CMS’s proposal for near-flat Medicare Advantage reimbursements paired with a rising medical care ratio has turned what was once a dependable profit engine for U.S. health insurers into a source of real uncertainty.

At the same time, new independent studies strongly suggest that Medicare Advantage still delivers greater value than traditional Medicare, with lower average costs to the federal government plus meaningfully reduced out-of-pocket expenses and richer benefits for enrollees. That split between tighter policy pressure and clear evidence of program value is reshaping how the market views every company closely tied to this business.

Humana (HUM) and CVS Health (CVS) now sit squarely in that spotlight, with both stocks slipping after expectations for Medicare Advantage profitability were reset by the latest reimbursement outlook. Does this pullback in two established dividend payers represent a chance to buy quality at a discount or a sign that returns will be capped for years? Let's dive in.

Humana (HUM)

Humana is a Louisville, Kentucky–based health insurer focused on Medicare Advantage and related medical and specialty coverage. HUM pays an annualized dividend of $3.54 per share, which equates to a forward yield of 1.34% at current levels.

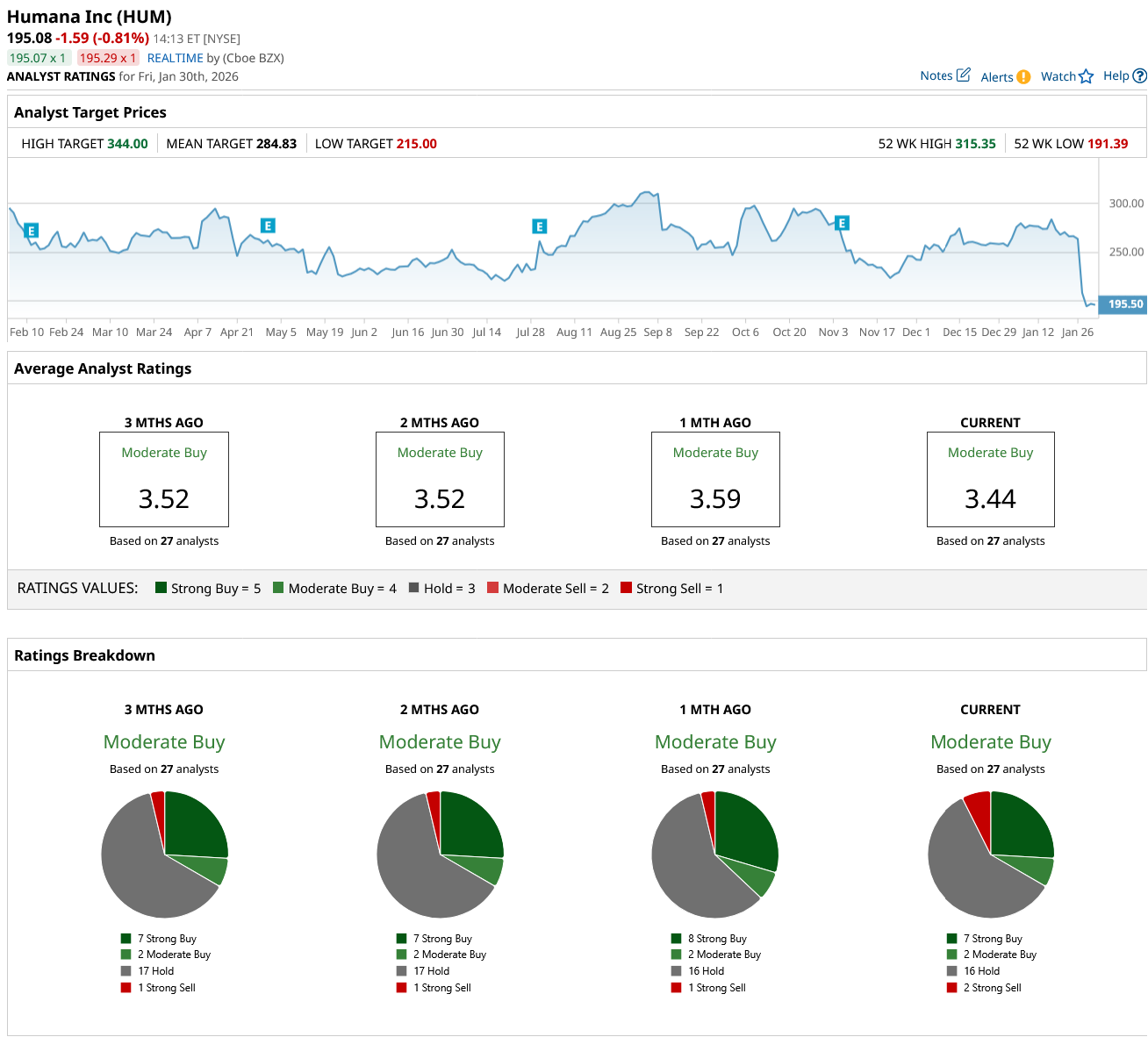

The stock trades at $195.14 as of Jan. 30, down 24% year-to-date (YTD) and 34% over the past 52 weeks.

This pricing now reflects a market value of roughly $25 billion and 13.93× trailing earnings versus a sector median of 17.98×, while the 21.72× forward multiple sits slightly above the sector’s 19.51× benchmark as investors brace for a near-term earnings reset.

This intersects with a significant leadership reshuffle. Humana announced in mid-December that long-time insurance chief George Renaudin will retire and that Amazon (AMZN) veteran Aaron Martin has joined as president of Medicare Advantage, with a phased handover designed to run through the 2026 cycle.

HUM’s most recent earnings scorecard gives investors a clearer read on how the business is absorbing cost pressure. The company reported third-quarter 2025 results on Nov. 5, posting GAAP net income of $195 million, or $1.62 per share, as higher utilization and investments weighed on the bottom line. This result translated into adjusted EPS of $3.24, beating the $2.91 consensus by $0.33 for an 11.34% positive surprise, emphasizing that underlying operations are still capable of outpacing expectations.

The health insurer generated $32.65 billion in revenue for the quarter, ahead of the roughly $31.98 billion analysts projected, helped by incremental premium growth and stable membership trends. That revenue figure represented about 0.81% year-over-year (YoY) sales growth, but net income fell 64.22% versus the prior year as higher medical cost trends and prior-period development flowed through the income statement.

HUM’s next earnings release is slated for Feb. 11, 2026, with consensus looking for a Q4 2025 loss of $4.01 per share, full-year 2025 EPS of $17.07 (up 5.31% from $16.21), and a step down to $12.16 in 2026, implying a 28.76% decline as the new rate environment bites into profitability.

The stock’s current consensus stance across 27 covering analysts sits at a “Moderate Buy,” with an average 12‑month price target of about $285, suggesting a roughly 44% upside from its current price.

CVS (CVS)

CVS is a Woonsocket, Rhode Island–based health solutions company spanning insurance, pharmacy benefit management, and nearly 10,000 retail pharmacies across the U.S. The stock offers an annualized dividend of $2.66 per share and a forward yield of 3.17%.

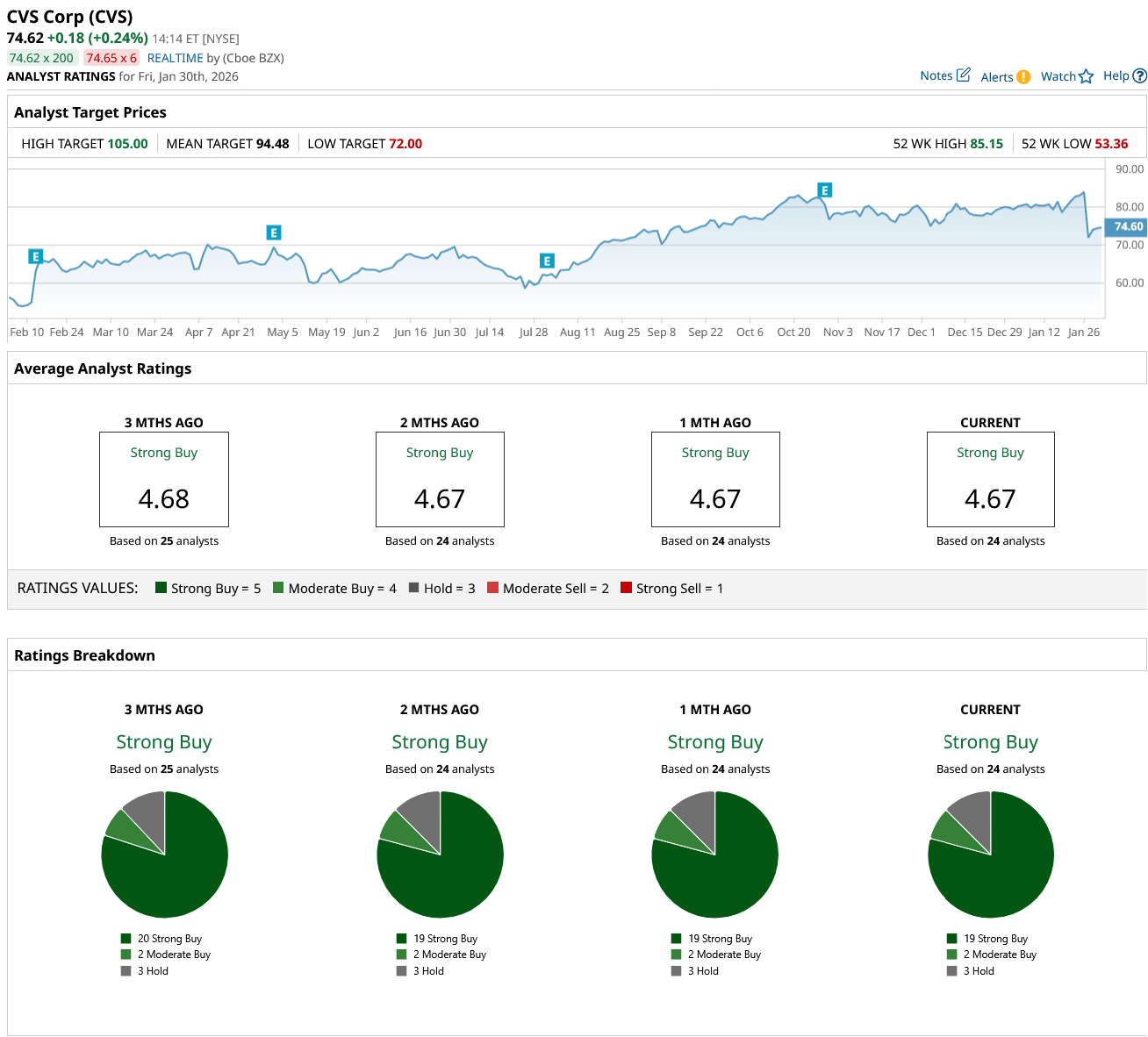

CVS changes hands at $74.60 as of Jan. 30, down 6%YTD but still up 31% over the past 52 weeks.

This pricing is at roughly 11.75x forward earnings against a healthcare sector median of 19.51x and at 1.46x book value versus a 3.17x sector benchmark, making it undervalued.

CVS's earnings record shows why the equity does not trade like a pure defensive. They reported third-quarter 2025 results on Oct. 28, posting adjusted EPS of $1.60 versus the $1.36 consensus, a 17.65% upside surprise that underlined management’s ability to manage through higher medical costs and reimbursement pressure.

It generated $102.87 billion in revenue for the quarter, up 4% YoY and a new high for the company as health services and pharmacy volumes continued to climb. The same period produced a GAAP net loss of $3.98 billion, with net income down 489.32% versus the prior year after a $5.7 billion goodwill impairment in the Health Care Delivery unit.

CVS recently revealed initiatives to make health insurance simpler and more affordable, emphasizing expanded access to Aetna Medicare Advantage plans that integrate pharmacy, virtual care, and local clinics to keep members healthier and lower the total cost of care. This push was reinforced by a $2.6 million grant from the CVS Health Foundation to the American Diabetes Association to expand a maternal diabetes program across two more New York City communities, validating the company’s effort to tie community investment directly to long-term chronic care economics.

CVS enters its next reporting checkpoint and is scheduled to report fourth-quarter 2025 results on Feb. 10, 2026, with consensus looking for Q4 EPS of $0.98 and Q1 2026 EPS of $2.24, down 17.65% and 0.44% YoY. The same estimates call for full-year 2025 EPS of $6.65, up 22.69% from $5.42, and 2026 EPS of $7.14, a further 7.37% increase.

CVS’s consensus rating across 24 covering analysts stands at “Strong Buy,” and an average 12‑month price target of $94.48 implies roughly 27% upside.

Conclusion

Humana looks like a higher‑risk rebound idea, best suited to investors who can handle policy noise and sharper earnings swings, while CVS offers a steadier, higher‑yield entry for long‑term income portfolios. Given current pricing and Street expectations, CVS shares seem more likely to grind higher over the next year, with Humana skewed to a bumpier but potentially stronger upside if Medicare Advantage profitability holds up better than feared.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)