/Nike%2C%20Inc_%20swish%20by-%20Tartezy%20via%20Shutterstock.jpg)

NIKE, Inc. (NKE) is a leading company that designs, develops, markets, and sells athletic footwear, apparel, equipment, accessories, and related services worldwide, with well-known brands including Nike, Jordan, and Converse. It is recognized as one of the world’s largest suppliers of athletic shoes and apparel and a major force in the global sportswear industry. NIKE is headquartered in Beaverton, Oregon, and its market cap is around $91.7 billion.

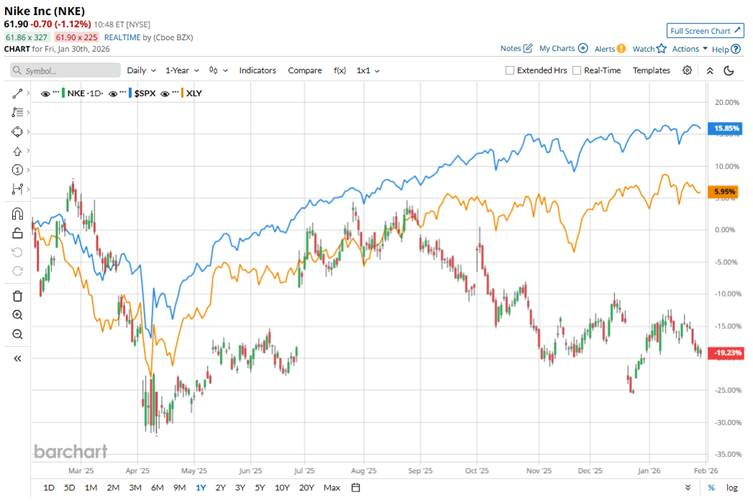

Shares of NIKE have underperformed the broader market over the past 52 weeks. NKE has dipped 20.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. In addition, shares are down 2.7% on a YTD basis, compared to SPX’s 1.8% uptick.

Focusing more closely, NKE has lagged behind the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 3.7% return over the past 52 weeks and a 1.3% YTD rise.

Over the past year, Nike’s stock has declined primarily due to a combination of weaker financial performance and market headwinds that have dented investor confidence. Shares fell notably after earnings reports showed softer-than-expected sales growth, particularly in key markets like Greater China, where revenues dropped significantly, and direct-to-consumer channels slowed, both of which weighed on Nike’s growth outlook. Nike also faced margin pressure from higher costs and tariffs, alongside softer consumer demand and increased competition in the athletic apparel and footwear space.

In Nike’s most recent quarterly results (Fiscal Q2 2026, ended Nov. 30, 2025), the company reported $12.4 billion in revenue, a modest 1% increase year-over-year, and EPS of $0.53, which beat expectations but still represented a 32% decline from the prior-year quarter. Greater China revenue fell sharply by around 17%, continuing a persistent slowdown in that key market, which has been a drag on overall growth. Meanwhile, NIKE Direct revenues were down about 8%.

For the current fiscal year, ending in May, analysts expect NKE’s EPS to decline 27.3% year-over-year to $1.57. However, the company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

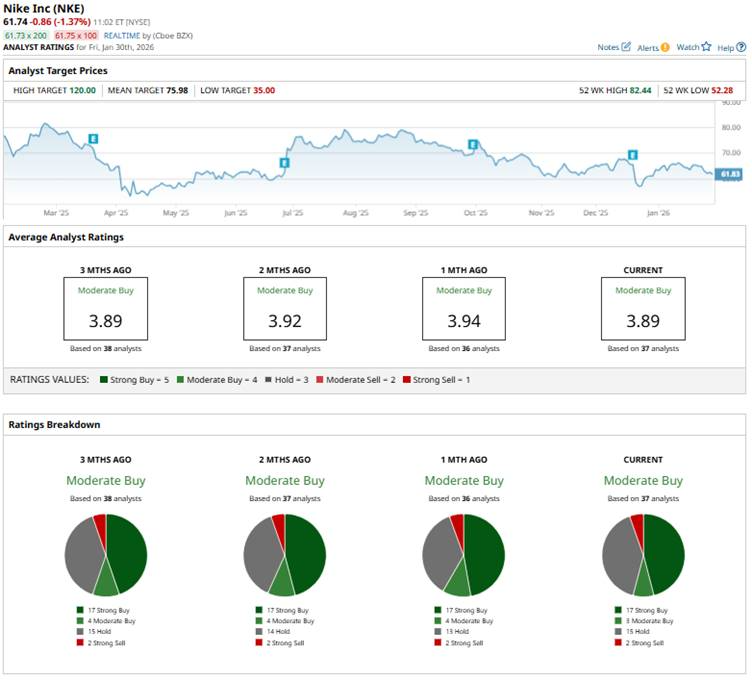

Among the 37 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, three “Moderate Buy,” 15 “Holds,” and two “Strong Sells.”

This configuration has remained largely consistent over the past few months.

On Jan. 6, RBC Capital analyst Piral Dadhania reiterated an “Outperform” rating on Nike but cut the price target to $78 from $85.

NKE’s mean price target of $75.98 represents a premium of 21.4% from the current market prices. The Street-high price target of $120 implies a potential upside of 91.8%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)