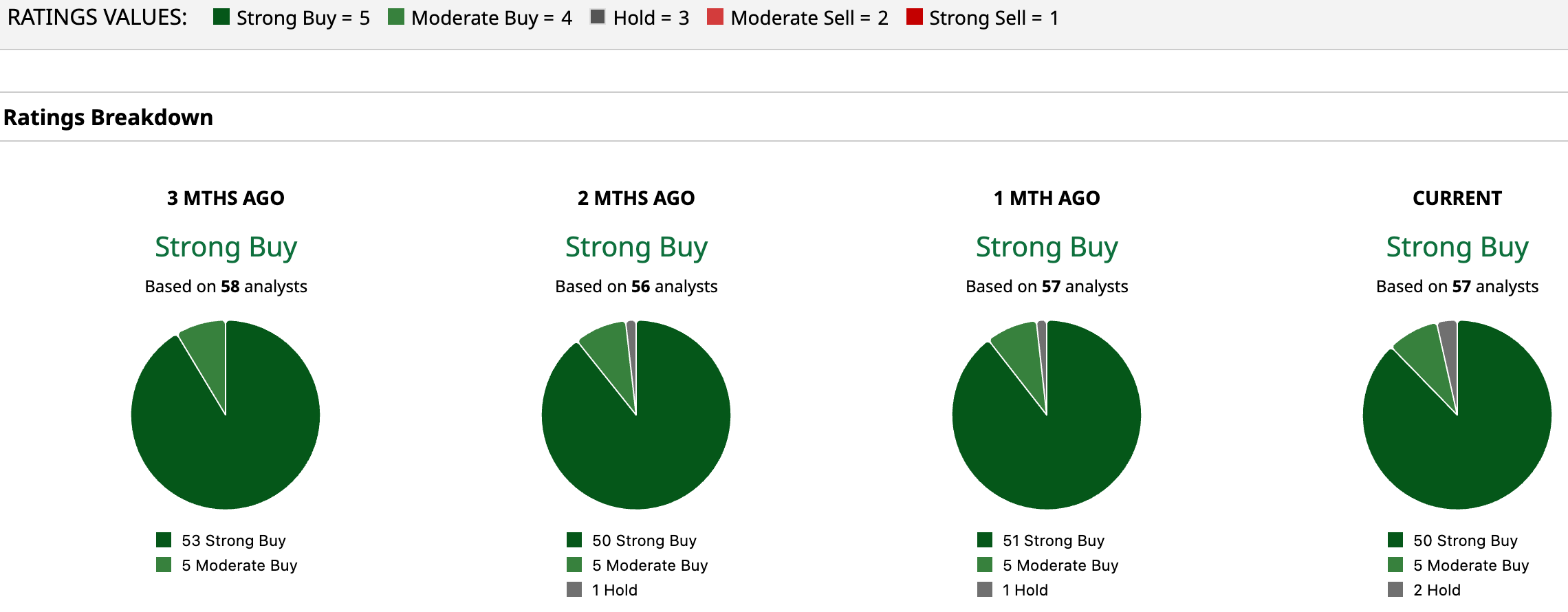

Wall Street is clearly bullish on Amazon, with the stock sporting a solid consensus “Strong Buy” rating overall. Out of 57 analysts covering AMZN, a whopping 50 rate it a “Strong Buy,” five call it a “Moderate Buy,” and just two sit on the sidelines with a “Hold.” That kind of lineup shows a high level of confidence in the company’s growth story.

The numbers behind those ratings are just as eye-catching. The average price target of $297.67 points to roughly 24.4% upside from current levels, while the most optimistic target on the Street, $360, suggests the stock could climb as much as 50% from here. In other words, many analysts believe Amazon still has plenty of room left to run.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)